A down payment calculator is an essential tool for anyone planning to buy a home. Understanding how much you’ll need for a down payment, how it impacts your loan amount, and what your monthly payment could be are critical steps in the home buying process. This guide explains how to use a down payment calculator, why it matters, and how different down payment amounts can affect your financial future.

What Is a Down Payment Calculator?

A down payment calculator helps you estimate the amount of cash you’ll need upfront when purchasing a home, based on the home price and your chosen down payment percentage. It also reveals your estimated loan amount and monthly payment, making it easier to plan your finances and set realistic savings goals.

How Does a Down Payment Calculator Work?

Most down payment calculators require you to enter:

Home price: The total cost of the property you want to buy.

Down payment percentage: The portion of the home price you plan to pay upfront (e.g., 5%, 10%, 20%).

Interest rate: The expected mortgage rate.

Loan term: The length of your mortgage (typically 15, 20, or 30 years).

Closing costs (optional): Additional upfront fees, often 2–5% of the home price.

Once you enter these details, the calculator instantly estimates:

Your required down payment amount

The loan amount you’ll need to borrow

Your estimated monthly mortgage payment

Total upfront costs including closing fees

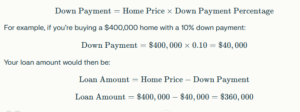

Down Payment Calculator Formula

The basic formula for calculating your down payment is:

Why Use a Down Payment Calculator?

Using a down payment calculator offers several benefits:

Accurate estimates: Know exactly how much you need to save and borrow.

Scenario planning: Compare different down payment percentages to see how they affect your loan and monthly payment.

Time savings: Instantly calculate costs without manual math.

Financial clarity: Plan for other expenses like closing costs and monthly payments.

How Down Payment Size Impacts Your Mortgage

Larger down payment: Reduces your loan amount, lowers your monthly payment, and may eliminate the need for private mortgage insurance (PMI) if you put down at least 20%.

Smaller down payment: Requires less cash upfront but increases your loan amount and monthly payment. You may need to pay PMI, which adds to your monthly costs.

Step-by-Step: Using a Down Payment Calculator

Gather your financial details: Home price, desired down payment percentage, interest rate, loan term, and estimated closing costs.

Enter the information: Input these numbers into the calculator fields.

Review your results: See your required down payment, loan amount, and estimated monthly payment.

Adjust for scenarios: Try different down payment percentages or home prices to see how your upfront and monthly costs change.

Example Calculation

Let’s say you want to buy a $350,000 home:

Down payment percentage: 15%

Interest rate: 6%

Loan term: 30 years

Down payment: $350,000 × 0.15 = $52,500

Loan amount: $350,000 – $52,500 = $297,500

Estimated monthly payment: Use a mortgage calculator to factor in principal, interest, taxes, and insurance.

Tips for Saving for a Down Payment

Automate savings: Set up automatic transfers to a dedicated account.

Cut unnecessary expenses: Reduce discretionary spending.

Explore down payment assistance: Look for grants or programs in your area.

Consider gifts: Family members can sometimes contribute toward your down payment.

Frequently Asked Questions: Down Payment Calculator

Q: Do I need a 20% down payment to buy a house? A: No. Many loans allow down payments as low as 3% (conventional), 3.5% (FHA), or even 0% (VA/USDA).

Q: Does a larger down payment always make sense? A: Not always. While it lowers your loan and monthly payment, it may tie up cash you could use for other investments or emergencies.

Q: Can a down payment calculator include closing costs? A: Yes. Many calculators let you add estimated closing costs for a more complete picture of your upfront expenses.

Conclusion

A down payment calculator is a must-have tool for any homebuyer. It helps you estimate your upfront costs, loan amount, and monthly payment, empowering you to make informed decisions and set achievable savings goals. Use a down payment calculator early in your home buying journey to plan confidently and avoid surprises at closing.