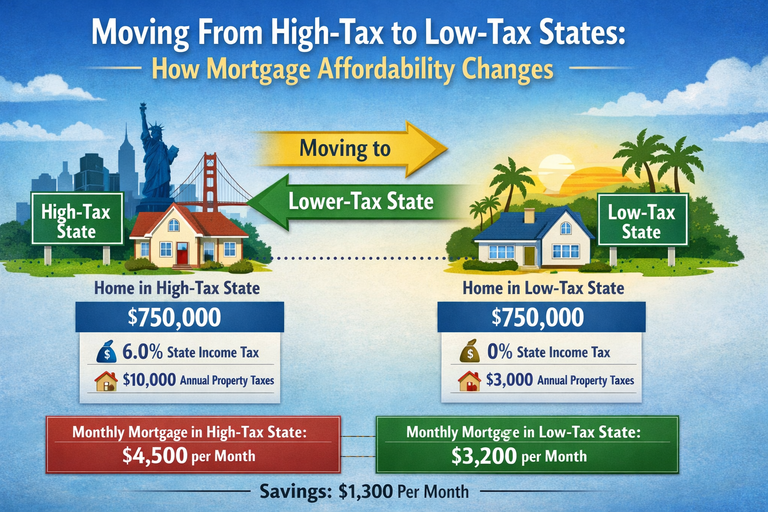

If you’re thinking about relocating to save money on housing,

tax differences can make a real impact on what you

can afford. Property taxes—one of the largest ongoing costs of homeownership—vary dramatically across the U.S., so the same home price in different states can have very different monthly costs. In addition, broader tax burdens (income, sales, local levies) influence where people move; historically,

Americans have continued migrating from high-tax to lower-tax states seeking lower overall cost of living. This article explains

how moving states affects mortgage affordability, with real tax examples, calculation steps, and actionable planning tips for 2025.

1) Why state taxes matter for mortgage affordability

Mortgage affordability isn’t just principal and interest. Monthly house costs typically include:

- Property taxes

- Homeowners insurance

- Private Mortgage Insurance (PMI) (if applicable)

- HOA fees

- Maintenance reserves

Lenders commonly bundle

property taxes into your monthly payment via escrow. A higher tax bill therefore increases your

PITI (principal, interest, taxes, insurance), which directly affects your

Debt-to-Income (DTI) ratio and how large a loan you can get.

Actionable tip: Don’t forget property taxes when using affordability tools—they are

not optional add-ons, they are core parts of your mortgage payment.

2) State tax differences: high-tax vs low-tax examples

Property tax rates vary widely. In 2025:

- High: New Jersey ~2.23% effective rate

- Mid: Pennsylvania ~1.35%

- Low: Alabama ~0.38%, Hawaii ~0.27%

From a $400,000 home:

- New Jersey: ~$8,920/year in property tax

- Alabama: ~$1,520/year in property tax

That’s a

$7,400 per year difference, or about

$620/month in escrow funds—enough to change your qualifying payment materially.

Actionable tip: When budgeting for homes across states, run separate

PITI estimates for each state’s typical tax rate. You can use a mortgage calculator that includes taxes and insurance to compare.

3) How taxes affect monthly payments (real calc)

Here’s a practical sample:

Assumptions- Home price: $400,000

- 30-year fixed mortgage

- Interest rate: 6.0% (example market context)

- Insurance: $1,500/yr

- No PMI

- Down payment: 20%

High-tax state (example ~1.8% effective)

- Property tax: 1.80% → $7,200/yr

- Monthly tax portion in escrow: $600

- Principal & interest: ≈ $1,919

- Insurance monthly: $125

- Total PITI: ~$2,644

Low-tax state (example ~0.6% effective)

- Property tax: 0.60% → $2,400/yr

- Monthly tax portion: $200

- Principal & interest: ~$1,919

- Insurance: ~$125

- Total PITI: ~$2,244

Difference: $400/month less in total housing cost just from tax differences — a gap that can mean the difference between qualifying for a loan or not.

Actionable tip: Run your own

Mortgage Payment + Tax comparison when targeting specific cities or counties. Tools like home affordability calculators that include property tax are especially useful.

4) Beyond property tax: overall state tax burden impacts

Property tax isn’t the only factor. State and local tax burdens—income taxes, sales taxes, and fees—also influence cost of living and mortgage decisions. States with low property tax often

also have lower income tax or no income tax (e.g., Florida), making mortgage costs feel more manageable. People relocate for tax reasons: recent migration patterns show a

net flow from high-tax states to those with lower burdens, which can also signal housing market competitiveness and price pressure variations.

Actionable tip: When assessing relocation, include

state income tax and cost of living indexes alongside property taxes in your affordability math.

5) How tax relief and policy changes factor in purchasing math

Recent tax policy changes—like an increased SALT cap in 2025 (allowing up to $40,000 of state and local tax deductions)—might help some homeowners reduce federal tax liabilities. However, this benefit doesn’t

directly reduce your monthly mortgage payment; it affects

after-tax income, which may improve your cash flow slightly.

Actionable tip: Include net after-tax cash flow—not just pre-tax payment—when modeling budget limits. This keeps your plan realistic rather than optimistic.

6) Migration trends and housing affordability

Economic data shows people continue leaving high-tax, high-cost states for lower-tax alternatives. This phenomenon can

indirectly affect affordability in both sending and receiving states:

- Sending states: higher taxes + slower price growth

- Receiving states: increased demand can push prices up over time

If you time your move when demand is rising, you may pay a

premium that partially offsets tax savings.

Actionable tip: Compare multiple metros within “low-tax” states to find

value markets, not just low tax rates.

7) Relocation checklist to maximize affordability

Before you move, run this checklist:

- Calculate total monthly housing cost including taxes and insurance using a mortgage calculator that includes PITI.

- Estimate DTI with new numbers and make sure you meet lender limits (often under ~45%).

- Check local tax exemptions (senior, homestead, veteran, etc.).

- Model net after-tax income using the SALT deduction and income tax differences.

- Compare housing supply and demand trends to avoid markets overheating.

Actionable tip: Use online affordability calculators and local tax data to quantify both

payment and

qualifying effects before writing an offer.

Conclusion

Moving from a high-tax state to one with lower taxes can meaningfully reduce your

monthly mortgage cost—sometimes by hundreds of dollars—by cutting property taxes alone. But taxes are only one piece of affordability. You also need to account for insurance, local market demand, income tax differences, and lender qualification rules. By running comparative mortgage and tax calculations before you relocate, you avoid surprises and ensure your move actually leaves you with

more housing affordability, not just optimism.

FAQs

1) Do property taxes really matter for mortgage qualification? Yes—because lenders often include property taxes in your monthly mortgage payment, which affects your debt-to-income ratio and how much loan you can get.

2) Which states have the lowest property taxes in 2025? States like

Alabama, Hawaii, Utah, and West Virginia have some of the lowest effective property tax rates, reducing monthly PITI.

3) Can moving reduce my mortgage payment? Yes—if property taxes and cost of living are lower, your monthly payment (PITI) can be significantly lower even for the same house price.

4) Does federal tax policy (like SALT cap changes) affect mortgage affordability? It affects your

after-tax income, not direct monthly payments, but it can improve your cash flow and therefore what you feel you

can afford.

5) Should I look beyond property tax when relocating? Absolutely—consider income tax, home prices, job market, and demand trends to ensure the move improves overall affordability.