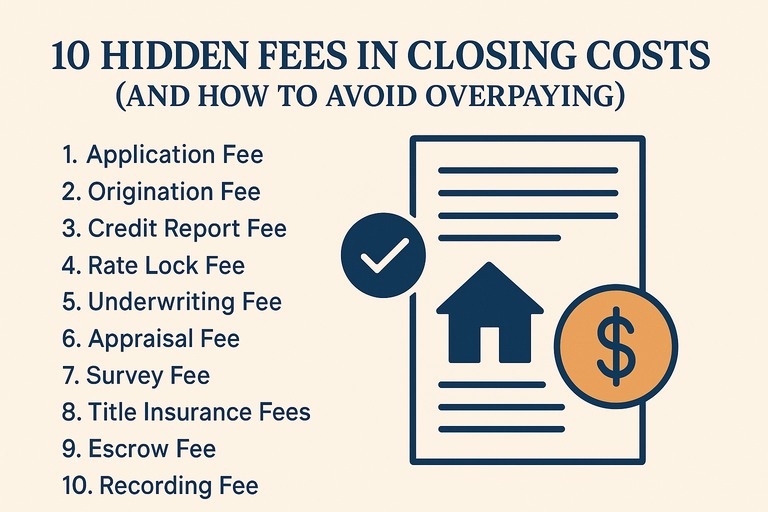

When you’re preparing to buy a home, most guides tell you closing costs will run 2–5% of the purchase price — but few explain what’s inside that number.

Beyond the obvious taxes and title fees, some “hidden” or poorly disclosed charges can quietly inflate your total by thousands.

This article uncovers the most common hidden fees, explains how to read your Loan Estimate (LE) and Closing Disclosure (CD), and shows how to use the Closing Costs Calculator to project a realistic total before you commit.

1. The Appraisal Re-Inspection Fee

You probably expect a one-time appraisal fee. But if the appraiser must re-inspect the property after repairs or updates, a second charge (typically $150–$250) appears at closing.

Tip: Ask your loan officer to confirm whether your appraisal “subject to repairs” could trigger reinspection.

2. Courier, Admin, or “Doc Prep” Fees

Small, vague charges like “admin fee,” “courier fee,” or “document preparation” often show up under lender or title costs.

They can total $100–$400, even though most documents are transmitted electronically.

Tip: Request written justification or ask to remove duplicate charges — lenders often agree when pressed.

2. Courier, Admin, or “Doc Prep” Fees

Small, vague charges like “admin fee,” “courier fee,” or “document preparation” often show up under lender or title costs.

They can total $100–$400, even though most documents are transmitted electronically.

Tip: Request written justification or ask to remove duplicate charges — lenders often agree when pressed.

4. Title Search Add-Ons

Standard title insurance and search fees are unavoidable, but some companies add “extra” abstract or doc review charges (especially in older counties).

Tip: Compare quotes from at least two title agencies — Florida and Texas especially allow “title shopping.”

5. Rate-Lock Extension Fee

If your closing is delayed beyond your lock period, lenders may charge 0.125–0.25 points of your loan balance.

On a $400,000 mortgage, that’s $500–$1,000.

Tip: Monitor your timeline — or choose a 45-day lock from the start if underwriting is expected to run long.

6. HOA Transfer or Estoppel Fees

If you’re buying into an HOA community, the management company may charge $200–$600 to transfer ownership records.

Some even tack on “capital contributions” or “initiation” fees.

Tip: Request the HOA disclosure early and verify all charges with your agent before making an offer.

7. Lender “Junk” Fees (Processing, Tech, Compliance)

Some lenders add line items labeled “technology,” “compliance,” or “processing support.”

These are effectively overhead costs — not government-required — and can total $300–$800.

Tip: Ask your lender whether these are fixed third-party costs or in-house profit fees. The latter are negotiable.

8. Prepaid Interest “Overlap”

If you close near the start of a month, you may pay extra days of prepaid interest because your first payment isn’t due for 30–45 days.

Tip: Schedule your closing near the end of the month to minimize overlap — a proven way to save a few hundred dollars.

9. Flood Certification Renewal

Every loan requires a flood certification (usually $15–$25).

Some lenders auto-renew it mid-process if the loan extends past 90 days — duplicating the cost.

Tip: If your lock is extended or file re-opened, confirm whether the cert will be reused or re-billed.

10. Escrow “Cushion” Overfunding

Lenders often collect a 2-month cushion for property taxes and insurance.

While legal, some over-collect due to outdated estimates — temporarily inflating your cash-to-close.

Tip: Review your Escrow Disclosure carefully; request corrections if tax/insurance rates changed.

How to Spot Hidden Fees Early

Before closing, you’ll receive two critical disclosures:

| Document | When You Receive It | What to Check |

|---|---|---|

| Loan Estimate (LE) | Within 3 days of application | Look for “Origination” & “Services You Can Shop For” |

| Closing Disclosure (CD) | At least 3 days before closing | Compare line-by-line vs. your LE for changes |

Focus on Sections A, B, and C — lender and third-party costs where discretionary fees hide.

💡 Use the Closing Costs Calculator to benchmark your total.

If your estimate exceeds 5% of the loan amount, check for duplicate or unnecessary add-ons.

Negotiating & Reducing Closing Costs

Shop lenders: Even a 0.25% lower rate or $500 fee reduction adds up.

Ask for lender credits: Many lenders offset costs by slightly raising the rate (~0.125%).

Request seller contributions: Up to 3% for Conventional, 6% for FHA, and 4% for VA loans.

Bundle title & escrow services: Saves 10–15% in some states.

Review fees within 10 days of LE — changes after that are limited by law.

Example: $400K Loan Closing Cost Comparison

| Scenario | With Hidden Fees | Without | Savings |

|---|---|---|---|

| Loan Origination + Misc. | $2,000 | $1,500 | $500 |

| Title/Settlement | $2,800 | $2,200 | $600 |

| Prepaid & Escrow | $4,000 | $3,700 | $300 |

| Total | $8,800 | $7,400 | $1,400 Saved ✅ |

Key Takeaways

Closing costs can hide $1,000–$2,000 in avoidable extras.

Always review Loan Estimate vs. Closing Disclosure.

Lock strategically to avoid extension penalties.

End-of-month closings save on prepaid interest.

Use calculators to benchmark and question every unexplained charge.

FAQ (Schema-Ready)

What are typical hidden closing costs?

Admin, wire, doc prep, and lock-extension fees often go unnoticed until the final disclosure.Can I negotiate closing costs?

Yes — especially lender and title fees. Government taxes aren’t negotiable, but most service fees are flexible.When should I review my Closing Disclosure?

At least 3 days before closing. Compare it carefully to your Loan Estimate to identify any surprise charges.How can I estimate closing costs early?

Use our Closing Costs Calculator to estimate by state, price, and loan type.