In 2025, a growing number of buyers are doing something dangerous—and calling it “normal”:

buying above their budget to get a home they like in a market they fear missing. The logic sounds familiar:

- “We’ll tighten spending later.”

- “Our income will grow.”

- “Everyone stretches at first.”

This article is your

reality check. We’ll calculate

payment shock, expose the hidden “sacrifice costs” most buyers ignore, and show you how to test whether stretching your budget is a temporary discomfort—or a long-term financial trap.

1) What “buying above your budget” actually means

Buying above your budget doesn’t mean you

can’t make the payment. It means:

- Housing costs crowd out other essentials

- Small surprises become crises

- Lifestyle tradeoffs are permanent, not temporary

A useful definition:

You’re buying above your budget if your housing costs require ongoing sacrifices—not short-term adjustments—to stay solvent.

Actionable tip: If your plan requires sustained willpower to survive, it’s not a plan—it’s hope.

2) Step one: calculate true monthly housing cost (PITI+)

Most buyers underestimate this by hundreds. Include:

- Principal & interest

- Property taxes

- Homeowners insurance

- HOA (if applicable)

- PMI (if <20% down)

- Maintenance baseline (1–2% of home value annually)

Example (2025 context):

- P&I: $3,100

- Taxes: $520

- Insurance: $180

- HOA: $250

- Maintenance reserve: $400

True monthly housing cost: $4,450 If you’re only budgeting $3,100, you’re lying to yourself.

Actionable tip: Always add maintenance—even new homes break.

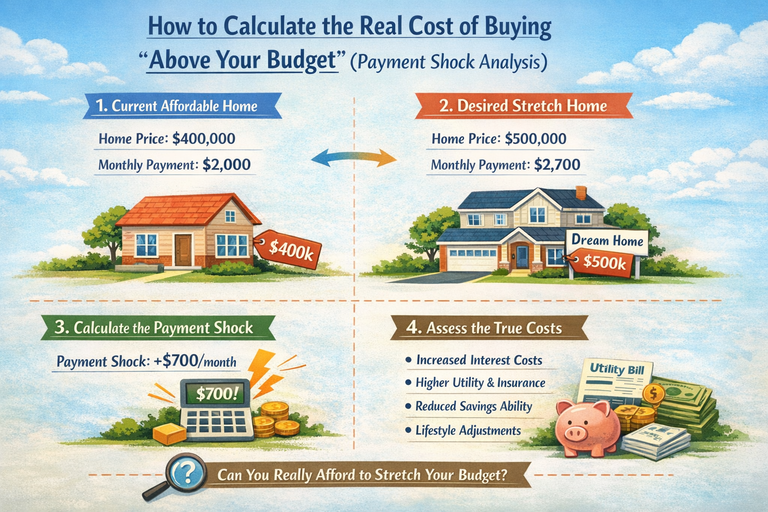

3) Payment shock: the most ignored risk

Payment shock is the difference between your current housing cost and your new one.

Example:

- Current rent: $2,300

- New housing cost: $4,450

Payment shock: +$2,150/month That’s not “tightening up.” That’s a lifestyle rewrite.

Rule of thumb:- <$500 increase → manageable

- $500–$1,000 → high stress

- $1,000+ → danger zone

Actionable tip: If payment shock exceeds what you save monthly today, the math already fails.

4) The sacrifice cost calculator (this is the real damage)

Here’s what buyers

say they’ll cut:

- Dining out

- Travel

- Subscriptions

Here’s what actually gets cut:

- Healthcare

- Retirement savings

- Emergency fund

- Relationship quality

Example: $2,150 monthly gap

| Sacrifice | Monthly Cost |

|---|

| Dining out | $400 |

| Vacations (averaged) | $300 |

| Gym / subscriptions | $150 |

| Retirement contributions | $700 |

| Healthcare delays | $300 |

| Total “cuts” | $1,850 |

You’re still short—and now underinsured, under-invested, and stressed.

Actionable tip: If retirement or healthcare are part of the “cut list,” the home is too expensive.

5) Stress-test your budget (most people won’t)

Run these three scenarios

before buying:

1️⃣ Income dip (−10%)

Layoffs, bonuses disappearing, reduced hours.

2️⃣ Cost creep (+10–15%)

Taxes, insurance, HOA, utilities always rise.

3️⃣ Life event

Childcare, medical expense, family obligation. If

any scenario breaks your budget, the purchase is fragile.

Actionable tip: Your mortgage should survive bad months, not just good ones.

6) The long-term cost of “just for now”

Let’s say you stretch successfully—for a while. What’s the cost?

- Lost retirement compounding

- Higher credit card reliance

- No buffer for opportunity (job change, move, investment)

- Chronic financial stress

Over 10 years, skipping $700/month in retirement contributions at a 7% return can cost

$120,000+ in future wealth. That’s the

hidden price of buying above your budget.

Actionable tip: A house that delays your future is not an asset—it’s an anchor.

7) When stretching can make sense (rare, specific)

Stretching may be rational if:

- You have large, stable cash reserves after purchase

- Income increase is contractually guaranteed (not hoped for)

- Payment shock is temporary (e.g., known debt payoff)

- You have a clear, credible exit (rent, sell, refi without relying on rate drops)

If you’re betting on appreciation or refinancing, that’s speculation.

Actionable tip: If the plan depends on things you can’t control, it’s not conservative enough.

8) A simple “above-budget” decision test

Answer honestly:

- Can I fund retirement, healthcare, and emergencies fully after buying?

- Would I still feel okay if rates never drop and income never rises?

- Does this purchase reduce or increase my financial flexibility?

If any answer is “no,” the house is too expensive.

Conclusion

Buying above your budget doesn’t fail immediately—it fails quietly, through stress, tradeoffs, and missed opportunities. Payment shock isn’t just a math problem; it’s a

life-quality problem. The real cost isn’t the mortgage.

It’s what the mortgage forces you to give up. If the house requires ongoing sacrifice of your future, it’s not worth it—no matter how nice it looks today.

FAQs

1) What does “payment shock” mean? It’s the increase between your current housing cost and your new one—and the stress it creates.

2) How much payment shock is too much? More than ~$1,000/month is high risk for most households.

3) Why do buyers underestimate housing costs? They ignore taxes, insurance, maintenance, and lifestyle sacrifices.

4) Can stretching ever work? Only with strong reserves, guaranteed income growth, or a short-term, well-defined plan.

5) What’s the biggest hidden cost of buying too much house? Lost retirement savings and long-term financial flexibility.