House hacking is one of the

few remaining strategies that blends affordability with investing in 2025. Instead of buying a single-family home you fully pay for, you

live in one unit of a multi-unit property (2–4 units) and rent the others to offset your mortgage. For Millennials priced out of traditional homeownership, the appeal is obvious. The confusion is too. Most buyers don’t understand

how rental income actually affects mortgage qualification, how lenders calculate DTI, or whether the deal truly cash-flows. This guide gives you a

house hacking mortgage calculator framework, shows how rental income is counted, and walks through real numbers so you can decide if this strategy works

before you make an offer.

1) What house hacking really is (and isn’t)

House hacking means:

- You own and occupy one unit as your primary residence

- You rent out 1–3 other units in the same property

- Rental income helps offset mortgage costs

It is

not:

- A short-term rental loophole

- A passive investment

- Guaranteed cash flow

Lenders treat house hackers differently from pure investors because you live in the property—but they still apply conservative math.

Actionable tip: If you don’t plan to live in one unit full-time, this is

not house hacking—it’s an investment property with stricter rules.

2) Loan types that allow house hacking

The most common house hacking-friendly loans in 2025:

FHA (most popular)

- 3.5% down

- Allows 2–4 unit owner-occupied properties

- Rental income can help qualify

- Mortgage insurance required

Conventional (5–15%+ down)

- Stronger credit needed

- Higher down payments

- Rental income allowed with limits

VA (eligible veterans)

- 0% down possible

- Strongest house hacking loan if eligible

Actionable tip: FHA is often the easiest entry point, but conventional loans may win long-term due to lower mortgage insurance costs.

3) How lenders count rental income (this is critical)

Here’s the rule most buyers misunderstand: 👉

Lenders do NOT count 100% of rent. Most use the

75% rule:

- 25% haircut for vacancy, maintenance, and risk

Example

- Gross rent from other units: $3,000/month

- Qualifying rental income:

$3,000 × 75% = $2,250/month

That $2,250 can be used to

offset your mortgage payment in DTI calculations.

Actionable tip: Always base rent estimates on

market comps, not optimistic projections. Inflated rents kill deals in underwriting.

4) House hacking mortgage calculator (DTI-focused)

Here’s the calculator logic lenders actually use.

Step 1: Calculate full housing payment (PITI)

Include:

- Principal & interest

- Property taxes

- Insurance

- FHA mortgage insurance (if applicable)

ExampleStep 2: Apply rental income offset

- Gross rent: $3,000

- Qualifying rent (75%): $2,250

Effective housing cost for DTI: [3,400 − 2,250 = 1,150]

Step 3: Add other debts

- Car loan, student loans, credit cards, etc.

ExampleStep 4: Calculate DTI

- Gross monthly income: $7,500

- Total debts: $1,150 + $700 = $1,850

[DTI = 1,850 ÷ 7,500 = 24.7%] That’s a

very strong DTI, even though the total mortgage payment is $3,400.

This is why house hacking works. Actionable tip: Run this calculation

before shopping so you know what price range actually qualifies.

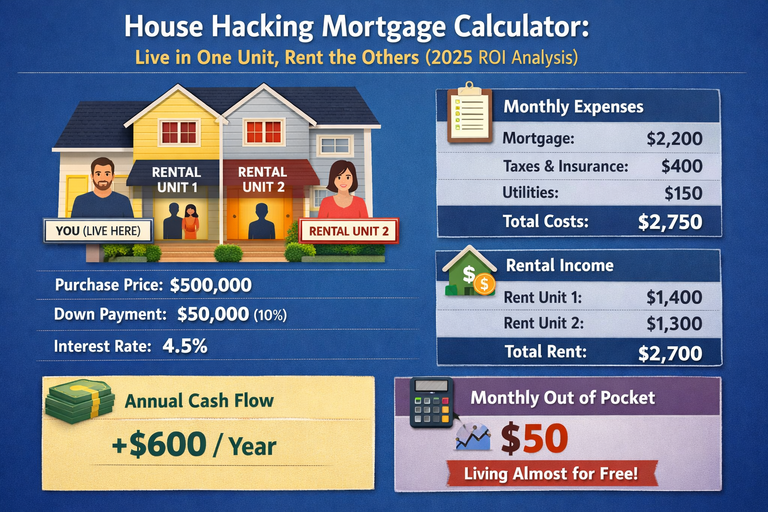

5) Full house hacking example (realistic numbers)

Property

- Triplex purchase price: $525,000

- Down payment (FHA 3.5%): ~$18,400

- Loan amount: ~$506,600

- Rate: ~6.5% (2025 context)

Monthly costs

- Mortgage (P&I): $3,200

- Taxes + insurance + MIP: $550

- Total PITI: $3,750

Rental income

- Unit 2 rent: $1,600

- Unit 3 rent: $1,500

- Total rent: $3,100

- Qualifying rent (75%): $2,325

Effective housing cost

If you lived alone in a $525k single-family home, your cost would be $3,750.

House hacking cuts it by

over 60%.

6) ROI: affordability first, profit second

House hacking ROI isn’t just cash flow—it’s:

- Reduced housing cost

- Forced savings via principal paydown

- Appreciation on the entire property

- Long-term rental upside

Simple first-year ROI snapshot

- Annual out-of-pocket housing cost: ~$17,100

- Comparable rent for similar unit: ~$2,200/month = $26,400/year

Effective savings: ~$9,300/year

That’s

before equity growth.

Actionable tip: If the deal only works assuming appreciation or rent hikes, it’s fragile. It should work on

today’s numbers.

7) Common house hacking mistakes that kill deals

❌ Overestimating rent

❌ Ignoring maintenance reserves

❌ Forgetting FHA mortgage insurance

❌ Assuming roommates = guaranteed income

❌ Not planning exit strategy (move-out refi)

Actionable tip: Stress-test your deal assuming:

- One unit vacant for 2 months

- Maintenance at 5–10% of rent

If it fails, walk away.

8) When house hacking stops making sense

House hacking may not be right if:

- You don’t want landlord responsibilities

- Rental income barely offsets the mortgage

- Property management stress outweighs savings

- You plan to move within 1–2 years

Actionable tip: This is a

strategy, not a lifestyle for everyone. Choose intentionally.

Conclusion

House hacking remains one of the most powerful affordability strategies in 2025—but only if you understand how rental income affects

DTI, qualification, and real costs. The magic isn’t appreciation or leverage—it’s the math lenders allow when rental income offsets your housing payment. Use a proper house hacking mortgage calculator, apply conservative rent assumptions, and structure the deal so it works

even if things go wrong. That’s how you buy smart—and sleep at night.

FAQs

1) Can rental income help me qualify for a mortgage? Yes. Most lenders allow ~75% of rental income from other units to offset the mortgage payment.

2) What loan is best for house hacking? FHA is the most common due to low down payment and multi-unit flexibility, but VA and conventional can also work.

3) Do I need landlord experience to house hack? No, but you should budget conservatively for vacancy and maintenance.

4) Is house hacking risky? It reduces housing cost but adds landlord responsibility. The risk is manageable with conservative math.

5) Can I refinance after moving out? Often yes—but only if income, equity, and lending conditions allow it.