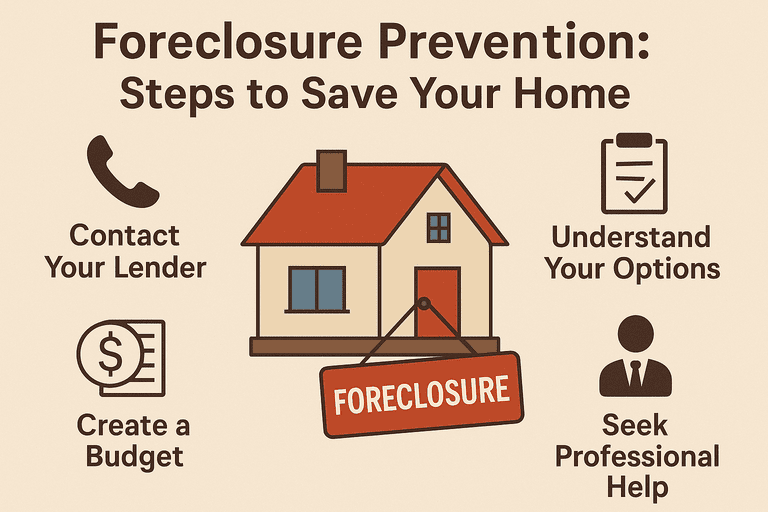

Facing the possibility of losing your home can be overwhelming. Financial setbacks, unexpected expenses, or changes in income can make keeping up with mortgage payments difficult. However, homeowners have multiple options to regain control and prevent foreclosure. Understanding your choices and taking proactive steps is crucial to protecting your most valuable asset.

Understanding Foreclosure and Its Consequences

Foreclosure occurs when a lender seizes a property due to unpaid mortgage payments. The process can significantly impact your credit score, reduce home equity, and limit future borrowing options. It’s essential to act early if you anticipate difficulties in making payments.

By exploring home retention options and seeking mortgage default help, homeowners can often avoid foreclosure and maintain ownership.

Step 1: Communicate with Your Lender

The first and most important step is to contact your lender as soon as you face financial difficulties. Lenders typically prefer to work with borrowers rather than initiate foreclosure proceedings.

Some options your lender may offer include:

Loan modification: Adjusting the interest rate, extending the term, or reducing the principal balance.

Forbearance agreements: Temporarily pausing or reducing payments to recover financially.

Repayment plans: Spreading missed payments over a period to catch up gradually.

Proactive communication demonstrates good faith and increases the likelihood of a workable solution.

Step 2: Explore Government and Nonprofit Programs

Several federal and state programs exist to assist homeowners at risk of foreclosure. These programs may provide:

Financial counseling and guidance from HUD-approved agencies.

Access to temporary relief programs like mortgage assistance grants.

Help negotiating with lenders for loan modification or repayment plans.

For example, the Making Home Affordable Program and local State Housing Finance Agencies (HFAs) can provide direct support for struggling homeowners.

Step 3: Consider Refinancing or Selling

Refinancing may reduce monthly payments by securing a lower interest rate or extending the loan term. However, refinancing requires meeting lender qualifications, which may be challenging during financial hardship.

If keeping the home is not feasible, selling can prevent foreclosure and preserve credit. Options include:

Traditional sale: Listing your home on the market to pay off the mortgage.

Short sale: Selling for less than the remaining mortgage balance with lender approval.

Both strategies may help avoid the long-term consequences of foreclosure.

Step 4: Budget and Prioritize Payments

Effective financial management is essential to prevent foreclosure. Homeowners should:

Analyze monthly income and expenses.

Prioritize mortgage payments over discretionary spending.

Seek temporary relief for other bills if necessary, such as utilities or credit cards.

Implementing a strict budget and prioritizing payments increases the likelihood of maintaining homeownership.

Step 5: Legal and Financial Counseling

Professional guidance can be invaluable when facing foreclosure. Qualified foreclosure prevention counselors can:

Explain all available home retention options.

Negotiate with lenders on your behalf.

Identify potential legal defenses if foreclosure proceedings begin.

HUD-approved housing counselors offer free or low-cost advice, ensuring homeowners understand their rights and options.

Step 6: Consider Bankruptcy as a Last Resort

In extreme cases, filing for bankruptcy may temporarily halt foreclosure. Chapter 13 bankruptcy allows for the restructuring of debts, including missed mortgage payments. This option should be carefully considered and discussed with a qualified attorney, as it carries long-term financial implications.

Conclusion: Act Early to Protect Your Home

Preventing foreclosure requires timely action, communication with your lender, and exploring all available mortgage default help and home retention options. By understanding your choices, seeking professional guidance, and taking proactive measures, homeowners can often avoid losing their homes and stabilize their financial future.

For additional guidance, calculators, and practical resources, visit CalculatingAMortgageLoan.com.

Sources: