A 30 year mortgage calculator is a specialized version of a mortgage tool tailored to the most common mortgage term: thirty years. Because 30-year fixed mortgage loans are widely used, offering stability and predictability, many users specifically search for a 30 year mortgage calculator. This article will explain the mechanics of 30-year mortgages, how the calculator works, practical use cases, pros & cons, and tips to make it more useful.

What Is a 30-Year Mortgage?

A 30-year fixed-rate mortgage is a home loan with a repayment period of 30 years (360 months), during which the interest rate remains constant (i.e., does not change).

It is the most popular mortgage term in many markets because it balances monthly affordability and long-term financing.

Because payments are spread over a longer time, monthly payments are lower compared to shorter terms (like 15 or 20 years), but total interest paid is higher.

Why Use a 30 Year Mortgage Calculator?

To estimate monthly payments under a 30-year fixed loan.

To compare how much interest will be paid over the life of the loan.

To model additional payments or prepayments and see how they shorten the term or save interest.

To compare the 30-year option with other term options (15, 20, adjustable rate) to see which is more favorable for your situation.

How the 30 Year Mortgage Calculator Works

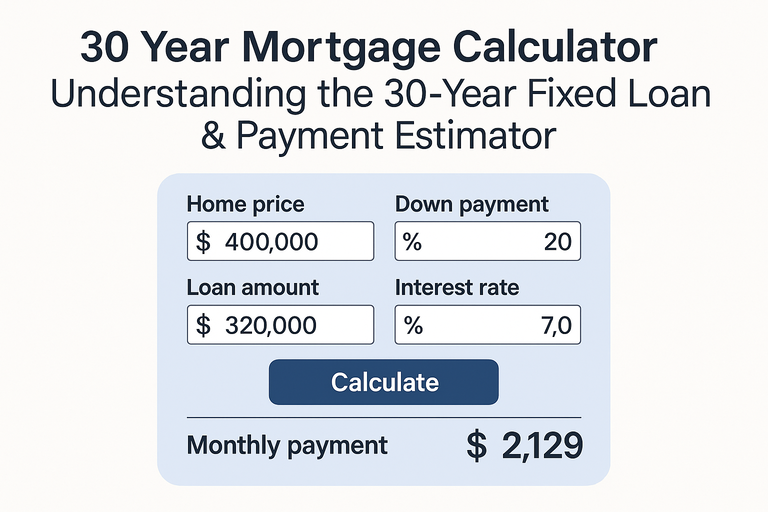

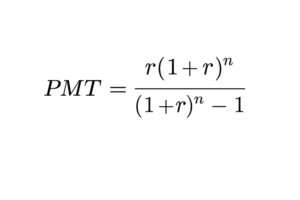

The core mechanics are almost identical to a general mortgage calculator, but the term is fixed at 30 years (n = 360 payments). The same annuity formula applies:

Where:

P = principal (loan amount)

r = monthly interest rate (annual ÷ 12)

n = 360 (for 30 years)

After computing the base payment, additional elements like taxes, insurance, and PMI can be added. The amortization schedule is then generated for 360 months, showing principal reduction, interest, and remaining balance each month.

Many 30-year mortgage calculators also allow extra payment options (monthly or yearly) to show how you can accelerate payoff. Some calculators even display what happens if interest rates change (for adjustable portions) or if you refinance midterm.

You’ll see this type of calculator on many financial sites. For example, the “30 Year Mortgage Calculator” on various mortgage / financial tools sites includes breakdowns, amortization, and tax/insurance options.

Pros & Cons of a 30-Year Fixed Mortgage

Pros:

More affordable monthly payments (spread over 30 years)

Predictable payments (interest rate locked)

Higher flexibility (lower barrier to entry)

Easier to qualify given lower monthly burden

Cons:

Higher total interest cost over the life of the loan

Slower equity buildup

If you pay early, you still might lose some of the interest benefit unless you make extra payments

Rate may be somewhat higher than for shorter-term loans

Because of the trade-off between monthly cost and total interest, many borrowers use a 30-year mortgage for flexibility and commit extra payments if finances allow, thereby getting the benefits of both worlds.

Outputs & Insights from the Calculator

When you use a 30 year mortgage calculator, users expect to see:

Monthly payment (principal + interest)

All-in monthly payment (with taxes, insurance, PMI)

Total interest paid over 30 years

Total payment (principal + interest + other costs)

Amortization schedule (monthly or yearly)

Graphical views (how the balance decays, interest vs principal share)

Effects of extra payments (how many years you can shave off, interest saved)

Comparison with other terms (e.g. 15-year, 20-year)

Example Scenario

Let’s walk through a sample:

Home price: $350,000

Down payment: 10% → $35,000

Loan amount: $315,000

Interest rate: 5.0%

Term: 30 years

Annual tax: $4,200

Annual insurance: $1,500

PMI: assume 0.5% annually (since down < 20%)

Calculations:

Monthly interest rate = 5.0% ÷ 12 = 0.0041667

Base payment = using formula → ≈ $1,692.39 (just principal + interest)

Tax per month = $4,200 / 12 = $350

Insurance per month = $1,500 / 12 = $125

PMI (annual 0.5% of loan = $1,575) → $131.25 monthly

All-in payment = 1,692.39 + 350 + 125 + 131.25 = $2,298.64

Over 360 payments, total interest on the base loan would be around $292,460 (this is approximate; actual numbers depend on compounding and amortization). If you make extra monthly payments, you can reduce the principal faster and save tens of thousands in interest.

30 Year Mortgage Calculator

Model a 30-year fixed home loan with principal + interest, taxes, insurance, PMI, HOA, and extra payments. See the full 360-month amortization and download it as CSV.

Inputs

This tool fixes the term at 30 years (360 payments) and removes PMI when you hit 80% LTV.

Results

30-Year Amortization (Monthly)

| Month | Payment | Principal | Interest | PMI | Taxes | Insurance | HOA | Balance |

|---|

Want to compare to a 15-year term? Try our 15 vs 30 Year Mortgage guide.

Why 30 years?

30-year mortgages offer lower monthly payments than shorter terms, at the cost of higher total interest. Many borrowers use the flexibility and add optional extra principal to accelerate payoff when cash flow allows.What drives your payment

- Interest rate: the biggest lever on monthly cost and lifetime interest.

- Down payment: affects loan amount and whether PMI applies.

- Taxes & insurance: vary by location; included here for an “all-in” view.

- Extra payments: can save years and tens of thousands in interest.