In 2025, the rent-vs-buy question isn’t philosophical—it’s financial survival. Mortgage rates are still high by recent standards, and both renters and owners are feeling the squeeze. Freddie Mac’s weekly survey shows the

average 30-year fixed rate at 6.22% (Dec. 11, 2025). Meanwhile, Harvard’s Joint Center for Housing Studies notes that housing costs are straining both renters and homeowners, with rising costs including taxes and insurance. Here’s how to calculate the

real break-even point—especially if you’re in (or moving to) a high-cost metro.

1) Define “break-even” the right way (most people don’t)

Break-even isn’t “my mortgage equals my rent.” It’s when your

net cost of owning becomes lower than renting

after you account for:

- Upfront costs (down payment, closing costs)

- Monthly costs (PITI + HOA + maintenance)

- Equity you build (principal paydown)

- Home value change (up or down)

- Opportunity cost (what your cash could earn elsewhere)

Tools like Zillow’s rent-vs-buy calculator frame it similarly: compare costs, equity, and the investment potential of money you don’t spend on owning.

Actionable tip: If you’re not including

closing costs + selling costs, your break-even math is fantasy.

2) Use current 2025 rates for a baseline (then stress-test)

Start with the 2025 benchmark:

6.22% for a 30-year fixed (Freddie Mac).

Stress-test rates because you may not lock the exact weekly average:

- Baseline: 6.22%

- Worse case: 7.22%

- Better case: 5.22%

Actionable tip: If you can only “afford” the home at the better-case rate, you can’t afford the home.

3) A real high-cost-city example (with actual numbers)

Assume a high-cost metro condo or starter home:

Buy scenario- Price: $750,000

- Down payment: 10% ($75,000)

- Loan: $675,000

- Rate: 6.22%, 30-year

- Principal & interest (approx.): $4,150/mo

- Property tax (example): $900/mo

- Insurance (example): $250/mo

- HOA (example): $500/mo

- Maintenance reserve (rule of thumb): $300/mo

Total owner outflow (example): ~$6,100/mo

Rent scenario- Comparable rent: $4,500/mo

At first glance, renting “wins” by ~$1,600/mo. But ownership builds equity.

Actionable tip: Run the same scenario with a

smaller home price and/or

bigger down payment to see what actually moves the needle (hint: price and rate matter more than anything else).

4) Equity isn’t guaranteed—so don’t treat it like a paycheck

Many break-even calculators assume some home appreciation. But even Reuters’ late-2025 polling suggests

modest home price growth ahead, not a boom. So you should model

three appreciation cases:

- 0% (flat)

- 2% (modest)

- -5% (down market / correction)

Actionable tip: If the deal only works in the “2%+ forever” scenario, you’re not investing—you’re hoping.

5) The silent killers: taxes, insurance, and “payment creep”

Harvard’s housing report explicitly calls out rising homeowner cost burdens, driven in part by

taxes and insurance costs. That’s why owners get surprised when their payment jumps even if their interest rate is fixed.

Rule of thumb to stress-test:- +10% on property taxes

- +20% on homeowners insurance

Actionable tip: Before you buy, ask your lender for a quote showing

PITI with conservative escrow assumptions, not the rosiest estimate.

6) Opportunity cost: the part renters underestimate (and owners ignore)

If you rent, you can invest:

- your down payment

- and the monthly “rent is cheaper” difference

Zillow’s calculator example logic includes this idea by modeling the investment return of money you don’t put into the house.

Actionable tip: Use a conservative return assumption (not a fantasy number). If you’re not comfortable investing, opportunity cost still exists—you’re just choosing “cash” as the investment.

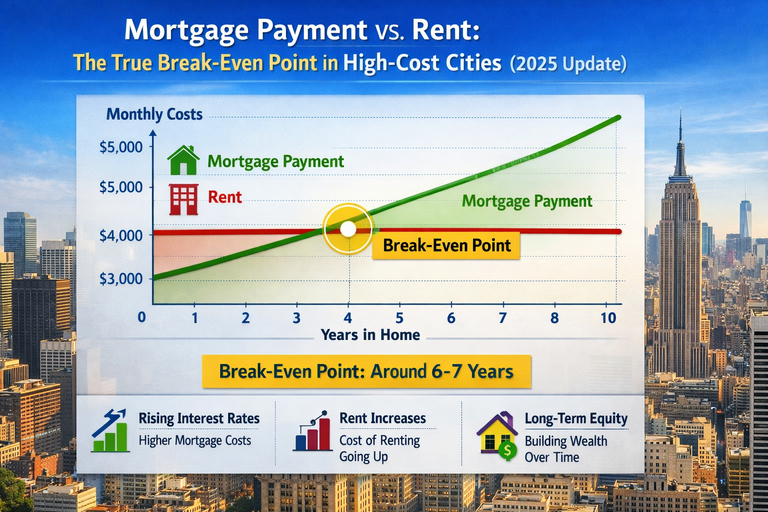

7) So what’s a typical break-even time in 2025?

There’s no universal number—high-cost markets often have longer break-evens because prices are high and carrying costs are brutal. In fact, some 2025 studies argue renting is cheaper than buying in many cities at current conditions, reflecting the pressure created by rates and prices. (Use these as directional signals, not gospel.)

Actionable tip: If you may move in

<5 years, renting often wins unless you get an unusually good purchase price, low fees, and stable carrying costs.

Conclusion

In 2025, the true rent-vs-buy decision comes down to

time horizon + carrying costs + risk tolerance. Use today’s rates (6.22% 30-year fixed benchmark), model conservative taxes/insurance, and compare owning vs renting

including opportunity cost. If the numbers are close, choose based on lifestyle flexibility and financial resilience—not “everyone says owning is always better.”

FAQs

1) What is the rent-vs-buy break-even point? It’s when the

net cost of owning (after equity and potential appreciation) becomes lower than renting, including transaction costs and opportunity cost.

2) What mortgage rate should I use for 2025 calculations? Use a current benchmark like Freddie Mac’s weekly average (30-year fixed

6.22% as of Dec. 11, 2025) and stress-test ±1%.

3) Why does owning look so much more expensive in high-cost cities? Because the payment stacks: principal/interest + taxes + insurance + HOA + maintenance, and high prices amplify everything.

4) How do taxes and insurance affect break-even? They increase monthly carrying cost and can rise over time, which Harvard notes is contributing to homeowner cost burdens. (

jchs.harvard.edu)

5) If I plan to move in 3–4 years, should I usually rent? Often yes, because selling costs and shorter time to build equity make break-even harder—unless you buy at a great price with low fees and stable costs.