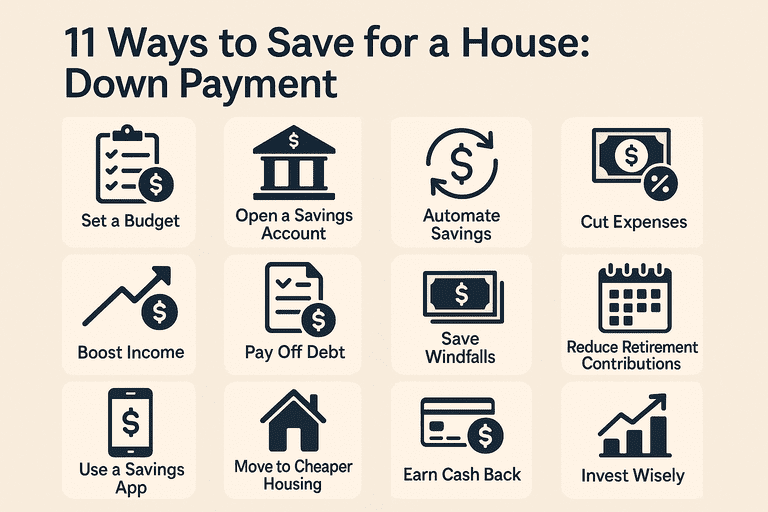

Saving for a house down payment is one of the most important steps toward homeownership. With rising home prices and evolving mortgage requirements, knowing the best ways to save for a house down payment can help you reach your goal faster. Whether you’re a first-time buyer or looking to upgrade, these 11 strategies will boost your savings and put you on the path to your dream home.

1. Build a Better Budget for Your Down Payment

The foundation of saving for a house down payment is a solid budget. Track your income and expenses to see where your money goes each month. Identify areas to cut back and set a specific savings goal for your down payment. Treat your savings like a non-negotiable monthly bill to ensure consistent progress.

2. Open a Separate Savings Account

Create a dedicated savings account exclusively for your house down payment. This separation makes it less tempting to dip into your savings for other expenses. Automate transfers from your checking account so your contributions happen without effort.

3. Automate Your Savings

Set up automatic deposits from your paycheck or checking account into your down payment fund. Automation ensures you never miss a contribution and helps you build your savings steadily over time.

4. Reduce Expenses and Cut Bad Habits

Analyze your discretionary spending and look for areas to freeze or reduce costs. This could mean eating out less, canceling unused subscriptions, or cutting back on impulse purchases. Even small changes can add up quickly when saving for a house down payment.

5. Consider Downsizing or Adjusting Your Living Situation

If possible, move to a smaller apartment or share housing with roommates or family to lower your rent and utility costs. The money saved can be redirected toward your down payment fund.

6. Seek Additional Income or Start a Side Hustle

Boost your savings by taking on freelance work, a part-time job, or a side hustle. Even selling unused items or renting out a spare room or parking space can provide extra cash for your house down payment.

7. Save Raises, Bonuses, and Windfalls

Whenever you receive a raise, bonus, tax refund, or monetary gift, transfer it directly into your down payment account. Using unexpected income accelerates your savings without affecting your regular budget.

8. Explore Down Payment Assistance Programs

Many states, counties, and cities offer down payment assistance for first-time buyers. These programs may provide grants, forgivable loans, or matching funds to help you reach your savings goal faster. Check local housing authorities for eligibility and application details.

9. Shop Around to Reduce Major Monthly Expenses

Review your recurring bills—like insurance, phone plans, and utilities—to find better deals or negotiate lower rates. The savings from these adjustments can be redirected to your house down payment fund.

10. Use High-Yield Savings Accounts or CDs

Maximize your savings by parking your down payment fund in a high-yield savings account, money market account, or certificate of deposit (CD). These accounts offer higher interest rates than standard savings, helping your money grow faster while you save for a house down payment.

11. Ask for Help or Use Gift Funds

Don’t hesitate to ask family or friends for help with your down payment, especially for special occasions like weddings or birthdays. Many lenders allow you to use gift money for all or part of your down payment, as long as you follow their documentation rules.

Bonus Tip: Break Your Goal Into Milestones

Saving for a house down payment can feel overwhelming. Break your goal into smaller milestones and reward yourself for each achievement. This keeps you motivated and focused on your progress.

Conclusion

Using these 11 ways to save for a house down payment will help you build your fund efficiently and confidently. From budgeting and automation to side hustles and assistance programs, every step brings you closer to homeownership. Start applying these tips today and watch your down payment savings grow.