Putting

3% down feels like the fastest way into a home. Putting

20% down feels impossible for many buyers in 2025. Lenders often frame this as a lifestyle choice. It’s not. It’s a

long-term cost decision, and the difference can easily exceed

$100,000 over the life of the loan. This article breaks down the

real math—monthly payments, PMI, interest, opportunity cost—and shows when low down payment is smart versus financially reckless.

1) What actually changes between 3% and 20% down

The down payment affects four critical things:

- Loan size (more interest over time)

- PMI requirement (extra monthly cost)

- Interest rate (often slightly higher with low down)

- Equity speed (how fast risk drops)

Most buyers fixate on

getting approved. The cost shows up later.

Actionable tip: Down payment is not just an entry fee—it’s a pricing lever on your entire mortgage.

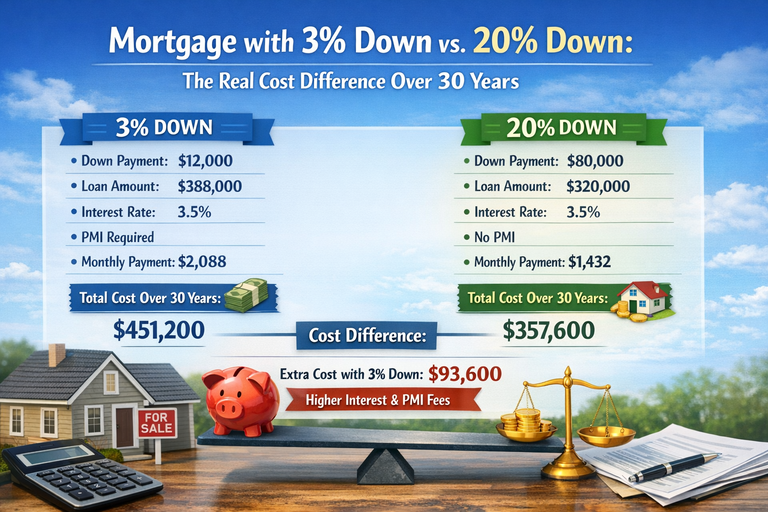

2) Base assumptions (realistic 2025 scenario)

Let’s compare apples to apples.

- Home price: $400,000

- Rate (20% down): 6.25%

- Rate (3% down): 6.75%

- Loan term: 30 years

- PMI (3% down): 0.8% annually

- Property taxes & insurance: excluded (same in both cases)

These assumptions are conservative and common in 2025.

3) Monthly payment comparison

🔹 Option A: 3% Down

- Down payment: $12,000

- Loan amount: $388,000

Principal & interest: ≈

$2,515/month PMI: ≈

$260/month 👉

Total monthly cost: $2,775🔹 Option B: 20% Down

- Down payment: $80,000

- Loan amount: $320,000

Principal & interest: ≈

$1,970/month PMI: $0 👉

Total monthly cost: $1,970Monthly difference

$805/month That’s not small. That’s a car payment

every month.

Actionable tip: If the payment difference forces lifestyle sacrifices, the low-down option may backfire.

4) PMI: the silent wealth killer

PMI doesn’t build equity.

It doesn’t lower your rate.

It doesn’t go away quickly.

PMI cost over time (realistic)

- $260/month

- ~$3,120/year

- PMI lasts ~7–10 years (depending on appreciation & payments)

👉

Total PMI paid: ~$22,000–$30,000 And that’s

on top of higher interest.

Actionable tip: PMI is a tax on impatience. Use it intentionally—or avoid it.

5) Total interest paid over 30 years (this is the gut punch)

3% Down Scenario

- Total interest paid: ~$517,000

- PMI paid: ~$25,000

- Total financing cost: ~$542,000

20% Down Scenario

- Total interest paid: ~$389,000

- PMI: $0

- Total financing cost: ~$389,000

💥 Difference

~$153,000 MORE with 3% down That’s not theoretical. That’s contractual.

Actionable tip: Always compare

total dollars paid, not just “can I afford the payment.”

6) “But I can invest the difference” (the common objection)

Yes, keeping $68,000 instead of using it as a down payment

could earn returns. But three problems:

- Most buyers don’t actually invest it—they spend it

- PMI and higher interest are guaranteed losses

- Risk-adjusted returns must beat a 6–7% after-tax cost

You’re not “investing the difference” unless you actually invest it—and outperform your mortgage rate

after taxes.

Actionable tip: If you’re not already investing consistently, this argument doesn’t apply to you.

7) When 3% down actually makes sense

Low down payment can be rational if:

- You expect to move within 5–7 years

- Appreciation will eliminate PMI quickly

- You need liquidity for business or emergencies

- Income growth is high and stable

- The alternative is renting much longer

In short:

short horizon, strong upside, high discipline.

Actionable tip: 3% down is a

bridge strategy, not a forever strategy.

8) When 20% down is the clear winner

20% down usually wins when:

- You plan to stay long-term

- Cash flow matters more than speed

- You’re risk-averse

- You’re buying near your max budget

- You want flexibility and lower stress

Lower fixed costs = fewer forced sacrifices.

Actionable tip: Peace of mind has financial value—especially in volatile markets.

Conclusion

The difference between 3% down and 20% down is not cosmetic. Over 30 years, it can exceed

$150,000—mostly from PMI and extra interest that never benefits you. Low down payment gets you in the door faster.

Higher down payment keeps you from bleeding quietly for decades. The right choice isn’t ideological. It’s mathematical. If you choose 3% down, do it with a plan to

eliminate PMI fast.

If you can manage 20% down, you’re buying lower risk, lower stress, and long-term leverage.

FAQs

1) Is 3% down bad? Not always—but it’s expensive. It works best as a short-term strategy.

2) How long does PMI last? Typically until you reach ~20% equity, which can take 7–10 years without appreciation.

3) Does 20% down always get a better rate? Often yes, but the bigger benefit is avoiding PMI and reducing loan size.

4) Can I remove PMI early? Yes, with appreciation or principal paydown—but it’s not automatic.

5) What’s the biggest mistake buyers make here? Only comparing monthly payments instead of total cost over time.