In 2025, most American households are still

priced out of median-priced homes. Nearly

75% of U.S. households cannot afford a median-priced new home when applying traditional underwriting rules (PITI ≤ 28% of income), with median prices near $460,000 and rates elevated. That makes identifying

truly affordable housing markets crucial for first-time buyers who want to translate income into a realistic mortgage payment. Here’s how to analyze and compare markets using real numbers, affordability ratios, and actionable strategies.

1) Why affordability varies so much across markets

Housing affordability is fundamentally about

home price relative to income. The National Association of Realtors’ affordability index has been weak (below the threshold where median earners can afford median homes), meaning

most cities are still unaffordable.

Key affordability drivers:- Median home prices

- Local incomes

- Property taxes & insurance

- Mortgage rates (still high in 2025)

Actionable tip: Always calculate the

price-to-income ratio: [\text{Price-to-Income} = \frac{\text{Median Home Price}}{\text{Median Household Income}}] A value near

3.0 or below is traditionally considered affordable; above that often signals stress.

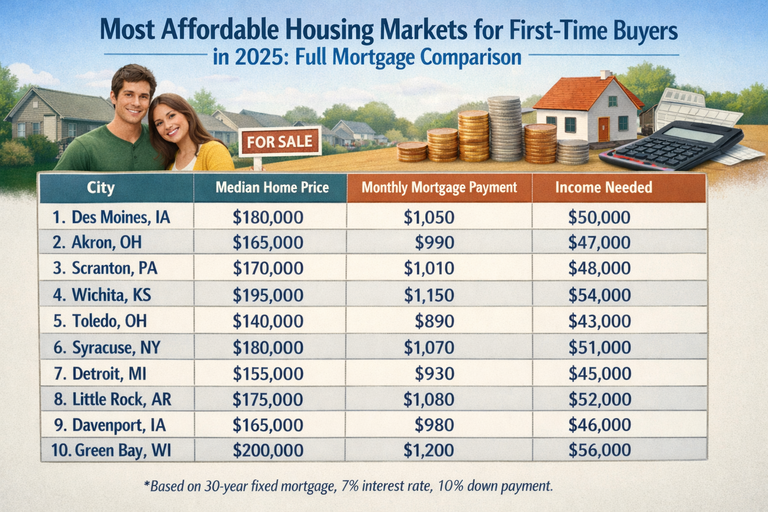

2) Top metros where first-time buyers have the best odds

Multiple 2025 market rankings highlight metros with strong affordability for first-time buyers, based on

price relative to income and availability.

Notable affordable metros:- Harrisburg, PA – Median prices much lower than national average with solid employment

- Rochester, NY – A low home price base around ~$130k makes payments small

- Lansing, MI – Strong ratio of income to price

- North Little Rock, AR – Good prices relative to income

- Villas / Cape Coral, FL – Lower median prices with growth potential

In these markets,

median mortgage payments can come in under $1,000–$1,500/month before taxes/insurance, depending on down payment and your rate assumptions.

Actionable tip: Don’t assume “cheap” means “good deal.” Always calculate expected monthly PITI using a

Mortgage Payment Calculator with your planned down payment and rate scenario.

3) Large city affordability: rare but possible

For the

50 largest U.S. metros, affordability remains weak: often requiring

>40–45% of income on housing before taxes/insurance—even when rates moderate. However, a few large metros still offer relative affordability due to lower prices or stronger incomes:

- Some Midwest and Rust Belt metros

- Secondary cities with balanced price/income ratios

Example calculation (illustrative):- Metro median home price: $230,000

- Income (median): $60,000

- Loan assumptions: 6.2% on a 30-year fixed

- Approx PI payment: $1,400

- Taxes & insurance (approx): $450

- Total PITI: $1,850

[\text{DTI housing ratio} = \frac{1,850}{5,000} = 37%] This is still

tight but often within stretch limits for many first-time buyers.

Actionable tip: If total housing ratio is above

35–38%, negotiate price down or increase down payment to reduce risk of DTI rejection.

4) Smaller markets & secondary cities: strongest numbers

Studies like the “Most Affordable Places To Buy A Home in 2025” list dozens of smaller cities — many in the Midwest and South — where average prices are

significantly below the national median.

Examples from affordability rankings:- Cincinnati, OH – single-family value often ~$230k–$240k

- El Paso, TX – values ~$220k–$230k

- Des Moines, IA – home values ~$200k range

- Tulsa, OK – consistent affordability for median incomes

Lower prices plus realistic incomes often deliver monthly payments under

$1,800 for modest homes — and sometimes under

$1,500 in the smallest cities.

Actionable tip: Use the

Home Affordability Calculator with local median incomes and prices to see where your dollars buy the most house.

5) Regional trends affecting affordability

Some regional patterns matter in 2025:

- Midwest & Rust Belt: Overall lower prices relative to incomes

- South & Southeast: Lower price bases but sometimes higher taxes/insurance

- Sun Belt: Mixed — lower taxes but growing demand pushing prices

- High-cost coastal metros: Least affordable — often impossible without high income or large down payment

These regional patterns show up in multiple affordability indices and market reports.

Actionable tip: Don’t ignore

tax/insurance costs even in lower-price areas — they can add

$200–$600/month to carrying cost.

6) Mortgage rate impact on affordability

Even in affordable markets,

mortgage rates dramatically shift monthly payments.

Example (illustrative): Using a 30-year fixed:

- 5.5% ➜ Lower payment

- 6.5–7.0% ➜ Roughly 10–15% higher monthly payment This can make a big difference when budgeting in tight markets.

Actionable tip: Calculate break-even scenarios at:

- current average rate

- +0.5% (worse case)

- –0.5% (best case)

This gives a realistic range of payment expectations before you make an offer.

7) A practical step-by-step market comparison

Here’s how to choose:

- Gather data: median price, median income, local property tax rate

- Run affordability math: use price, down payment, and a realistic rate

- Calculate DTI using your income (include other debts)

- Stress-test taxes & insurance (assume +10–20% increases)

- Add closing & moving costs into your upfront budget

This disciplined math is what separates

hope from

decision-ready offers.

Conclusion

Even as the U.S. housing market remains challenging in 2025—with national median prices high and many households priced out—there are

real markets where first-time buyers can still find affordable homes. By focusing on cities with lower price-to-income ratios and realistic monthly payments, you increase your odds of not just buying—but affording—your first home. Deep local data and national indices show that

secondary metros and smaller cities offer the most tangible affordability, while major coastal cities demand higher incomes or creative strategies.

FAQs

1) What makes a market “affordable” in 2025? Affordability is driven by low home prices relative to local median income, reasonable taxes/insurance, and manageable monthly payments after applying today’s mortgage rates.

2) Are there affordable large metro areas? A few Midwest and secondary metros remain relatively affordable, but most of the largest U.S. cities require a high income to afford median homes.

3) How do I compare cities using data? Use price-to-income ratios, median price data, and your own monthly budget to calculate expected payments and debt ratios. Tools like affordability calculators help.

4) Do mortgage rates matter for affordability? Greatly. Higher rates increase monthly payments and tighten what price you can realistically afford for any given income.

5) Should I relocate to an affordable city? Relocation can improve affordability but consider job prospects, taxes, insurance costs, and long-term plans before choosing a market.