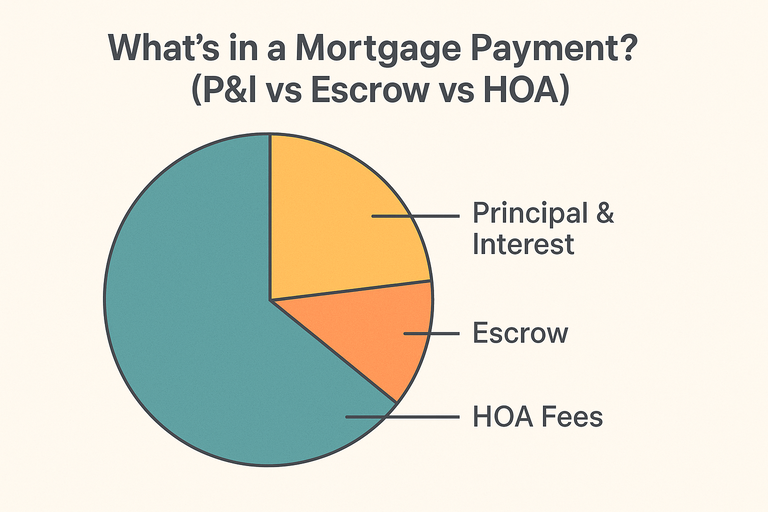

What’s in a Mortgage Payment? P&I vs Escrow vs HOA

Your monthly mortgage payment isn’t just what you owe the lender—it’s a bundle of several smaller costs that keep your home and loan current.

This guide unpacks each component so you can read your statement like a pro and use the Mortgage Payment Calculator

1. Principal & Interest (P&I)

This is the base of every mortgage.

| Term | Meaning | Example |

|---|---|---|

| Principal | The portion of your payment that reduces your outstanding loan balance. | If your loan is $300 000 and you pay $500 principal this month, your new balance is $299 500. |

| Interest | The lender’s charge for borrowing the money. | Determined by your interest rate and remaining balance. |

2. Property Taxes (Escrow Part 1)

Local governments collect property taxes—usually paid annually or semi-annually.

Your lender often divides that bill into 12 parts and collects it monthly in escrow, then pays the tax authority for you.

Why it matters: taxes can change yearly; expect your payment to adjust.

Florida note: county millage rates vary widely—check your county appraiser’s site.

Related: Florida Mortgage Calculator

3. Homeowner’s Insurance (Escrow Part 2)

Protects your property against fire, theft, and other covered events.

Paid annually but collected monthly in escrow.

You can shop insurance providers to lower this cost.

Combine taxes + insurance (+ PMI if any) = escrow portion of your payment.

4. Private Mortgage Insurance (PMI)

If you put < 20 % down, most conventional loans require PMI to protect the lender.

Typical cost: 0.3 – 1.0 % of loan balance per year.

Drops automatically near 80 % loan-to-value (LTV).

FHA loans use MIP instead—see the FHA Mortgage Calculator

5. HOA or Condo Dues

Monthly fees for community maintenance or amenities.

Paid separately from your lender (not escrowed).

Include this when estimating your “all-in” monthly housing cost.

6. Optional Add-ons & Fees

Mortgage points: upfront cost that lowers your rate. Try the Mortgage Rate Calculator

Flood or wind insurance: common in coastal Florida.

Supplemental tax assessments: after new construction or renovations.

Example: Typical Breakdown

| Component | Monthly Amount |

|---|---|

| Principal & Interest | $1 550 |

| Property Tax | $300 |

| Home Insurance | $120 |

| PMI | $90 |

| HOA Dues | $75 |

| Total Payment | $2 135 |

Smart Moves

Re-shop insurance annually to reduce escrow.

Ask your servicer to remove PMI when eligible.

Use extra principal payments to cut interest faster—see Extra Payment Calculator

FAQ

What does “escrow” mean in my mortgage payment?

It’s money your lender holds to pay taxes and insurance on your behalf.Why did my payment increase after a year?

Because your taxes or insurance premiums changed; the escrow adjusted.How can I remove PMI?

Once you reach ≈ 80 % LTV, request PMI cancellation in writing.