Most mortgages are set up with monthly payments—12 payments per year. But with a biweekly mortgage plan, you pay half of your monthly payment every two weeks. Since there are 52 weeks in a year, that works out to 26 half-payments, or 13 full payments per year. That one extra payment each year can shave years off your loan term and save you thousands in interest. For more mortgage strategies and payoff methods, see our Complete Mortgage Process Guide

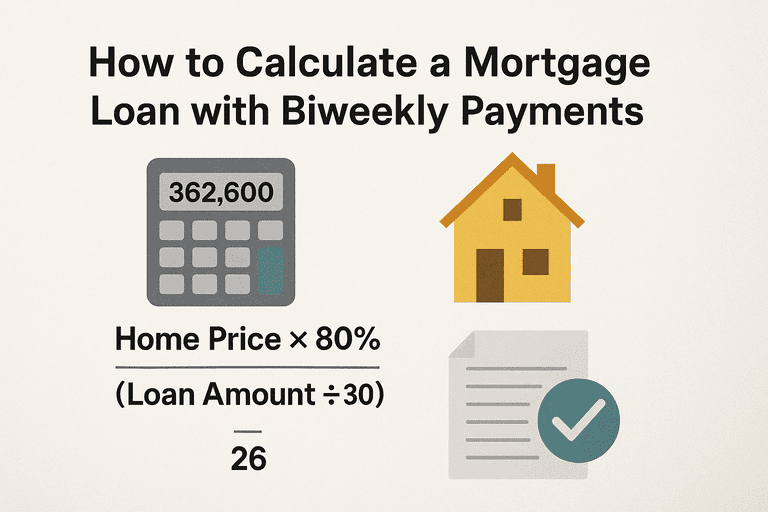

This guide explains how to calculate your mortgage with biweekly payments and shows the long-term benefits of this strategy.

1. How Biweekly Payments Work

Monthly plan: 12 full payments per year.

Biweekly plan: 26 half-payments per year (13 full payments).

Result: One extra month’s payment each year goes toward principal.

This extra payment accelerates payoff and reduces total interest.

2. Step-by-Step Biweekly Calculation

Let’s compare monthly vs. biweekly on a sample loan.

Loan Amount: $250,000

Interest Rate: 6% (0.005 monthly)

Term: 30 years (360 payments)

Standard Monthly Payment: ≈ $1,498.88

Biweekly Setup

Biweekly payment = $1,498.88 ÷ 2 = $749.44 every two weeks.

Payments per year = 26 × $749.44 = $19,485.44/year.

Compare to monthly: 12 × $1,498.88 = $17,986.56/year.

→ That’s an extra $1,498.88 each year applied to principal.

3. Impact on Loan Term and Interest

With biweekly payments:

Loan term drops from 30 years to about 25 years.

Interest savings ≈ $40,000–$50,000, depending on exact loan terms.

4. Creating a Biweekly Amortization Schedule

To calculate manually:

Start with loan balance.

Apply half the monthly payment every two weeks.

Recalculate interest based on reduced balance.

Continue until balance reaches zero (about 5 years earlier than monthly).

Example Snapshot

| Payment # | Payment Amount | Interest | Principal | Balance Remaining |

|---|

| 1 (biweekly) | $749.44 | $625.00 | $124.44 | $249,875.56 |

| 2 (biweekly) | $749.44 | $624.69 | $124.75 | $249,750.81 |

5. Things to Watch Out For

Lender Acceptance – Some lenders don’t allow biweekly schedules without a third-party service.

Third-Party Fees – Avoid companies that charge you to set up biweekly plans.

DIY Approach – You can often just make one extra monthly payment per year instead of switching to biweekly.

6. Why Biweekly Works So Well

You’re paying down principal faster.

Interest accrues on a smaller balance sooner.

Over time, this compounding effect shaves years off your mortgage.

Conclusion

Switching to biweekly payments is a simple but powerful way to pay off your mortgage early and save thousands in interest. By splitting your monthly payment in half and paying every two weeks, you effectively make an extra payment each year—without feeling the financial strain of writing one big check.