Knowing how to calculate your monthly mortgage payment is essential for every homebuyer and homeowner. Your monthly mortgage payment affects your budget, loan affordability, and long-term financial planning. In this guide, you’ll discover how to calculate your monthly mortgage payment, what factors influence it, and how to use the formula or a calculator to get accurate results.

What Is a Monthly Mortgage Payment?

A monthly mortgage payment is the amount you pay each month to your lender to repay your home loan. Typically, this payment includes principal (the loan amount), interest, and, in many cases, property taxes, homeowners insurance, and private mortgage insurance (PMI). Understanding how to calculate your monthly mortgage payment helps you make informed decisions and compare different loan options.

Why Calculating Your Monthly Mortgage Payment Matters

Budgeting: Accurately calculating your monthly mortgage payment helps you set a realistic housing budget.

Loan Comparison: You can compare different loan terms and interest rates to find the best deal.

Financial Planning: Knowing your payment breakdown enables you to plan for taxes, insurance, and other costs.

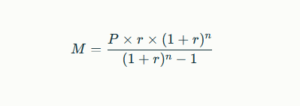

The Formula to Calculate Your Monthly Mortgage Payment

The standard formula for calculating your monthly mortgage payment (principal and interest only) is:

Where:

Where:M = Monthly mortgage payment

P = Principal loan amount

r = Monthly interest rate (annual rate divided by 12)

n = Total number of monthly payments (loan term in years × 12)

This formula works for fixed-rate mortgages. For variable-rate loans, payments may change over time.

Step-by-Step: How to Calculate Your Monthly Mortgage Payment

1. Determine the Principal Loan Amount

This is the amount you borrow from the lender, minus your down payment.

2. Find Your Annual Interest Rate

Use the annual interest rate provided by your lender. For calculation, convert it to a decimal (e.g., 5% becomes 0.05).

3. Convert the Annual Interest Rate to a Monthly Rate

Divide the annual rate by 12. For example, 5% annual interest becomes 0.004167 monthly (0.05 / 12).

4. Calculate the Total Number of Payments

Multiply the number of years in your loan term by 12. For a 30-year loan, that’s 360 payments (30 × 12).

5. Plug the Values into the Formula

Insert your principal, monthly interest rate, and number of payments into the formula to get your monthly payment.

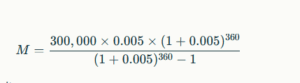

Example: Calculating Your Monthly Mortgage Payment

Suppose you have:

Loan amount (P): $300,000

Annual interest rate: 6%

Loan term: 30 years

Step 1: Convert annual interest rate to monthly: 6% / 12 = 0.005

Step 2: Calculate total payments: 30 × 12 = 360

Step 3: Use the formula:

Step 4: Calculate the result: Monthly payment ≈ $1,798.65 (principal and interest only).

What Else Is Included in Your Monthly Mortgage Payment?

In addition to principal and interest, your total monthly payment may include:

Property Taxes: Annual taxes divided by 12 and added to your payment.

Homeowners Insurance: Annual premium divided by 12.

Private Mortgage Insurance (PMI): Required if your down payment is less than 20%.

HOA Fees: If applicable, monthly homeowners association dues.

Total Monthly Mortgage Payment = Principal + Interest + Taxes + Insurance + PMI + HOA Fees.

Using a Mortgage Payment Calculator

While you can use the formula, mortgage payment calculators make the process easier. Simply enter your loan amount, interest rate, term, and other details to get an instant estimate. Calculators also let you adjust variables to see how changes affect your payment.

Tips for Managing Your Monthly Mortgage Payment

Compare Loan Offers: Shop around for the best rates and terms.

Consider Extra Payments: Making additional payments toward principal can save you money on interest.

Review Your Amortization Schedule: Understand how your payment is split between principal and interest over time.

Frequently Asked Questions: How to Calculate Your Monthly Mortgage Payment

Can I include taxes and insurance in my mortgage payment calculation?

Yes, add estimated monthly amounts for property taxes, homeowners insurance, and PMI to your principal and interest payment for a complete total.

Do adjustable-rate mortgages use the same formula?

The formula works for fixed-rate loans. Adjustable-rate mortgages (ARMs) may have changing payments as rates adjust.

How can I lower my monthly mortgage payment?

Consider a larger down payment, a longer loan term, or shopping for a lower interest rate.

Conclusion

Learning how to calculate your monthly mortgage payment empowers you to make smart financial decisions when buying or refinancing a home. Use the formula or a mortgage payment calculator to estimate your payment, compare loan options, and plan your budget with confidence.