Buying a home in Florida means planning for more than just your mortgage rate.

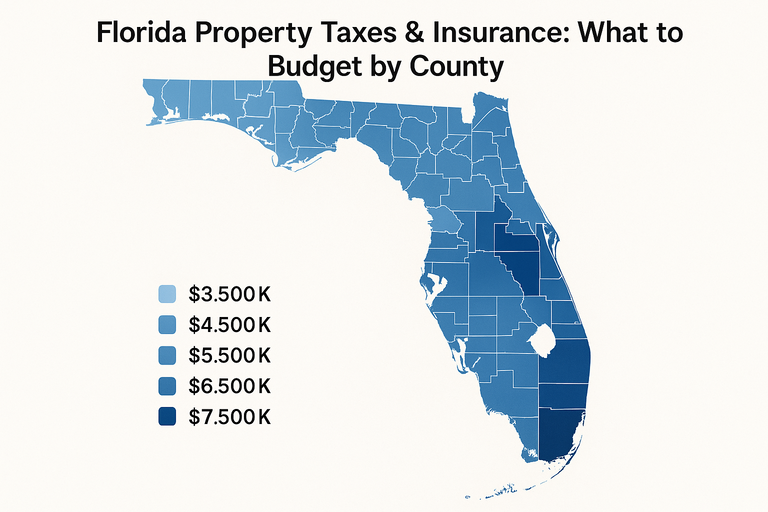

Across the Sunshine State, property taxes and insurance premiums vary dramatically — shaped by your county’s millage rate, exposure to hurricanes and flood zones, and your homestead exemption status.

This guide breaks down what to expect by region so you can budget accurately with the Florida Mortgage Calculator

1. The Big Picture: Why Florida Costs Vary So Widely

Even though Florida has no state income tax, homeowners still pay meaningful local taxes and insurance.

What drives variation?

County millage rates (used to calculate property tax)

Insurance risk zones (windstorm, flood, hurricane exposure)

Property value growth (especially in coastal metros)

Local assessments (schools, fire, water management)

For example, a homeowner in Miami-Dade pays a very different total than someone in Alachua or Leon County, even on the same-priced home.

2. Average Property Tax Rates by County (2025 Estimates)

| County | Avg. Effective Tax Rate | Annual Tax on $400K Home | Notes |

|---|---|---|---|

| Miami-Dade | 1.05% | $4,200 | High due to metro services & school millage |

| Broward | 1.10% | $4,400 | Slightly above state average |

| Palm Beach | 1.02% | $4,080 | Balanced urban-suburban blend |

| Hillsborough (Tampa) | 1.00% | $4,000 | Moderate; rising with growth |

| Orange (Orlando) | 0.98% | $3,920 | State average |

| Duval (Jacksonville) | 1.03% | $4,120 | Varies by city limits |

| Leon (Tallahassee) | 0.90% | $3,600 | Lower due to state facilities |

| Alachua (Gainesville) | 0.88% | $3,520 | College town offset |

| Collier (Naples) | 0.80% | $3,200 | Lower rate, higher property values |

| Monroe (Florida Keys) | 0.82% | $3,280 | Offsets extreme insurance cost |

3. Insurance Costs: Florida’s Real Wildcard

Florida has some of the highest homeowners insurance premiums in the U.S. — averaging over $6,000/year statewide, compared to about $1,700 nationally.

| County / Region | Avg. Annual Premium | Risk Drivers |

|---|---|---|

| Miami-Dade | $7,800 | Wind, flood, litigation costs |

| Broward | $7,200 | Similar windstorm exposure |

| Palm Beach | $6,000 | Coastal risk, high rebuild costs |

| Hillsborough | $4,800 | Inland storms, wind coverage |

| Orange | $4,200 | Moderate risk, fewer flood zones |

| Duval | $4,600 | Coastal + river flood potential |

| Collier | $6,500 | Gulf wind + luxury rebuild values |

| Monroe (Keys) | $9,500 | Highest wind and flood risk in state |

4. Windstorm & Flood Add-Ons: What to Expect

Florida homeowners may see two to three separate insurance policies on one home:

| Coverage Type | When It’s Required | Who Issues It |

|---|---|---|

| Standard Homeowners (HO-3) | Always | Private or state-backed insurers |

| Windstorm (Wind/Hurricane) | Coastal counties or older homes | Citizens Property, private carriers |

| Flood Insurance (NFIP or Private) | FEMA flood zones (AE, VE) | NFIP or private insurers |

Homes in Zone AE or VE (common in coastal Miami, Keys, Naples) will almost always require it.

5. The Florida Homestead Exemption: A Hidden Savings Boost

Florida’s Homestead Exemption reduces your property’s taxable value by up to $50,000 if it’s your primary residence.

Even better, the Save Our Homes cap limits annual assessment increases to 3% per year — protecting homeowners from surging values.

Example:

Home assessed at $400,000

Exemption = $50,000

Taxable value = $350,000

Tax savings = 1.0% × $50,000 = $500/year

🏡 File with your county’s property appraiser between January 1 and March 1 after purchase to qualify.

6. Regional Examples: Total Payment Snapshot (PITI)

| County | Home Price | Taxes | Insurance | Monthly Total* |

|---|---|---|---|---|

| Miami-Dade | $450,000 | $4,725 | $7,800 | $2,740/mo |

| Orange (Orlando) | $400,000 | $3,920 | $4,200 | $2,240/mo |

| Hillsborough (Tampa) | $400,000 | $4,000 | $4,800 | $2,320/mo |

| Collier (Naples) | $500,000 | $4,000 | $6,500 | $3,000/mo |

*Estimate assumes 6.5% rate, 10% down, 30-year fixed mortgage.

These differences can make hundreds of dollars per month in variation — so always localize your estimates using the calculator.

7. How to Budget Smartly for Florida Homeownership

✅ Use realistic insurance quotes, not national averages

🌀 Add flood and windstorm premiums separately if applicable

🧾 Factor taxes post-homestead, not on purchase price alone

💸 Re-run your PITI annually — insurance renewals and reassessments are common

🏠 Work with a local broker who knows regional carriers and exemptions

Connect with our Mortgage Broker Miami Beach Mortgage Broker Tampa , or Mortgage Broker West Kendall pages for county-specific guidance.

8. Why It Matters: Escrow Surprises and Affordability

Even with a fixed-rate mortgage, your total payment can rise each year due to:

Property reassessments increasing taxes

Insurance carriers adjusting premiums

Escrow accounts catching up after shortages

Use our Mortgage Loan with PMI, Taxes & Insurance article for a deeper look at how escrow fluctuations work — especially in hurricane-prone states like Florida.

9. Tools to Plan Accurately

To get your true monthly budget:

Open the Florida Mortgage Calculator

Enter your home price, down payment, and rate

Add your county’s tax rate and estimated insurance premium

Adjust for homestead exemption savings

You’ll see a complete monthly payment — not just principal and interest.

10. Key Takeaways

Florida’s property taxes average ~1%, but insurance costs can double your total payment.

Homestead Exemption and Save Our Homes protect long-term owners.

Flood and wind coverage drive major regional differences.

Use county-level data and local broker insights for true affordability estimates.

FAQ

What’s the average property tax rate in Florida?

Around 0.9–1.1% of assessed value, depending on the county.Which Florida county has the highest insurance costs?

Monroe County (Florida Keys) — due to wind and flood exposure.Does Florida offer a homestead exemption?

Yes, up to $50,000 off assessed value plus annual 3% assessment caps.Are flood and hurricane insurance required?

Yes, if your home lies in a FEMA flood zone or a high-wind area.