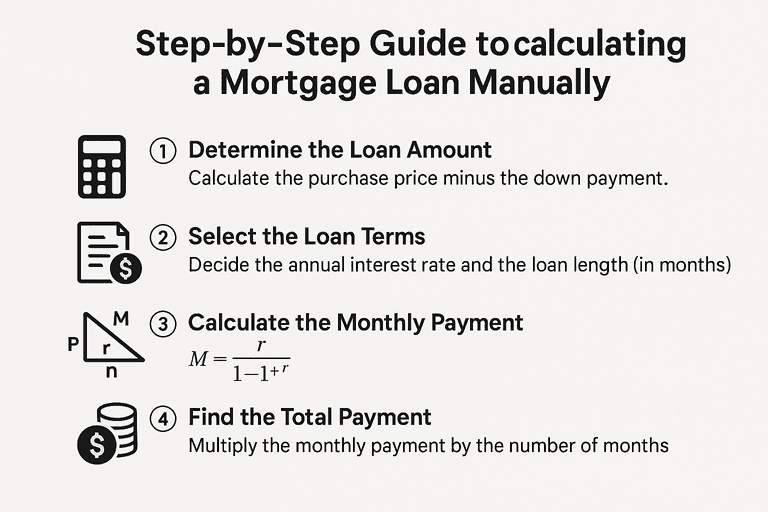

While online mortgage calculators are convenient, understanding how to calculate a mortgage loan manually gives you full control over the numbers. By doing the math yourself, you’ll know exactly how each factor—loan amount, interest rate, and term—affects your monthly payment. This guide will walk you step by step through the manual process.

“learn more about calculating a mortgage loan here”

1. Gather the Required Information

Before you begin, make sure you have these details ready:

Loan amount (Principal) – The total borrowed after subtracting your down payment.

Annual interest rate – Expressed as a percentage.

Loan term – The number of years you’ll take to repay the loan.

Payment frequency – Usually monthly, but sometimes bi-weekly.

2. Understand the Mortgage Formula

The standard formula for calculating fixed-rate monthly payments is:

M = P × [ r × (1 + r)^n ] / [ (1 + r)^n – 1 ]

Where:

M = Monthly payment

P = Principal (loan amount)

r = Monthly interest rate (annual ÷ 12)

n = Total number of payments (years × 12 for monthly payments)

3. Work Through an Example

Let’s calculate a real scenario:

Loan amount (P) = $250,000

Annual interest rate = 6% → monthly rate = 0.06 ÷ 12 = 0.005

Loan term = 30 years → 30 × 12 = 360 payments

Now, plug these into the formula:

M = 250,000 × [0.005 × (1 + 0.005)^360] / [(1 + 0.005)^360 – 1]

After solving, you’ll get:

M ≈ $1,498.88 per month (before taxes and insurance).

4. Create an Amortization Breakdown

To see how your payments apply over time:

Early years – Most of your payment goes toward interest.

Later years – More goes toward principal, reducing the loan balance faster.

A simple amortization table can look like this:

| Payment # | Interest Paid | Principal Paid | Balance Remaining |

|---|---|---|---|

| 1 | $1,250.00 | $248.88 | $249,751.12 |

| 2 | $1,248.76 | $250.12 | $249,501.00 |

5. Tips for Manual Calculation

Use a spreadsheet – Excel or Google Sheets makes this process much easier.

Double-check with a calculator – Confirm your results with an online tool.

Experiment with extra payments – Add extra principal to see how much interest you can save.

Conclusion

Manually calculating your mortgage payment gives you financial clarity and confidence. By knowing how to work through the formula and amortization schedule, you’ll understand your loan inside and out—something no calculator alone can give you.

For a deeper dive into mortgage strategies, visit our Complete 2025 Mortgage Loan Guide