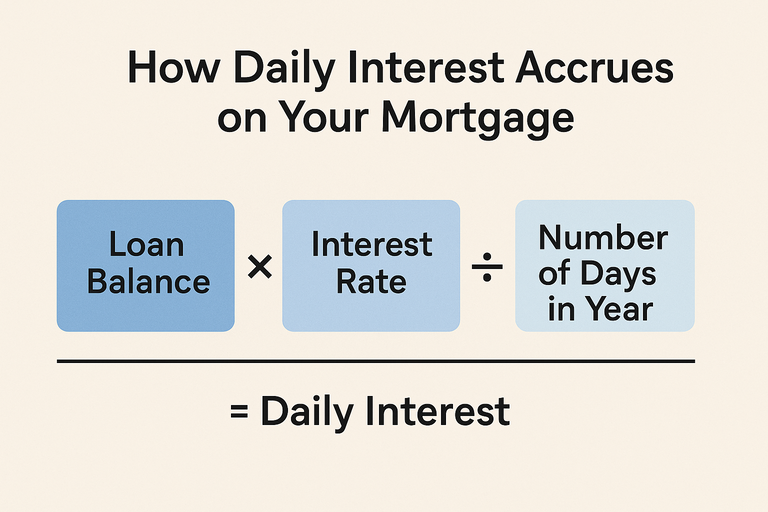

Every mortgage borrower pays interest—but few realize how that interest is calculated.

While your payment might look fixed each month, behind the scenes, lenders calculate interest daily, based on your outstanding balance and days between payments.

In this guide, we’ll demystify daily interest, show you how to calculate it manually, and explain how even small timing differences can affect your total cost.

👉 To experiment with your numbers, use our Mortgage Interest Calculator for precise, real-time results.

1. What “Daily Interest Accrual” Means

Daily accrual means your loan balance grows with interest every single day—not just once a month.

When you make a payment, the lender first applies what you owe for interest since your last payment, and only then reduces the principal.

![]()

Example:

Balance: $300,000

Annual rate: 6%

Daily rate = 0.06 ÷ 365 = 0.0001644

Daily interest = $300,000 × 0.0001644 = $49.32/day

If your payment is delayed by five days, that’s $49.32 × 5 = $246.60 extra interest before your next payment even posts.

2. Why Daily Interest Matters

Most homeowners think of their mortgage as a static monthly payment—but daily accrual explains why:

Payment timing affects cost: Paying early saves interest; paying late adds it.

Payoff quotes differ: If you request a payoff for a specific day, it includes daily interest up to that date.

Refinance closings include per diem interest: Lenders collect interest from your closing date to month’s end.

💡 Tip: Always check your payoff statement date—it’s usually valid for 10 days to account for daily accrual.

3. Step-by-Step: How It Works Each Month

Start with your current balance.

Calculate daily interest:

Multiply by days since last payment.

Subtract interest from your payment.

Apply the rest to principal.

Each month, this process repeats—so paying a few days early means fewer “interest days” and more going to principal.

4. Example: Payment Timing Impact

| Payment Date | Days of Interest | Interest Owed | Principal Applied |

|---|---|---|---|

| On time (30 days) | 30 | $1,480 | $318 |

| 5 days early (25 days) | 25 | $1,233 | $565 |

| 5 days late (35 days) | 35 | $1,727 | $71 |

Result:

Paying 5 days early increases your principal reduction by nearly $500—and reduces lifetime interest.

You can test your own loan scenario using the Mortgage Interest Calculator or Mortgage Payment Calculator

5. How It Ties to Your Closing Date

When you buy or refinance a home, your closing date determines your first payment due date and your prepaid interest.

Example:

Closing: July 20

First payment due: September 1

Lender collects prepaid interest from July 20–31 (12 days)

If you close early in the month, you’ll pay more prepaid interest at closing but skip a longer wait before your first payment.

If you close near month-end, you’ll pay less upfront interest but start payments sooner.

Pro tip: Schedule closings near the 25th for a balanced cash-flow month.

6. Fixed vs Adjustable Loans: Interest Timing Differences

| Feature | Fixed-Rate Loan | Adjustable-Rate (ARM) |

|---|---|---|

| Rate | Constant | Resets periodically |

| Interest accrual | Daily | Daily |

| Payment changes | Only if escrow changes | After rate resets |

| Tip | Use consistent payoff planning | Check margin + index before next adjustment |

7. How Extra Payments Affect Daily Interest

Every dollar of extra principal reduces your balance—and since interest accrues on balance, you immediately lower your future daily interest.

Example:

Balance: $250,000 at 6%

Daily interest = $41.10/day

Add $500 extra to principal

→ New balance = $249,500 → daily interest = $40.99/day

You save $0.11/day instantly, which compounds into thousands over years.

Use the Extra Payment Mortgage Calculator to see how many months (and dollars) you’ll save.

8. Why Your Payoff Statement Looks Higher Than Expected

When you request a payoff, the lender adds daily interest from your last payment date to your payoff date.

If you close early, you’ll often see:

“Per diem interest” (interest per day × days until payoff)

A “good-through date”

If your payoff takes longer, you’ll need a new statement—interest keeps accruing daily.

9. Quick Reference: Daily vs Monthly Accrual

| Method | How It Works | Typical Use |

|---|---|---|

| Daily accrual | Interest calculated each day | Mortgages, credit cards |

| Monthly accrual | Interest calculated once monthly | Auto loans, personal loans |

10. Key Takeaways

Mortgage interest accrues daily, even if you pay monthly.

Paying earlier—even a few days—reduces total interest paid.

The payoff quote includes per diem interest through a specific date.

Use calculators to plan prepayments and visualize savings.

FAQ

How is daily mortgage interest calculated?

Multiply your loan balance by your interest rate, divide by 365, and multiply by the number of days between payments.Does paying early really help?

Yes. Even paying a few days early reduces your interest charge because fewer days accrue.What’s per diem interest at closing?

It’s prepaid interest covering the days between closing and the start of your first full payment period.Is interest compounded daily?

No. It’s calculated daily but applied monthly—your loan doesn’t “compound” daily.