Job loss turns a mortgage from “manageable” into

urgent math overnight. In 2025, layoffs remain uneven across industries, and even high-income households can face sudden income gaps. According to the U.S. Bureau of Labor Statistics, the

median duration of unemployment has hovered around 9–10 weeks, but many workers experience much longer gaps—especially in white-collar and tech roles. If you lose your job, the right question isn’t

“Will things work out?” It’s:

How many months can I realistically carry this mortgage—and what’s my exit plan if I can’t? This guide shows you how to calculate your financial runway using real numbers, understand relief options, and make decisions before panic forces them.

1) First priority: calculate your true monthly housing cost

Start with

total housing cost, not just principal and interest. Include:

- Mortgage principal & interest

- Property taxes (monthly escrow portion)

- Homeowners insurance

- HOA dues (if any)

- Minimum utilities to keep the home functional

Example:- Principal & interest: $2,050

- Taxes: $450

- Insurance: $150

- HOA: $250

- Utilities (bare minimum): $200

True monthly housing cost: $3,100 Actionable tip: If you only count the mortgage payment, you’re underestimating your burn rate—and overestimating your survival time.

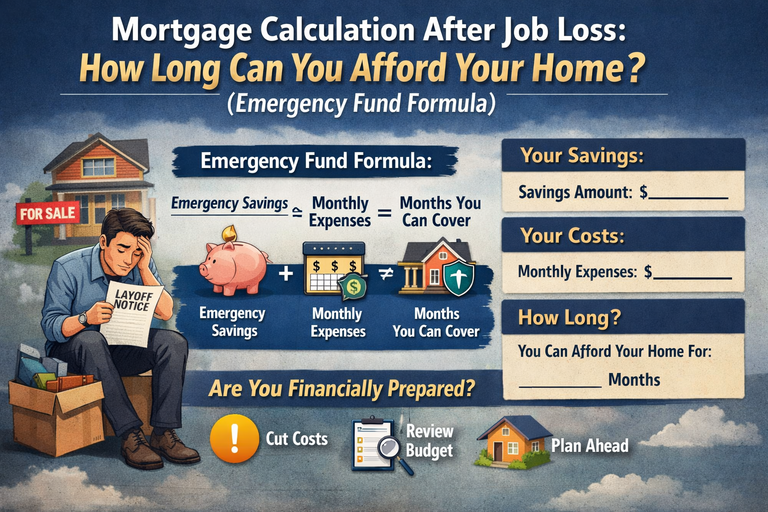

2) The emergency fund formula (simple but brutal)

Here’s the formula that matters: [\textbf{Months You Can Afford} =\frac{\text{Available Cash + Income Support}}{\text{Monthly Housing + Living Costs}}]

Step A: Calculate available cash

Include:

- Savings and checking

- Emergency fund

- Severance (after tax)

- Expected unemployment benefits

Do NOT include: retirement accounts unless you’re prepared for penalties and long-term damage.

Example:- Savings: $38,000

- Severance: $12,000

- Unemployment benefits (estimated): $10,000

Total available cash: $60,000Step B: Add non-housing living costs

Minimum realistic expenses:

- Food

- Transportation

- Health insurance (often spikes after job loss)

- Debt minimums (car loans, credit cards, student loans)

Example:- Non-housing essentials: $2,200/month

Step C: Run the math

- Housing cost: $3,100

- Living costs: $2,200

- Total monthly burn: $5,300

[60,000 ÷ 5,300 ≈ 11.3 \text{ months}] You don’t have “a year.”

You have

11 months—and that’s assuming nothing goes wrong. Actionable tip: Build your plan around

70–80% of that number, not the optimistic maximum.

3) Unemployment benefits: helpful, but not enough

Unemployment insurance can soften the blow, but it rarely covers housing fully—especially for homeowners. In most states:

- Benefits replace ~30–50% of prior wages

- Payments are capped

- Duration is limited (often ~26 weeks under standard programs)

Actionable tip: Treat unemployment benefits as

partial income, not a mortgage solution. They buy time—not safety.

4) Mortgage relief options in 2025 (what actually exists)

Pandemic-era blanket forbearance programs are gone, but

loss-mitigation options still exist. Common lender options:

- Temporary forbearance (pause or reduce payments)

- Loan modification (re-amortize missed payments)

- Repayment plans (spread missed payments over time)

Important realities:

- Interest often still accrues

- Missed payments are usually added to the loan balance

- Forbearance is not forgiveness

Actionable tip: Call your lender

before you miss a payment. Once you’re delinquent, options shrink and credit damage begins.

5) When keeping the home becomes risky (honest thresholds)

You should seriously evaluate selling or downsizing if:

- Your runway is <6 months

- Your industry has slow re-hiring cycles

- Housing costs exceed 40–45% of prior gross income

- You’re draining retirement accounts to stay afloat

Waiting too long creates forced decisions:

- Fire-sale pricing

- Credit damage

- Missed refi or sale windows

Actionable tip: Selling early—while you still have equity and control—is often

less damaging than clinging on until cash is gone.

6) Refinance or HELOC after job loss? Usually no.

Without active income:

- Refinancing is usually impossible

- HELOCs may freeze or require income re-verification

Even if rates drop, lenders still require:

- Stable employment

- Verified income

- Acceptable DTI

Actionable tip: If refinancing is part of your plan, it must happen

before job loss—not after.

7) A simple decision framework (use this)

Ask yourself:

- Can I cover 12 months without touching retirement?

- Can I reduce housing costs meaningfully (roommate, rent a unit, cut HOA exposure)?

- Is my re-employment timeline realistic—or hopeful?

If the answer to #1 is no and #3 is uncertain, you need a

Plan B now, not later.

Actionable tip: Write down three options—

keep,

pause,

exit—with trigger dates for each. Decisions feel less emotional when they’re pre-planned.

Conclusion

A mortgage after job loss isn’t just a cash-flow problem—it’s a

timing and decision problem. By calculating your true monthly burn, understanding how long your savings realistically last, and knowing when relief options actually help, you regain control. The biggest mistake homeowners make is waiting until the math decides for them. Run the numbers early.

Make decisions while you still have leverage.

FAQs

1) How long should my emergency fund last if I have a mortgage? Ideally

6–12 months of total living expenses, not just the mortgage payment—especially in uncertain job markets.

2) Can I pause my mortgage payments after losing my job? Possibly. Many lenders offer temporary forbearance or hardship options, but interest often accrues and payments resume later.

3) Will job loss automatically hurt my credit? No—but

missed mortgage payments will. Contact your lender before missing payments to protect your credit.

4) Should I sell my home if I lose my job? If your runway is short and re-employment is uncertain, selling early can preserve equity and reduce long-term damage.

5) Can I refinance after I lose my job? Usually no. Most lenders require active, stable income to approve a refinance.