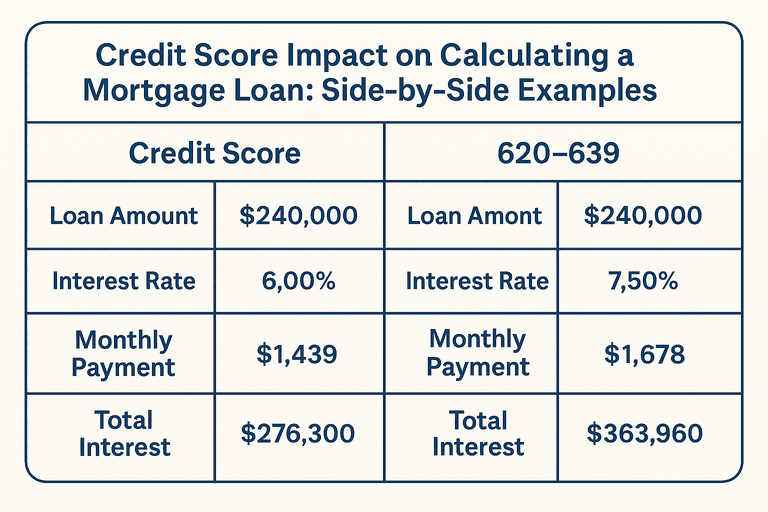

Your credit score doesn’t just influence whether you get approved for a mortgage — it also determines how much you’ll pay each month. Even a small difference in your score can change your interest rate, and over the life of a 30-year loan, that can add up to tens of thousands of dollars. If you’re new to the math behind home loans, you may want to start with our Complete Guide to Calculating a Mortgage Loan which breaks down the basics. In this article, we’ll focus on side-by-side examples to show how your score — whether it’s 640, 700, or 760 — affects your monthly payment.

1. How Credit Score Impacts Mortgage Rates

Lenders see your credit score as a measure of how risky it is to lend to you.

Lower scores (e.g., 640): Higher interest rates to offset risk.

Mid-range scores (e.g., 700): Moderate rates with decent loan terms.

High scores (e.g., 760+): Best rates and terms available.

Even a 0.5% difference in interest rate can increase or decrease your monthly payment by over $100, depending on the loan size.

2. Example Mortgage: $300,000 Loan, 30-Year Fixed

To illustrate, let’s assume you’re taking out a $300,000 mortgage with a 30-year term. (If you’d like to learn how to calculate these payments yourself.

A. Credit Score: 640

Typical interest rate: ~7.5%

Monthly principal & interest (P+I): ≈ $2,095

Total interest paid (30 years): ≈ $454,000

B. Credit Score: 700

Typical interest rate: ~6.5%

Monthly P+I: ≈ $1,704

Total interest paid (30 years): ≈ $342,000

C. Credit Score: 760

Typical interest rate: ~6.0%

Monthly P+I: ≈ $1,620

Total interest paid (30 years): ≈ 283,000

3. What These Numbers Mean

The difference between a 640 and a 760 score is about $475 more per month on this loan size.

Over 30 years, that’s more than $170,000 extra in interest.

Even the jump from 700 to 760 saves about $85 per month, which adds up to over $30,000 across the loan term.

4. How to Improve Your Mortgage Terms

If your credit score is holding you back, here are a few practical steps:

Pay bills on time — even one late payment can lower your score.

Reduce credit card balances to improve your credit utilization ratio.

Avoid opening new accounts right before applying.

Check your credit report for errors and dispute any inaccuracies.

Final Thoughts

The difference between a “good” and an “excellent” credit score can be the difference between comfortably affording your mortgage or straining your budget. Improving your score before applying can save you thousands over the life of your loan.