When you take out a mortgage, your monthly payment isn’t just guessed by the bank—it’s calculated using a standard mathematical formula. Understanding this formula helps you see exactly how your loan is structured and why your payments are set the way they are.

In this guide, we’ll break down the mortgage loan formula step by step and show you examples so you can calculate your payments with confidence.

1. The Standard Mortgage Formula

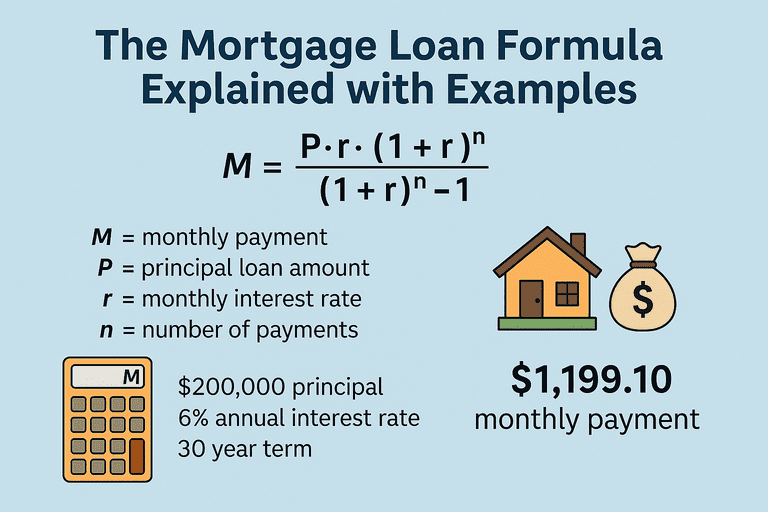

The formula for calculating the monthly payment on a fixed-rate mortgage is:

M = P × [ r × (1 + r)^n ] / [ (1 + r)^n – 1 ]

Where:

M = Monthly mortgage payment

P = Loan principal (the amount you borrow)

r = Monthly interest rate (annual interest ÷ 12)

n = Total number of payments (loan term × 12 for monthly payments)

This formula ensures your payments stay consistent over time, even though the mix of principal and interest changes.

2. Breaking Down Each Variable

Principal (P): If you buy a $300,000 home with a $60,000 down payment, your loan principal is $240,000.

Interest Rate (r): If your annual interest rate is 6%, your monthly rate is 0.06 ÷ 12 = 0.005.

Number of Payments (n): A 30-year mortgage has 30 × 12 = 360 payments.

3. Example: 30-Year Loan

Let’s calculate a 30-year fixed-rate mortgage.

Loan amount (P) = $240,000

Annual interest rate = 6% (0.005 monthly)

Loan term = 30 years (360 payments)

Plugging into the formula:

M = 240,000 × [0.005 × (1 + 0.005)^360] / [(1 + 0.005)^360 – 1]

M ≈ $1,439.00 per month (before taxes and insurance).

4. Example: 15-Year Loan

Now, let’s see the difference with a 15-year loan at the same rate.

Loan amount (P) = $240,000

Annual interest rate = 6% (0.005 monthly)

Loan term = 15 years (180 payments)

M ≈ $2,028.00 per month.

Notice: The monthly payment is higher, but you pay far less interest over the life of the loan.

5. Why the Formula Matters

It shows how small interest rate changes can make a big difference.

It helps you compare loan terms (15 vs. 30 years).

It allows you to test scenarios—like extra payments—to see how they impact your payoff schedule.

Conclusion

The mortgage loan formula is the foundation of every home loan. By understanding it, you can calculate your payments manually, compare different scenarios, and make smarter financial decisions.

For a complete walkthrough of mortgage calculations—including amortization schedules and money-saving strategies—explore our Step-by-Step Mortgage Guide