When choosing a mortgage, one of the most important decisions is whether to go with a 15-year term or a 30-year term. Both options have their pros and cons, and the right choice depends on your financial goals, monthly budget, and long-term plans. For a deeper dive into strategies, visit our Full Mortgage Guide

This guide walks you through how to calculate and compare both loan types so you can make the best decision for your situation.

1. The Mortgage Formula

The same formula applies to both 15- and 30-year loans:

M = P × [ r × (1 + r)^n ] / [ (1 + r)^n – 1 ]

Where:

M = Monthly payment

P = Loan principal

r = Monthly interest rate (annual ÷ 12)

n = Number of payments (years × 12)

The difference comes from n (the number of payments) and, in many cases, the interest rate, since shorter terms usually qualify for lower rates.

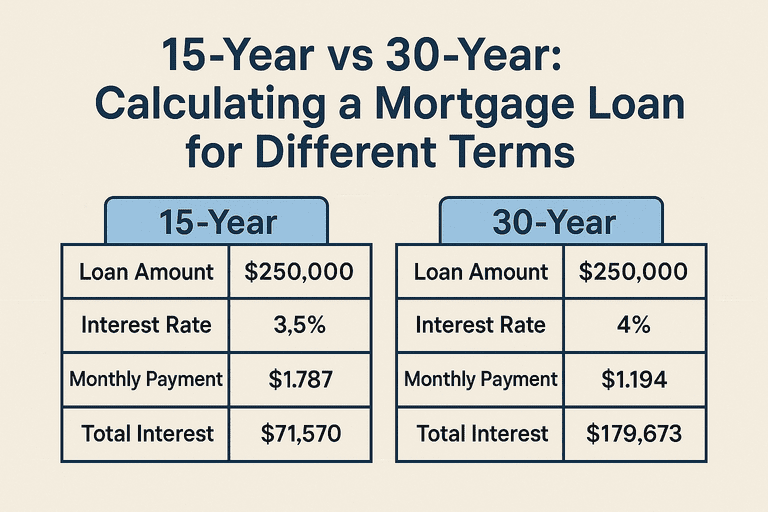

2. Example: $250,000 Loan

Let’s compare a $250,000 loan at two terms.

30-Year Loan

Interest Rate: 6%

Term: 30 years (360 payments)

Monthly Payment: ≈ $1,499

Total Interest Paid: ≈ $289,595

15-Year Loan

Interest Rate: 5.5%

Term: 15 years (180 payments)

Monthly Payment: ≈ $2,042

Total Interest Paid: ≈ $117,533

3. Side-by-Side Comparison

| Feature | 15-Year Mortgage | 30-Year Mortgage |

|---|---|---|

| Monthly Payment | Higher ($2,042) | Lower ($1,499) |

| Total Interest Paid | Much less | Much more |

| Loan Term | 15 years | 30 years |

| Interest Rate | Lower | Slightly higher |

| Equity Build-Up | Faster | Slower |

| Flexibility | Lower (big payment) | Higher (easier monthly budget) |

4. How to Decide

Ask yourself these key questions:

Can I afford the higher monthly payment comfortably?

Do I want to free up cash flow for other goals? (retirement savings, college, investing)

How important is paying off the house early?

Do I want to minimize total interest paid?

5. Hybrid Strategy: Extra Payments

If you’re not sure, a 30-year loan with extra principal payments can offer flexibility:

You keep the lower required payment.

You can pay extra when you have extra cash.

With consistent extra payments, you can pay off the loan almost as fast as a 15-year mortgage.

Conclusion

A 15-year mortgage saves you a huge amount of interest and gets you debt-free faster, but the payments are significantly higher. A 30-year mortgage offers lower payments and more flexibility, but at the cost of much higher interest over time. Check here Pros and Cons.

The best choice depends on your income stability, financial goals, and comfort with monthly payments. Run both calculations and decide which balance of savings and flexibility works best for you.