In 2025,

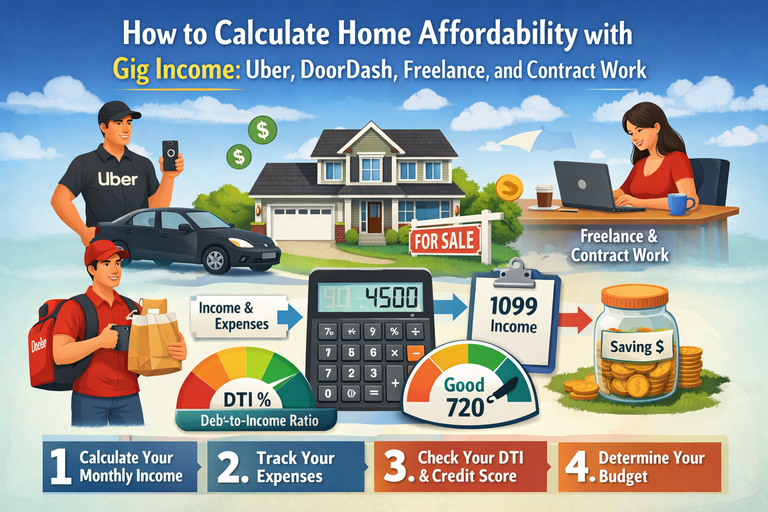

gig economy income—from rideshare driving to freelancing—is mainstream and increasingly part of homebuying math. Millions of Americans earn non-traditional income, and lenders have adapted programs to help these borrowers qualify for mortgages. But if you’ve ever tried to qualify for a home loan without a W-2 or traditional paycheck, you know one thing is clear:

lenders calculate income very differently for gig workers, and if you misinterpret how it works, you might miscalculate what home price you can afford. This article breaks down mortgage income calculation for gig workers, with

real examples, numbers, and actionable steps.

1) Why gig economy income matters for mortgage qualification

Gig workers include:

- Rideshare drivers (Uber, Lyft)

- Delivery couriers (DoorDash, Instacart)

- Freelancers (Upwork, Fiverr, design/tech)

- Independent contractors & consultants

This segment has grown rapidly and lenders

do recognize it—

approving mortgage applications from variable income borrowers is already common. But unlike traditional salaried income, lenders need proof that your earnings are:

- Stable

- Documented

- Sustainable

Actionable tip: Don’t assume irregular income disqualifies you—just prepare

documentation in advance.

2) Traditional income vs gig income: the difference in calculations

With a W-2 job, a lender typically uses your:

- Pay stubs

- W-2 forms

- Employer income verification

For gig workers, lenders rely on:

- 1099 forms (tax documents showing contract earnings)

- Bank statement deposits

- Profit & loss statements

- Invoices or platform earnings reports

These alternatives help lenders judge

actual cash flow rather than tax-adjusted income numbers.

Actionable tip: Gather your

last 12–24 months of income data before applying.

3) How lenders calculate gig income (with examples)

A) 1099 income loans

Some lenders use your

1099 income directly to calculate qualifying earnings. They may average your earnings over the past 1–2 years and apply a qualifying factor (often

75–90% of gross 1099 income).

Example:- Total 1099 income (2 yrs): $120,000 + $130,000

- Average annual: ($120k + $130k) ÷ 2 = $125,000

- Qualifying factor (80%): $100,000/year → $8,333/month

This becomes the income figure lenders test for DTI (debt-to-income) calculations.

B) Bank statement loans

Instead of tax returns,

bank statement loans use average deposits to calculate income.

Example:- Yearly deposits (12-mo total): $96,000

- Monthly average: $8,000

- Expense factor: 60% (lender assumption)

- Qualifying income: $4,800/month

This can be more reflective of real cash flow, especially if you deduct business expenses on tax returns.

Actionable tip: Keep

clean, consistent deposit records (avoid unexplained transfers).

4) Real numbers: how income affects affordability

Let’s say your qualifying income (after lender adjustments) is

$4,800/month. If you aim for a mortgage with:

- Down payment: 15%

- Purchase price: $450,000

- 30-year fixed rate: assume current market average around 6.2% (Dec. 2025 context)

Your principal + interest payment might be around

$2,400/month (before taxes & insurance). With property tax, insurance, and PMI included, your total housing cost might be

$3,000+. Your DTI calculation then becomes crucial:

- Monthly debt obligations (car, cards, student loans): say $800

- Proposed housing cost: $3,000

- Gross income: $4,800

DTI = (

3,000 + 800) ÷

4,800 ≈

79% That’s

too high for most lenders—indicating the purchase price may be too aggressive.

Actionable tip: Use a

Home Affordability Calculator to test multiple price points and ensure your DTI stays within program limits (often under 45–50% for non-traditional income loans).

5) Documentation: what lenders need and why it matters

To prove income as a gig worker, have:

- 1099 forms showing earnings from platforms or clients

- 12–24 months of bank statements with clear deposits

- Profit & loss statements if applicable

- 1099-NEC and 1099-K forms (if issued by platforms)

Many lenders will also ask for the

same line of work for 2+ years to establish consistency.

Actionable tip: Separate personal and business accounts. Mixing deposits makes underwriting slower and riskier.

6) Programs that help gig workers qualify

Several mortgage options cater to non-traditional income:

✔ Bank statement loans

Use deposit history, not tax returns, to prove income.

✔ 1099 income loans

Use documented 1099 earnings as qualifying income.

✔ Non-QM mortgages

Flexible documentation options for irregular income.

✔ Conventional & government loans (FHA/VA)

Require solid documentation and consistent income history (often 2+ years).

Actionable tip: Compare program requirements and expected interest rates; gig worker programs may carry slightly higher rates due to perceived risk.

Conclusion

Being a gig worker doesn’t disqualify you from homeownership—but it does require

different math and documentation. Lenders will assess your actual cash inflows, often averaging income over time and applying qualifying factors to reflect real earnings. The key to success is:

- Organizing income records early

- Understanding how lenders calculate qualifying income

- Choosing the right loan program

With preparation and the right strategy, your gig income can be a

pathway to homeownership in 2025.

FAQs

1) Can I qualify for a mortgage with just gig income? Yes. Lenders use 1099 forms, bank statements, and profit & loss documents to calculate qualifying income for gig and freelance workers.

2) Do lenders require two years of gig income? Many lenders prefer at least 12–24 months of consistent income to demonstrate stability.

3) What is a bank statement loan? A bank statement loan uses your actual deposit history (instead of tax returns) to calculate qualifying income, making it useful for self-employed or gig workers.

4) Are interest rates higher for gig worker loans? They can be slightly higher than traditional loans because lenders view non-traditional income as higher risk.

5) How do lenders verify gig income? Lenders review 1099s, bank statements, profit & loss statements, and sometimes platform reports to verify stable, recurring income.