Medical Debt and Mortgages: How Illness Affects Affordability and Qualification

Medical debt is the most misunderstood debt category in mortgage lending. In 2025, millions of otherwise qualified buyers worry that a hospital bill—or a health crisis from years

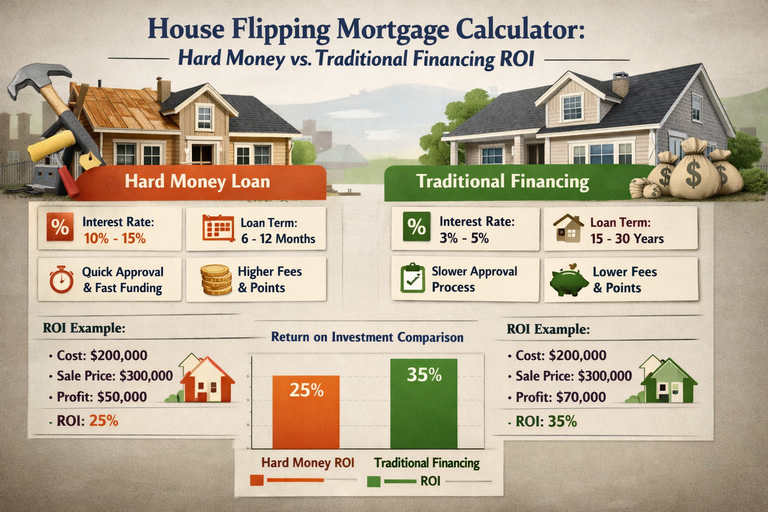

House Flipping Mortgage Calculator: Hard Money vs. Traditional Financing ROI

House flipping looks simple on Instagram. In reality, most flips fail because investors miscalculate financing costs, not renovation costs. In 2025, with higher interest rates and tighter lending,

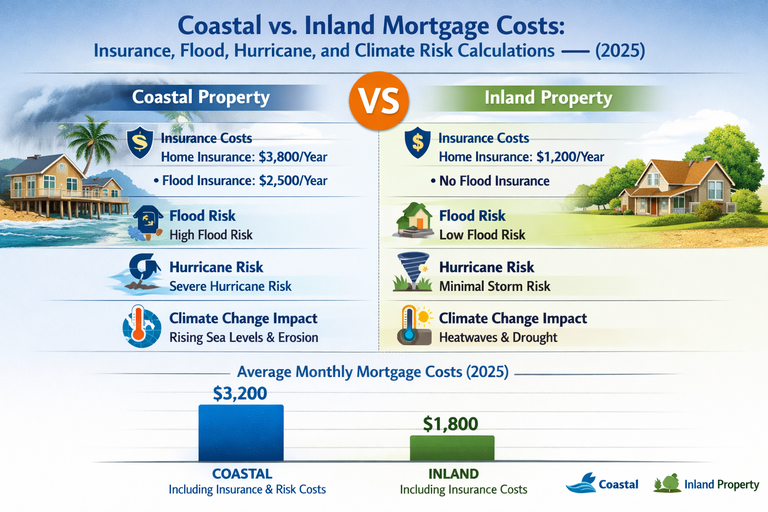

Coastal vs. Inland Mortgage Costs: Insurance, Flood, Hurricane, and Climate…

In 2025, the biggest hidden cost in homeownership isn’t interest rates. It’s insurance driven by climate risk. Two homes with the same price and mortgage rate can differ

Remote Worker Mortgage Calculator: How to Qualify When Living in…

Remote work changed where people live—but it didn’t change how lenders think about risk. In 2025, thousands of remote workers earn coastal salaries while buying homes in lower-cost

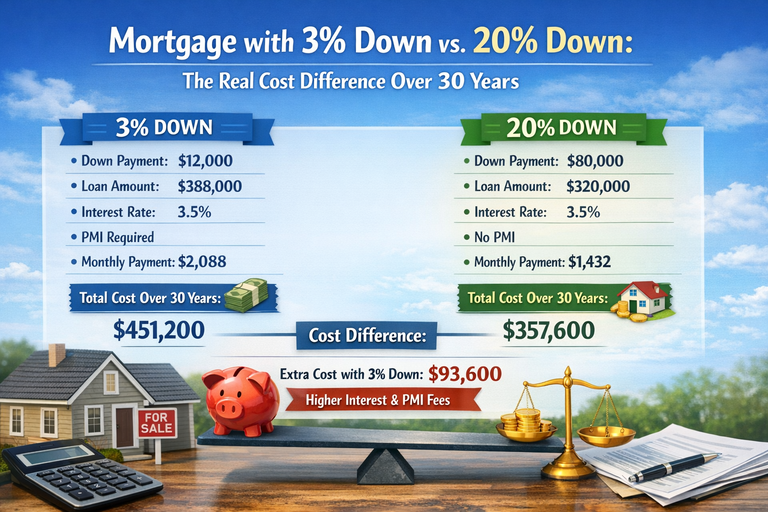

Mortgage with 3% Down vs. 20% Down: The Real Cost…

Putting 3% down feels like the fastest way into a home. Putting 20% down feels impossible for many buyers in 2025. Lenders often frame this as a lifestyle

Interest-Only Mortgage Calculator: When It Makes Sense (And When It’s…

Interest-only mortgages are back in the conversation in 2025—not because they’re safer, but because high home prices and 6–7% rates are pushing buyers to look for relief. For

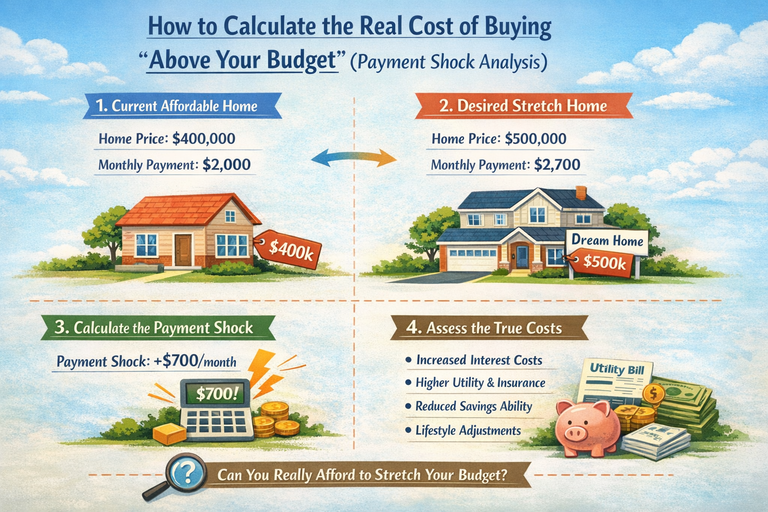

How to Calculate the Real Cost of Buying “Above Your…

In 2025, a growing number of buyers are doing something dangerous—and calling it “normal”: buying above their budget to get a home they like in a market they

Should You Buy Now and Refinance Later? The True Cost…

In 2025, many homebuyers are wrestling with the same dilemma: interest rates are high (often 6%–7% or more), but the housing market remains tight. The popular advice to

Mortgage Calculation for Delayed Homebuyers: How to Catch Up After…

Buying your first home at 35–45 is no longer unusual—it’s becoming normal. The problem isn’t age. The problem is math. Delayed homebuyers often earn strong incomes but have

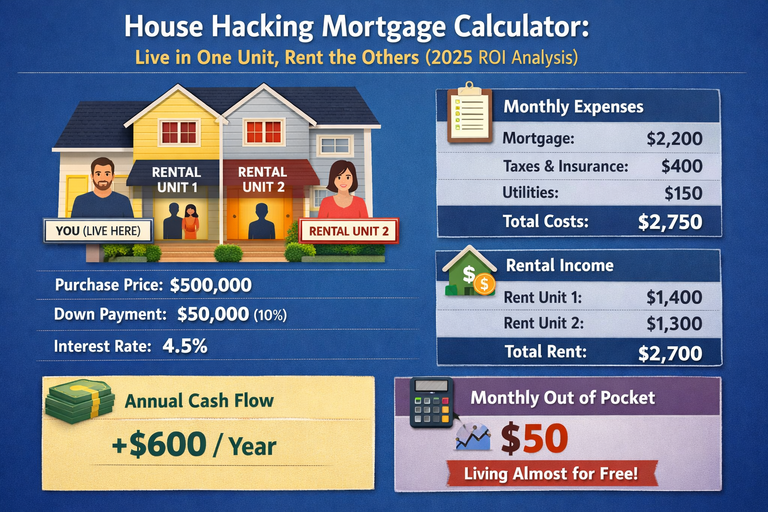

House Hacking Mortgage Calculator: Live in One Unit, Rent the…

House hacking is one of the few remaining strategies that blends affordability with investing in 2025. Instead of buying a single-family home you fully pay for, you live

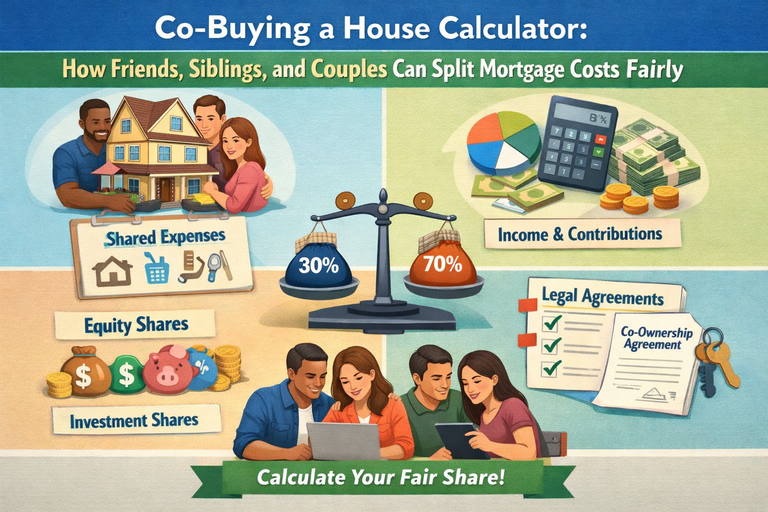

Co-Buying a House Calculator: How Friends, Siblings, and Couples Can…

With rising home prices, many buyers in 2025 are turning to co-buying — purchasing a home with one or more trusted people to share the cost and make

Mortgage Pre-Approval in 60 Seconds: Digital Lenders vs. Traditional Banks…

“Get pre-approved in 60 seconds.” In 2025, that promise is everywhere—and it’s tempting in competitive housing markets where speed feels like everything. But here’s the uncomfortable reality: speed

How to Use AI to Predict the Best Time to…

Everyone wants the same thing in 2025: buy at the “right” time—when mortgage rates dip, prices soften, and affordability improves. AI tools now promise to forecast exactly that.

Blockchain Mortgages and Smart Contracts: How Crypto Is (and Isn’t)…

Blockchain mortgages sound revolutionary: instant approvals, no paperwork, smart contracts replacing lenders, and crypto-backed home loans with lower costs. In 2025, the hype is loud—but the reality is

AI Mortgage Calculators vs. Traditional: Which Gives More Accurate Affordability…

AI mortgage tools are everywhere in 2025. Buyers ask ChatGPT-style tools what they can afford, when to buy, and whether to refinance—often before touching a traditional mortgage calculator.

Best Online Mortgage Lenders 2025: Rates, Reviews & Comparison Guide

In a housing market where mortgage rates for a 30-year fixed loan are still above 6% on average even late in 2025, finding the right lender matters almost

Widow/Widower Mortgage Guide: Can You Afford the Home Alone? (Income…

Losing a spouse is emotionally devastating—and financially destabilizing. For homeowners, the mortgage often becomes the most urgent question: Can I afford this home on one income? In 2025,

Inheriting a House with a Mortgage: Should You Keep, Sell,…

Inheriting a home feels like a gift—but when a mortgage comes with it, that gift quickly turns into a financial decision. Unlike cash or investments, real estate with

Divorce and Mortgage: How to Calculate Refinancing, Buyouts, and Single-Income…

Divorce doesn’t just end a relationship—it forces a financial reckoning, and the mortgage is usually the biggest landmine. In the U.S., roughly 40–45% of marriages end in divorce,

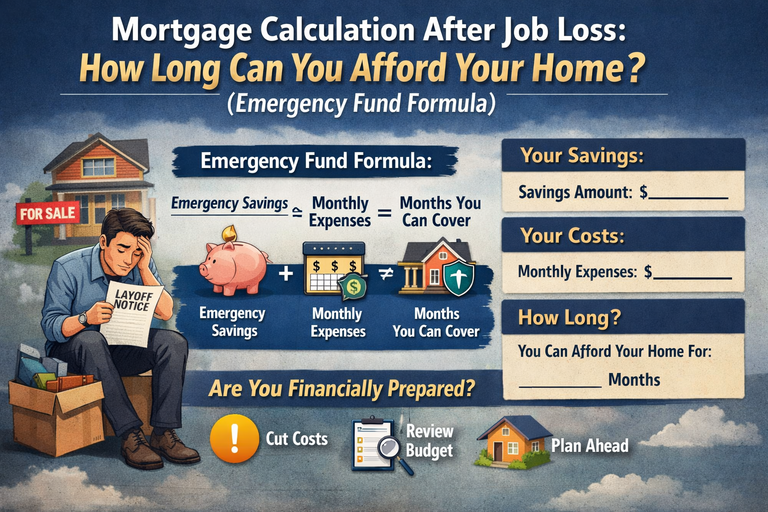

Mortgage Calculation After Job Loss: How Long Can You Afford…

Job loss turns a mortgage from “manageable” into urgent math overnight. In 2025, layoffs remain uneven across industries, and even high-income households can face sudden income gaps. According

Mortgage for a Duplex, Triplex, or Fourplex: How Multi-Unit Properties…

Buying a multi-unit property—like a duplex, triplex, or fourplex—can be a powerful way to build wealth while living in one unit and renting the others. But the mortgage

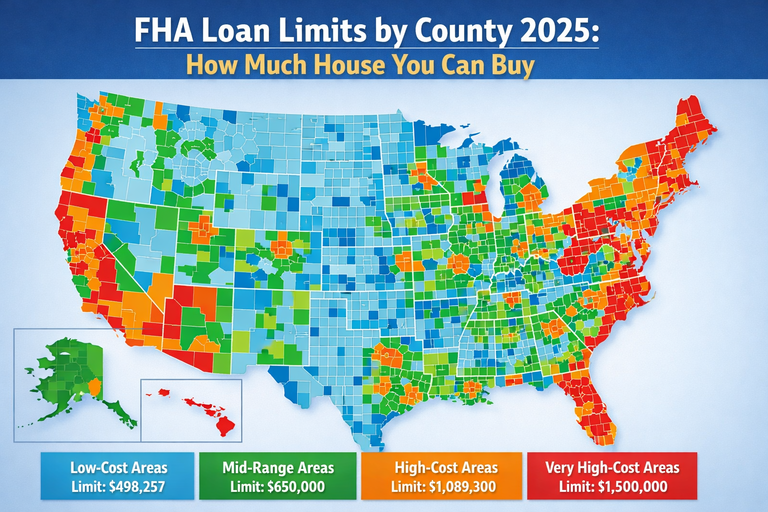

FHA Loan Limits by County 2025: How Much House You…

For many first-time buyers and moderate-income homebuyers, an FHA loan is one of the most accessible mortgage options. The Federal Housing Administration (FHA) insures these loans, enabling lenders

Building a Rental Property Portfolio: How to Calculate Maximum Mortgages…

Investing in rental properties can be one of the most powerful ways to build long-term wealth—but only if you understand how mortgages, rental income, and lender underwriting work

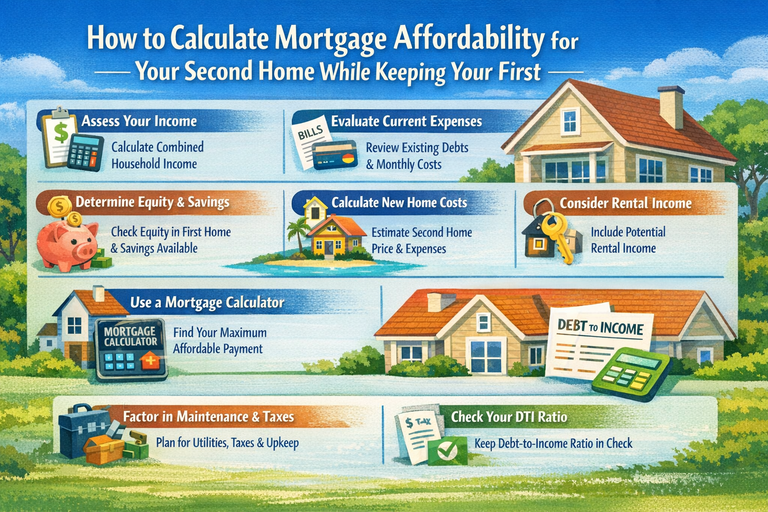

How to Calculate Mortgage Affordability for Your Second Home While…

Buying a second home—whether a vacation retreat, family getaway, or future retirement spot—is a dream for many U.S. homeowners. But owning two properties means two sets of monthly

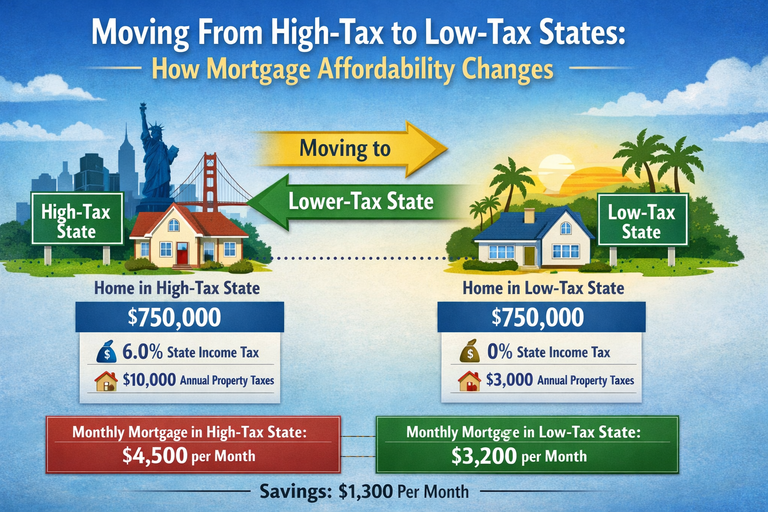

Moving From High-Tax to Low-Tax States: How Mortgage Affordability Changes

If you’re thinking about relocating to save money on housing, tax differences can make a real impact on what you can afford. Property taxes—one of the largest ongoing

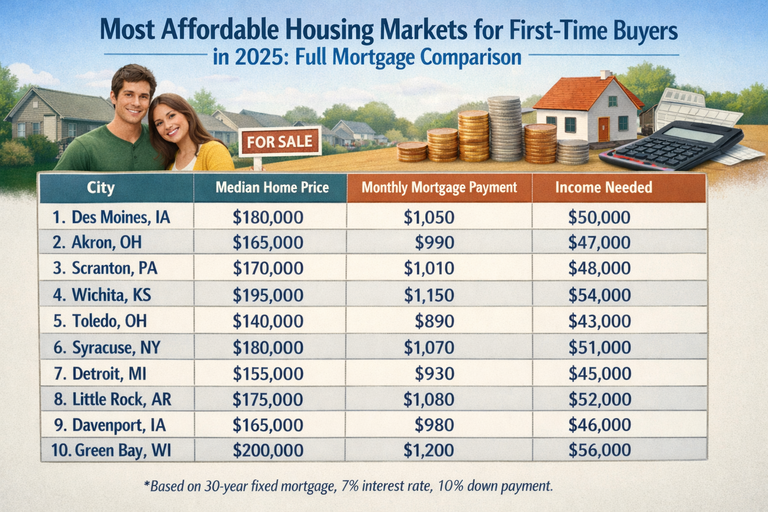

Most Affordable Housing Markets for First-Time Buyers in 2025: Full…

In 2025, most American households are still priced out of median-priced homes. Nearly 75% of U.S. households cannot afford a median-priced new home when applying traditional underwriting rules

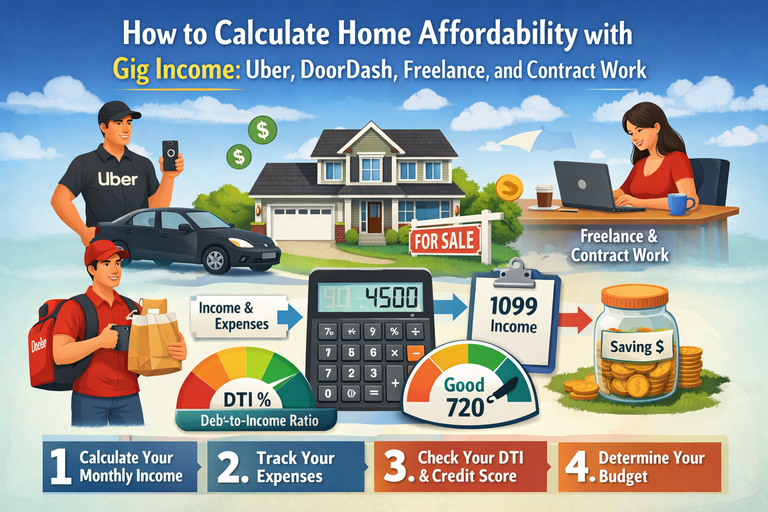

How to Calculate Home Affordability with Gig Income: Uber, DoorDash,…

In 2025, gig economy income—from rideshare driving to freelancing—is mainstream and increasingly part of homebuying math. Millions of Americans earn non-traditional income, and lenders have adapted programs to

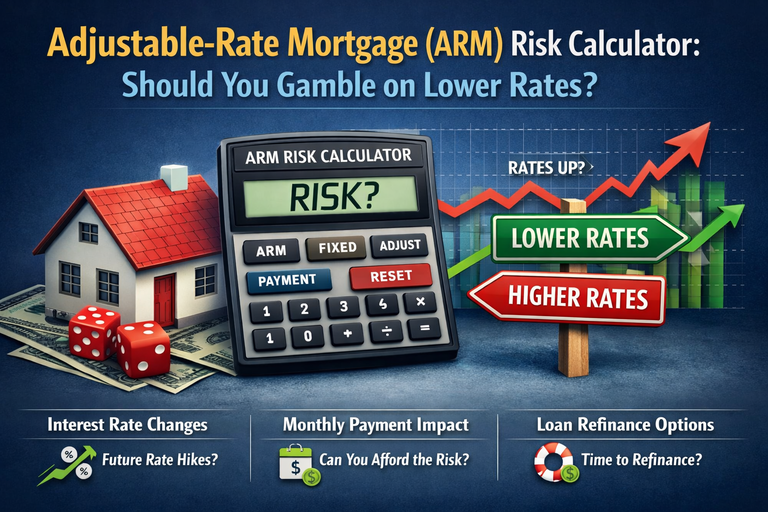

Adjustable-Rate Mortgage (ARM) Risk Calculator: Should You Gamble on Lower…

ARMs are back because people are desperate to lower the monthly payment. The Mortgage Bankers Association reported ARMs hit 9.6% of total applications in mid-2025—one of the higher

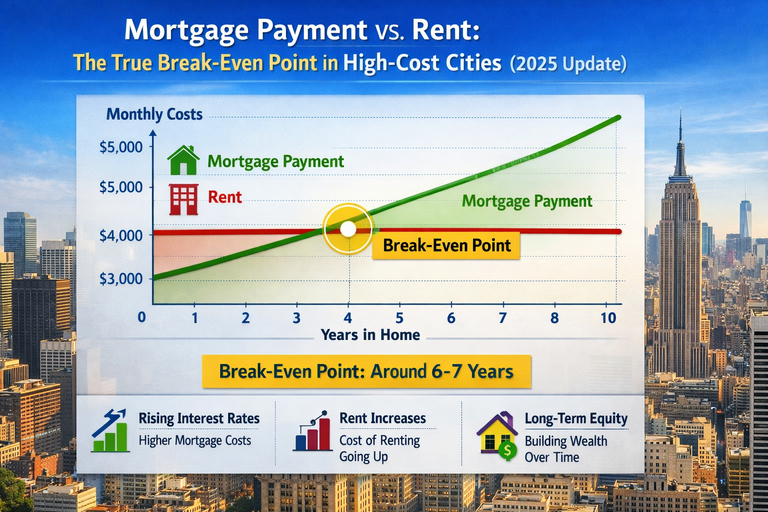

Mortgage Payment vs. Rent: The True Break-Even Point in High-Cost…

In 2025, the rent-vs-buy question isn’t philosophical—it’s financial survival. Mortgage rates are still high by recent standards, and both renters and owners are feeling the squeeze. Freddie Mac’s

The 40-Year-Old First-Time Homebuyer: How to Calculate Affordability When You’ve…

If you’re buying your first home around age 40, you’re not an outlier anymore—you’re the new normal. The National Association of REALTORS® reports the typical first-time buyer age

Mortgage Recasting vs Refinancing Calculator: Which Saves More Money? (2025…

Homeowners looking to reduce monthly payments generally choose between mortgage recasting or refinancing. Both strategies can lower your monthly payment, but they work very differently. In 2025, with

Gen Z First-Time Homebuyers: Mortgage Calculation Strategies for 2025

Gen Z — buyers born between 1997 and 2012 — is entering the housing market in record numbers. With rising rents, remote work flexibility, and long-term wealth goals,

1031 Exchange and Mortgage Calculations: Investment Property Tax Deferrals (2025…

The 1031 exchange remains one of the strongest tax-deferral tools available for real estate investors. It allows investors to sell an investment property and reinvest the proceeds into

Foreign National Mortgages: ITIN vs SSN Loan Calculations (2025 Guide)

Foreign nationals buying property in the United States face unique mortgage requirements — especially when they do not have a Social Security Number (SSN). In 2025, demand for

Expat Mortgages: US Citizens Buying Property Abroad — Calculation Guide…

More Americans than ever are purchasing homes abroad — for retirement, relocation, investment, or remote-work lifestyles. From Mexico to Portugal to Costa Rica, international real estate markets offer

Energy-Efficient Home Mortgages: FHA EEM and Calculation Benefits (2025 Guide)

Energy-efficient home improvements have become a priority for homeowners as electricity rates rise and sustainability becomes more valuable in the real estate market. The FHA Energy-Efficient Mortgage (EEM)

Calculating Mortgages in High-Tax States: NY, CA, NJ Comparison (2025…

New York, California, and New Jersey consistently rank among the highest-tax states in the U.S. These states also have some of the most expensive housing markets, strictest zoning

Wildfire and Hurricane Zones: How Natural-Disaster Risk Affects Mortgage Rates…

Wildfires and hurricanes have become more frequent and more destructive across the United States. As a result, mortgage lenders and insurers now place significant emphasis on natural-disaster risk

Solar Panel Financing and Mortgage Calculations: PACE Loans Explained (2025…

Solar adoption has surged across the U.S., driven by federal tax credits, rising energy bills, and an increased push for sustainability. Many homeowners use PACE loans (Property Assessed

Climate Risk and Mortgage Calculations: Flood Zones and Insurance Costs…

Climate risk is now one of the most important factors in mortgage qualification and home affordability. Flood zones, wildfire zones, hurricane-prone regions, and coastal erosion areas significantly impact

Military Deployment and Mortgage Payments: VA Loan Relief Options (2025…

Military deployment presents unique financial challenges for service members and their families. When income changes, orders arrive unexpectedly, or relocation occurs, handling a mortgage can become complicated. Fortunately,

Single Parent Mortgage Guide: Income Calculations and Assistance Programs (2025)

Single parents face some of the toughest financial hurdles in homeownership: one income, rising childcare costs, limited savings, and often higher debt loads. Despite this, millions of single

Baby Boomer Downsizing: Calculating Mortgages for Smaller Retirement Homes (2025…

Baby Boomers — born between 1946 and 1964 — are downsizing at record rates in 2025. With rising property taxes, home maintenance costs, and lifestyle changes, many are

Millennial Homebuying Challenges: Student Debt and Mortgage Calculations (2025 Guide)

Fractional homeownership — where multiple buyers jointly own a property and split usage, costs, and equity — has become one of the fastest-growing alternative ownership models in 2025.

Mortgage Calculation for Fractional Homeownership & Property Shares (2025 Guide)

Fractional homeownership — where multiple buyers jointly own a property and split usage, costs, and equity — has become one of the fastest-growing alternative ownership models in 2025.

Co-Living Space Mortgages: Financing Shared Housing Properties (2025 Guide)

Co-living has become one of the fastest-growing housing trends in the U.S. and internationally. With rising rents, remote work, and affordability challenges, shared housing properties offer a profitable

Gig Economy Workers: Calculating Mortgage Affordability With Uber, DoorDash &…

Gig economy workers — Uber drivers, DoorDash couriers, Instacart shoppers, freelancers, rideshare operators, and independent contractors — now make up a massive share of U.S. income earners. But

Cryptocurrency and Mortgages: Using Bitcoin for Down Payments (2025 Guide)

Cryptocurrency has moved from a niche investment to a mainstream financial asset — and in 2025, more homebuyers are asking whether they can use Bitcoin, Ethereum, or other

Digital Nomad Mortgages: Financing a Home with Remote Income (2025…

Digital nomads — remote workers who live and work from anywhere — are now a major force in the housing market. But financing a home as a nomad

Non-QM Loans for Non-Traditional Borrowers: Calculation Guide 2025

Non-QM (Non-Qualified Mortgage) loans have become a lifeline for borrowers who don’t fit traditional lending guidelines — self-employed buyers, gig-workers, real estate investors, foreign nationals, ITIN borrowers, and

Student Loan Forgiveness Programs and Mortgage Qualification (2025 Guide)

Student loan debt is one of the biggest obstacles for young homebuyers — and with new forgiveness programs and repayment plans rolling out in 2024–2025, many buyers want

Unemployment Rate and Mortgage Approval: How Job Market Affects Lending…

Mortgage approval depends heavily on employment stability — and in 2025, lenders are more cautious than ever. When unemployment rates rise, lenders tighten underwriting, raise credit score requirements,

Tariffs and Trade Wars: Impact on Mortgage Rates and Housing…

Tariffs and international trade conflicts have become one of the most underestimated drivers of U.S. housing costs. While most buyers focus on interest rates, inflation, and supply shortages,

Mortgage Rate Predictions for 2026: What Economists Are Forecasting

After the extreme rate volatility of 2022–2024, buyers in 2025 want one thing: clarity. Will mortgage rates fall in 2026? Or will economic pressures push them even higher?

How Government Shutdowns Affect Mortgage Rates and Loan Processing (2025…

Every time the U.S. government faces a shutdown, homebuyers and lenders experience immediate uncertainty. Mortgage rates may fluctuate, processing slows down, and key verification systems are impacted —

Voice-Activated Mortgage Calculators: Using Alexa and Google Home for Home…

Smart speakers like Amazon Alexa and Google Home have become powerful financial tools. In 2025, buyers can ask voice assistants to calculate mortgage payments, estimate affordability, compare loan

Best Mortgage Apps for 2025: Compare Rates, Calculate Payments &…

In 2025, homebuyers expect fast, mobile-first mortgage tools that simplify rate shopping, loan tracking, and payment estimation. Mortgage apps have become essential for anyone planning to buy a

Blockchain Mortgages: Smart Contracts and Digital Home Loans in 2025

Blockchain technology is reshaping the mortgage industry in 2025. Smart contracts can automate underwriting, secure records, verify borrower data, and even handle payment transfers without traditional intermediaries. But

ChatGPT and AI Mortgage Assistants: Can They Replace Human Loan…

AI mortgage assistants exploded in popularity in 2024–2025 as buyers sought faster answers, instant prequalification estimates, and simplified explanations of complex loan rules. Tools like ChatGPT can calculate

Mortgage Calculator API Integration: How to Embed Calculators on Your…

If you run a real estate, mortgage, or financial website, embedding a mortgage calculator directly into your pages is one of the highest-ROI upgrades you can make. It

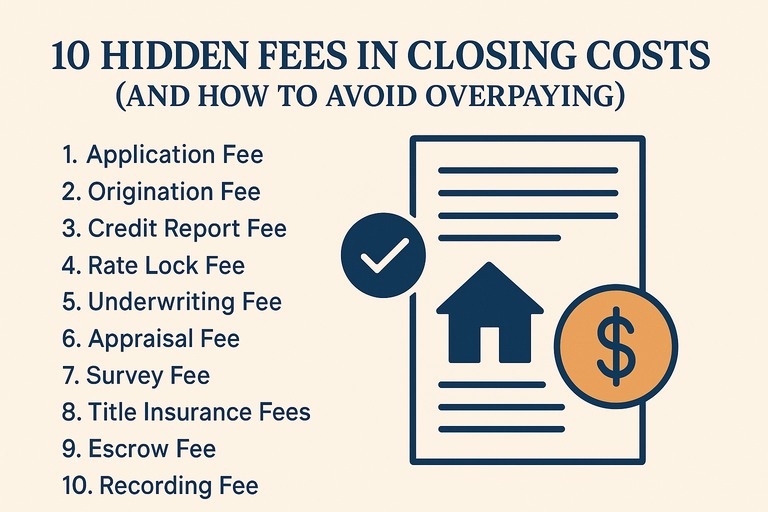

10 Hidden Fees in Closing Costs (and How to Avoid…

When you’re preparing to buy a home, most guides tell you closing costs will run 2–5% of the purchase price — but few explain what’s inside that number.Beyond

Rate Shopping 101: Lock, Float-Downs & Points Strategy

Mortgage rates move every day — sometimes several times per day.That’s why knowing when to lock, how to compare quotes, and whether to buy points can save you

What Moves Mortgage Rates? (A Plain-English Guide)

Mortgage rates don’t rise or fall randomly — they follow a set of predictable patterns shaped by inflation, economic data, and investor demand for mortgage-backed securities (MBS).Understanding these

First-Time Buyers in Florida: Closing Costs & Programs Checklist

If you’re buying your first home in Florida, understanding the true upfront costs — and the programs that can help — can make or break your budget.While the

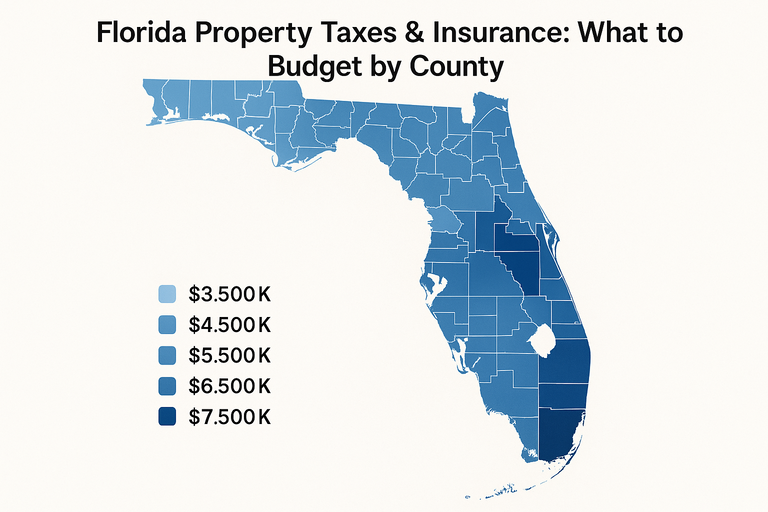

Florida Property Taxes & Insurance: What to Budget by County

Buying a home in Florida means planning for more than just your mortgage rate.Across the Sunshine State, property taxes and insurance premiums vary dramatically — shaped by your

FHA vs Conventional: Which Payment Is Lower for You?

When you’re buying a home, one of the first choices you’ll face is FHA vs Conventional financing.The two programs may look similar, but once you account for credit

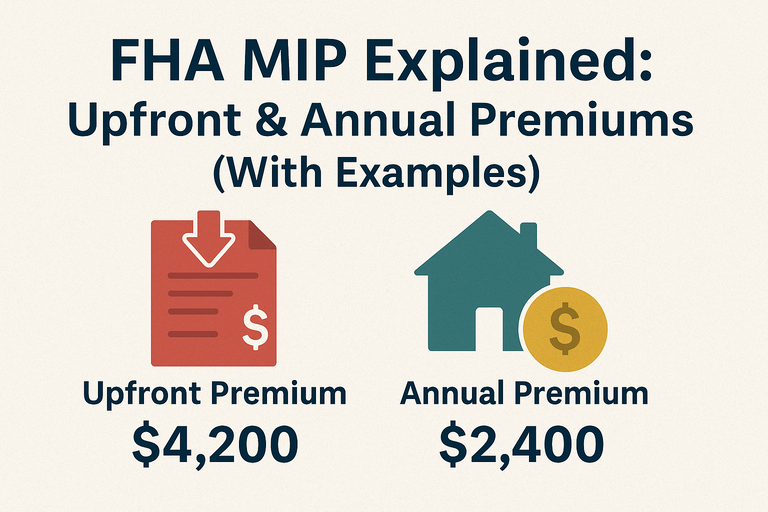

FHA MIP Explained: Upfront & Annual Premiums (With Examples)

If you’re considering an FHA loan, you’ll encounter a unique cost: Mortgage Insurance Premium (MIP).Unlike conventional loans, FHA mortgages require both an upfront premium and an annual premium

Hidden Costs in Your House Payment: Taxes, Insurance, HOA &…

When you calculate your “monthly mortgage payment,” it’s easy to focus only on the loan itself — but your real house payment is much more complex. Beyond principal

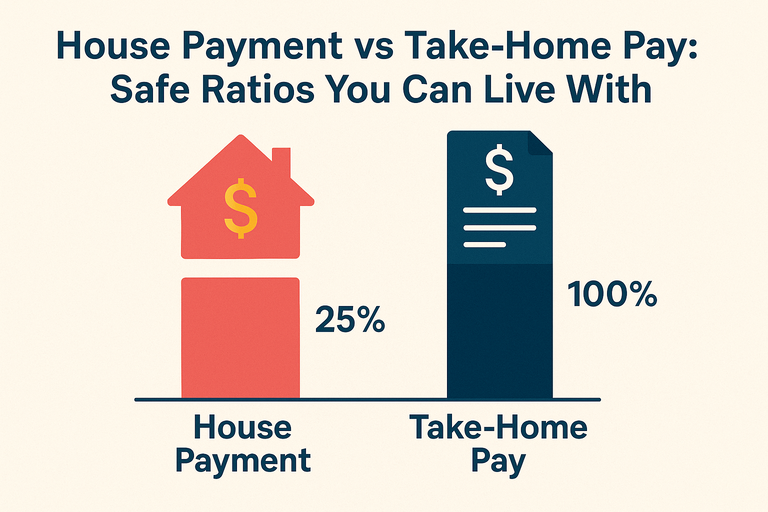

House Payment vs Take-Home Pay: Safe Ratios You Can Live…

Your mortgage payment shouldn’t keep you awake at night.The key to comfortable homeownership is knowing how much of your income can safely go toward housing — and where

The 5-Year Rule: When Buying Beats Renting (With Scenarios)

If you’re on the fence between renting and buying, the 5-Year Rule can simplify the decision.It’s a proven benchmark showing when homeownership typically starts paying off versus renting

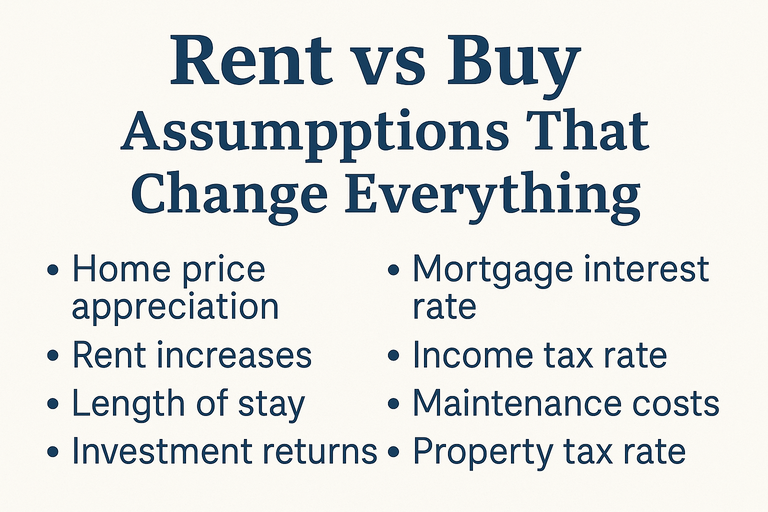

Rent vs Buy Assumptions That Change Everything

Ever run a rent vs buy calculator and get a different result than your friend?That’s not a glitch — it’s because tiny assumption changes completely shift the outcome.Factors

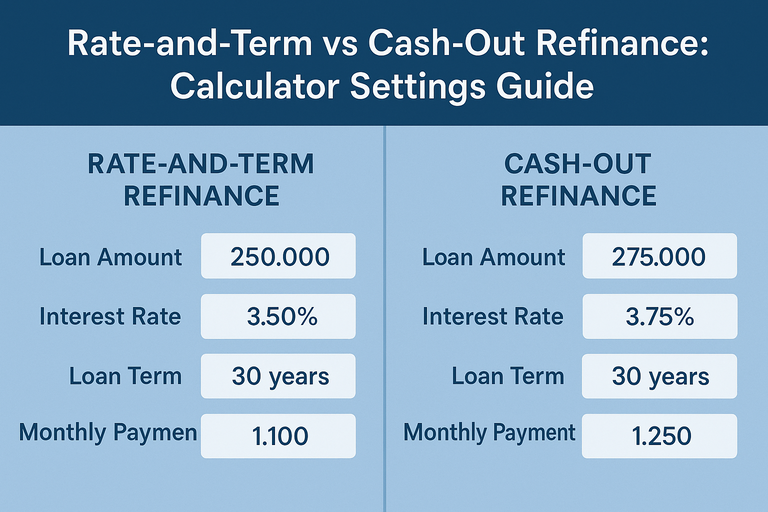

Rate-and-Term vs Cash-Out Refinance: Calculator Settings Guide

When you use a refinance calculator, one small setting—“cash-out” vs “rate-and-term”—can change your entire payment picture.Both refinance types lower costs or free up cash, but they do it

How Often Can You Refinance? Timing Your Next Refi

Refinancing a mortgage can be a powerful financial strategy, whether you’re aiming to lower your monthly payments, shorten your loan term, or tap into home equity. But how

Cash-Out Refinance vs HELOC: Which Saves More?

If you need cash for renovations, debt consolidation, or investment, two options often come up: a cash-out refinance or a home equity line of credit (HELOC).Both convert your

Refi Break-Even Explained: When Refinancing Actually Saves You Money

A refinance can feel like “free money” when mortgage rates drop—but not every refi saves you money.Between closing costs, origination fees, and rate resets, you might pay thousands

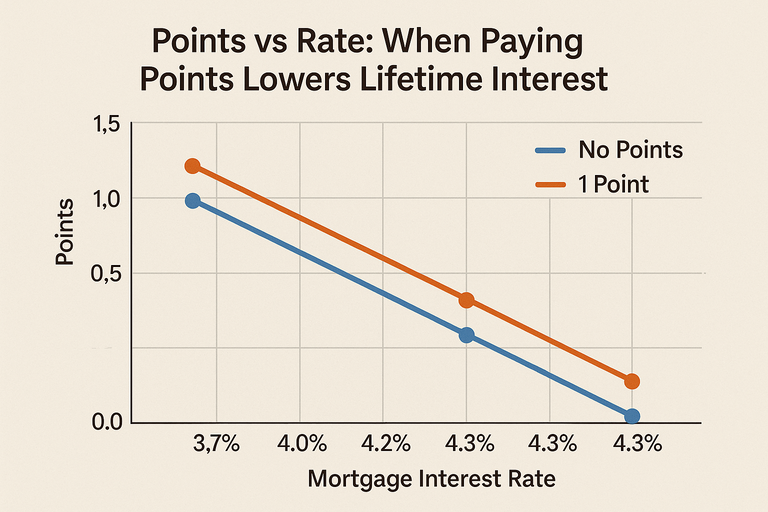

Points vs Rate: When Paying Points Lowers Lifetime Interest

Buying a home comes with hundreds of line items, but few have more long-term impact than mortgage points. Paying “points” upfront can reduce your interest rate for decades—but

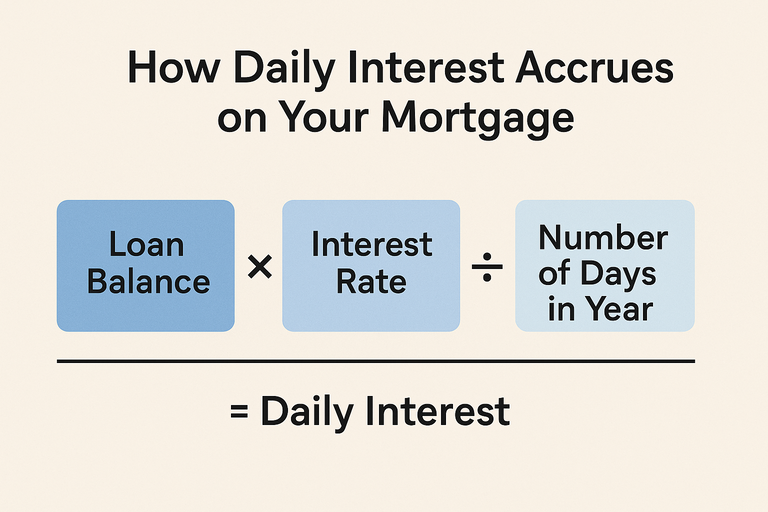

How Daily Interest Accrues on Your Mortgage (With Examples)

Every mortgage borrower pays interest—but few realize how that interest is calculated.While your payment might look fixed each month, behind the scenes, lenders calculate interest daily, based on

VA Funding Fee Calculator: How It Changes Your Payment

If you’re using your VA home loan benefit, one of the most confusing line items is the VA funding fee.It’s unique to VA loans, and though it’s not

VA Loan vs FHA vs Conventional: Which Calculator Settings to…

If you’ve ever run a mortgage calculator and wondered “Why do these numbers look so different?”—you’re not alone.Each loan type (VA, FHA, and Conventional) has unique rules for

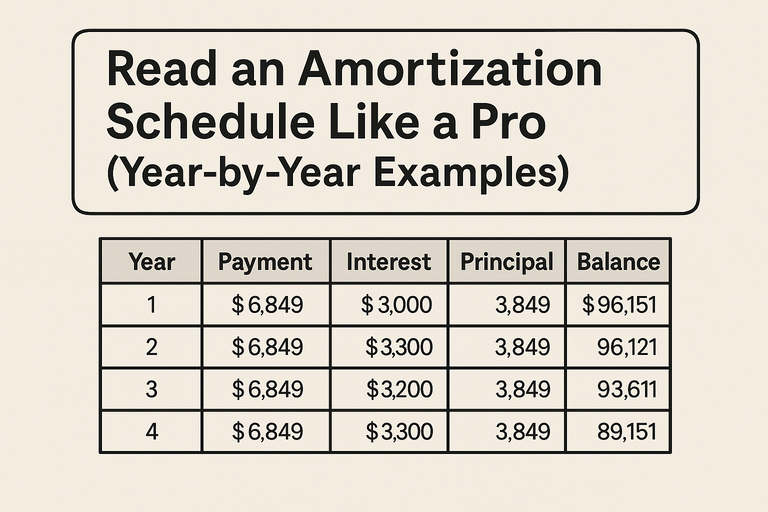

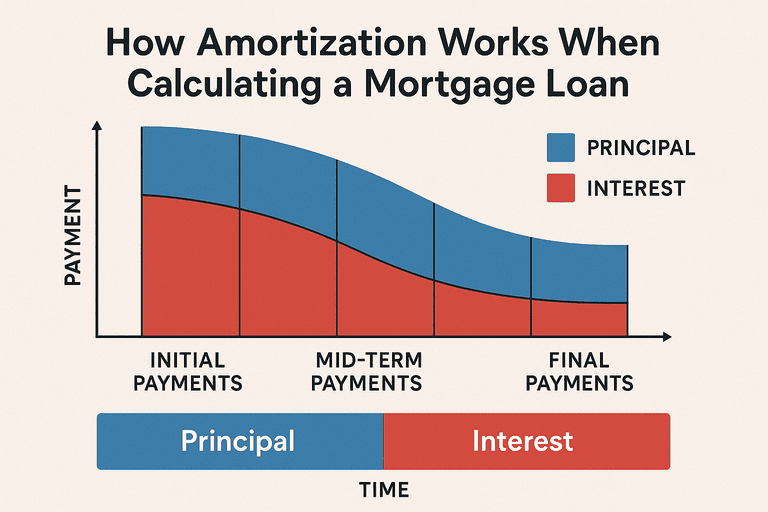

Read an Amortization Schedule Like a Pro (Year-by-Year Examples)

When you make a mortgage payment, part goes to interest, and part chips away at your principal balance.An amortization schedule shows exactly how that balance shifts over time—month

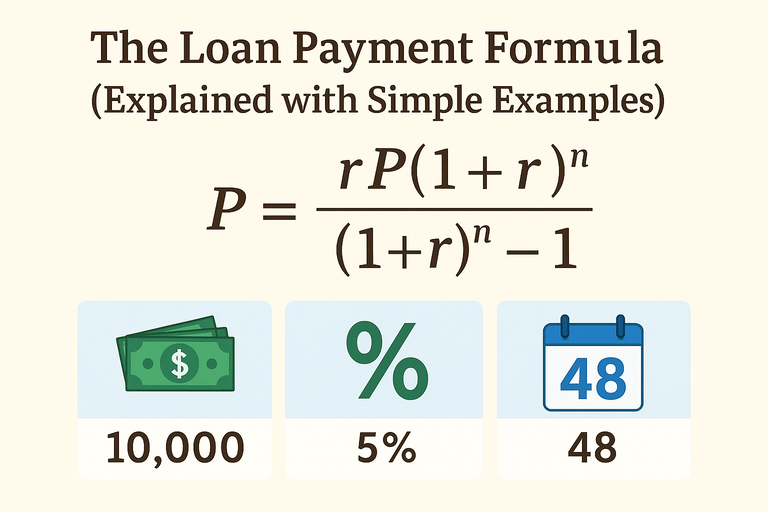

The Loan Payment Formula (Explained with Simple Examples)

Every loan—from car loans to 30-year mortgages—relies on the same foundation: the loan payment formula.Once you understand it, you can check any calculator’s math, estimate payments by hand,

Loan Calculator Basics: From Car Loans to Mortgages (Key Differences)

Not all loan calculators speak the same language. Auto, personal, and mortgage loans may look similar on paper, but they calculate interest, fees, and amortization differently. Understanding those

First-Time Buyers: How to Read Your Home Loan Calculator Results

As a first-time homebuyer, diving into the world of home financing can feel overwhelming. A home loan calculator is a powerful tool to help you estimate monthly payments,

Home Loan Calculator vs. Mortgage Calculator: What’s the Difference?

When navigating the world of homeownership, terms like “home loan calculator” and “mortgage calculator” often pop up, leaving many wondering if they’re interchangeable or distinct tools. While both

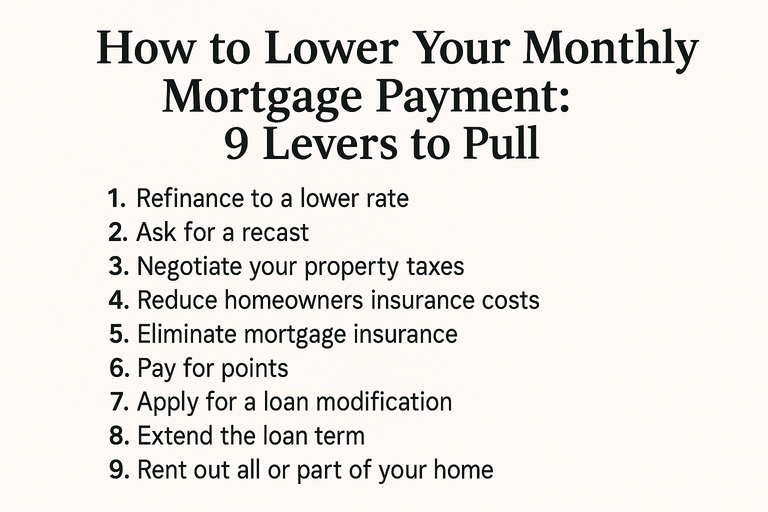

How to Lower Your Monthly Mortgage Payment: 9 Levers to…

If you’re feeling the pinch from rising living costs, inflation, or unexpected expenses, your monthly mortgage payment might be one of the biggest culprits straining your budget. The

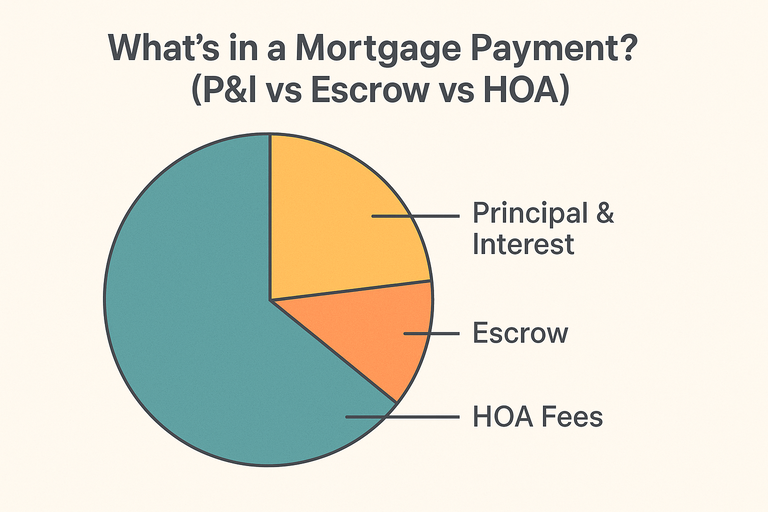

What’s in a Mortgage Payment? (P&I vs Escrow vs HOA)

What’s in a Mortgage Payment? P&I vs Escrow vs HOA Your monthly mortgage payment isn’t just what you owe the lender—it’s a bundle of several smaller costs that

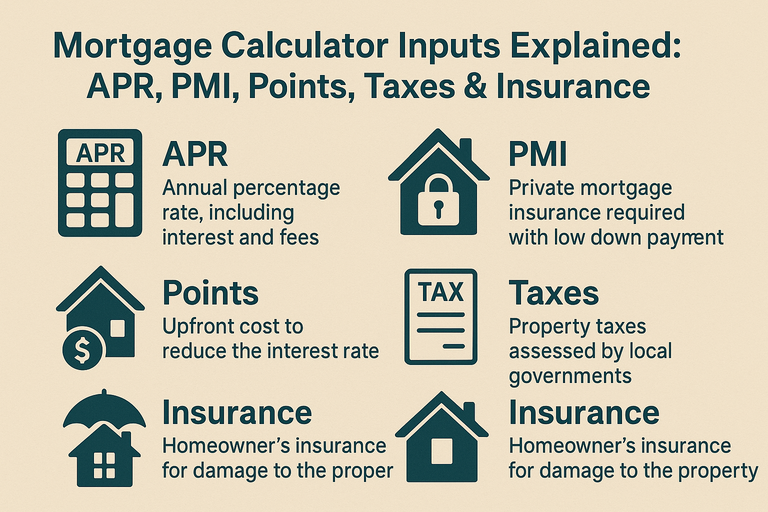

Mortgage Calculator Inputs Explained: APR, PMI, Points, Taxes & Insurance

A mortgage calculator is only as accurate as the numbers you feed it. This guide demystifies each input so you can model payments with confidence—and make smarter decisions

6 Pro Ways to Use a Mortgage Calculator (Save Time…

A mortgage calculator is more than a quick payment estimate. Used well, it helps you stress-test your budget, compare loan options, and avoid hidden costs before you make

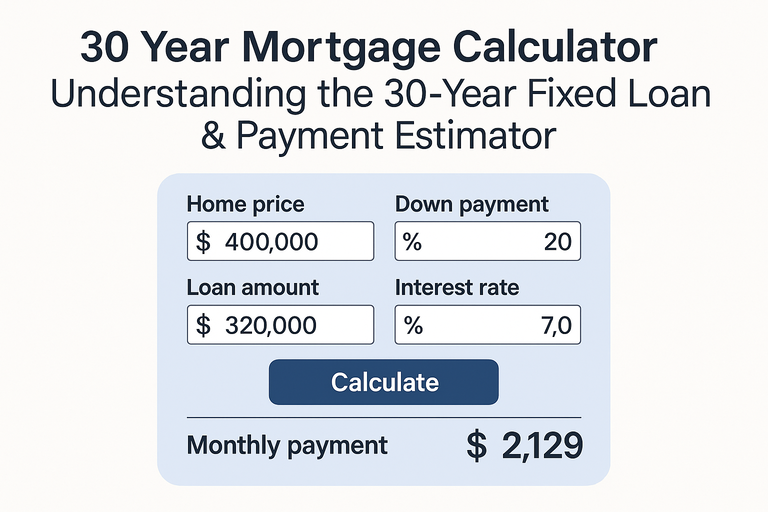

30 Year Mortgage Calculator | Understanding the 30-Year Fixed Loan…

A 30 year mortgage calculator is a specialized version of a mortgage tool tailored to the most common mortgage term: thirty years. Because 30-year fixed mortgage loans are

Home Loan Mortgage Calculator | How It Works & Why…

A home loan mortgage calculator is one of the most useful tools a prospective homebuyer or refinancer can have. It helps you estimate what your monthly payments might

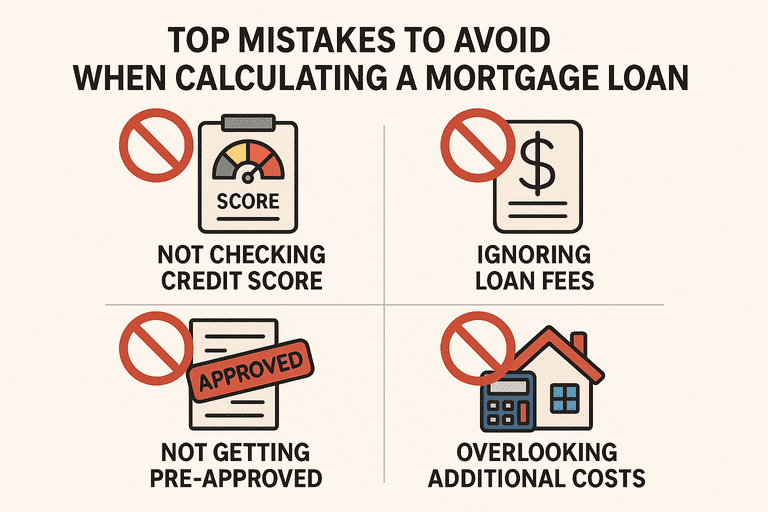

Top Mistakes to Avoid When Calculating a Mortgage Loan

Calculating your mortgage payment is one of the most important steps in the homebuying process. But it’s easy to make mistakes—especially if you’re doing the math manually or

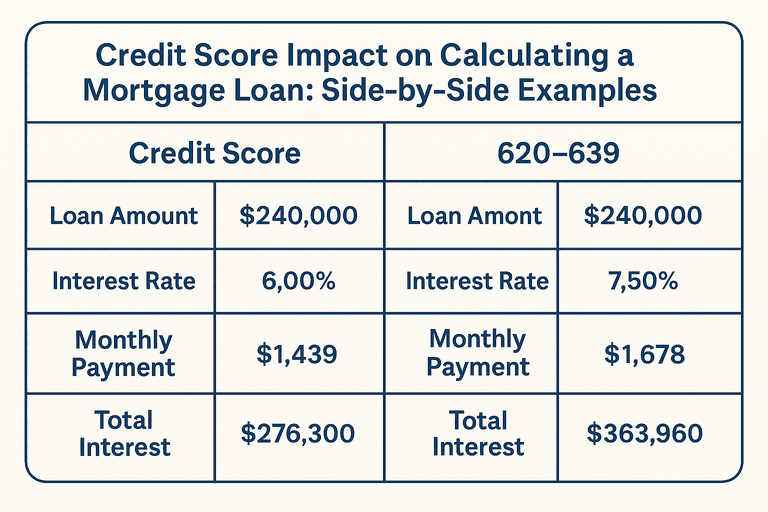

Credit Score Impact on Calculating a Mortgage Loan: Side-by-Side Examples

Your credit score doesn’t just influence whether you get approved for a mortgage — it also determines how much you’ll pay each month. Even a small difference in

Calculating a Mortgage Loan for Investment Properties vs. Primary Residences

When you’re applying for a mortgage, one of the most important distinctions is whether the home will be your primary residence or an investment property. While the calculation

How Amortization Works When Calculating a Mortgage Loan

Amortization is one of the most important concepts in mortgage lending. It explains how each payment you make is divided between interest and principal over time. Understanding amortization

Calculating a Mortgage Loan for Self-Employed Borrowers

If you’re self-employed, calculating your mortgage loan requires more than just plugging numbers into a formula. While the math for monthly payments is the same as for traditional

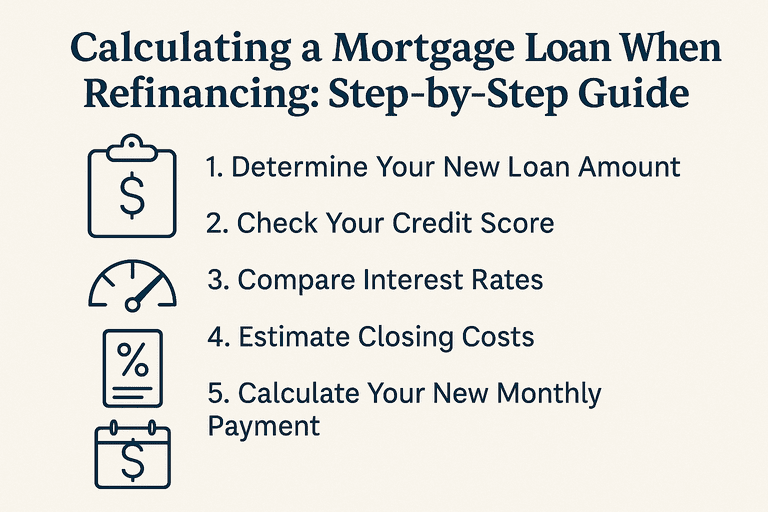

Calculating a Mortgage Loan When Refinancing: Step-by-Step Guide

Refinancing your mortgage can lower monthly payments, reduce interest costs, or shorten your loan term. But before deciding, it’s critical to calculate whether refinancing is worth it. This

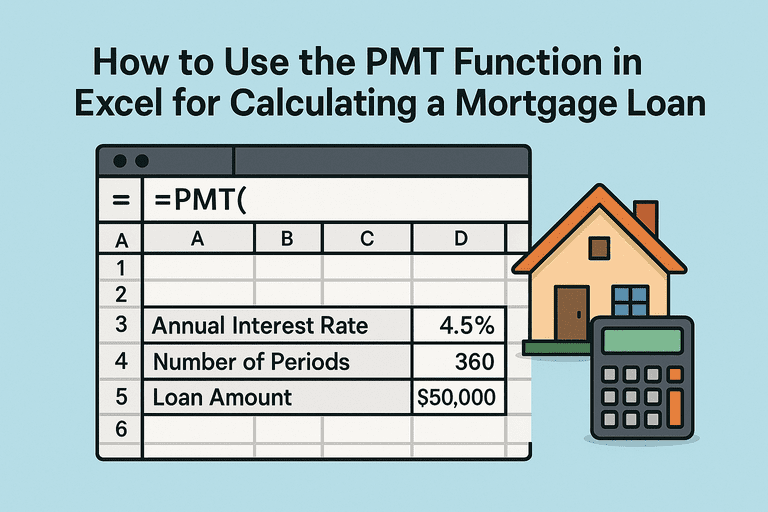

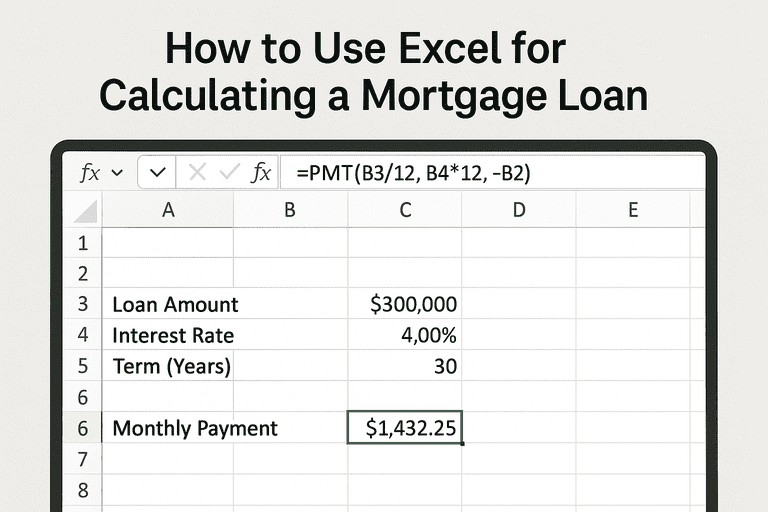

How to Use the PMT Function in Excel for Calculating…

If you want to calculate a mortgage loan quickly in Excel, the PMT function is one of the most powerful tools available. Instead of entering long formulas manually,

Debt-to-Income Ratio Explained: Its Role in Calculating a Mortgage Loan

Understanding your Debt-to-Income Ratio (DTI) is just as crucial as knowing the mortgage formula. Mortgage lenders rely heavily on your DTI to judge whether you can manage a

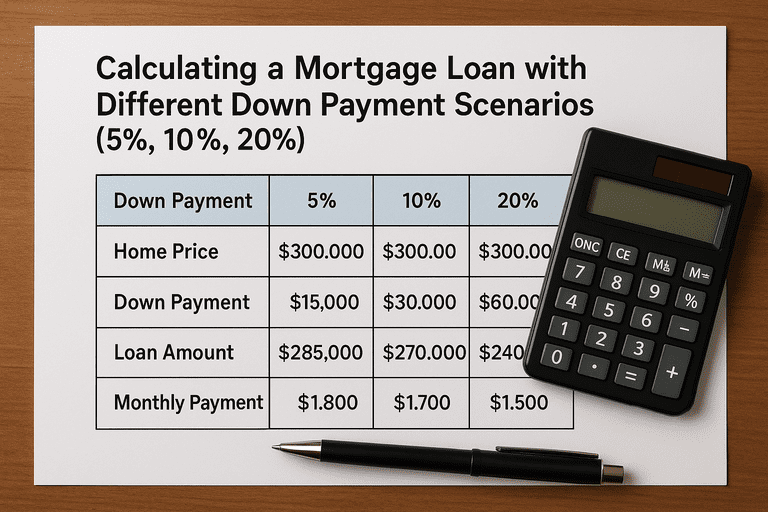

Calculating a Mortgage Loan with Different Down Payment Scenarios (5%,…

Down payments play a pivotal role in determining your mortgage amount, monthly payment, equity trajectory, and insurance requirements. This article walks you through how different down payment scenarios—5%,

How Interest Rate Changes Affect Calculating a Mortgage Loan

Understanding how interest rate fluctuations impact your mortgage calculations is essential — whether you’re buying a home, refinancing, or simply planning ahead. Not only do rates determine your

Future Trends in Calculating a Mortgage Loan (Fintech & AI)

Mortgage loan calculations have come a long way—from pen-and-paper math to online calculators, and now into the era of artificial intelligence and fintech innovation. By 2025 and beyond,

Calculating a Mortgage Loan When You’re Self-Employed

If you’re self-employed, buying a home comes with unique challenges. While the mortgage calculation formula is the same as for traditional employees, lenders evaluate your income differently, and

Common Mistakes People Make When Calculating a Mortgage Loan

Calculating a mortgage loan might seem straightforward, but small errors in the process can lead to big financial surprises later. Many homeowners underestimate their payments, forget to include

AI Tools for Calculating a Mortgage Loan in 2025

In 2025, mortgage loan calculations are no longer limited to static spreadsheets or basic online calculators. Thanks to artificial intelligence (AI), borrowers now have access to smart tools

How Inflation Affects Calculating a Mortgage Loan

Inflation affects nearly every part of the economy, from grocery bills to gas prices—and mortgages are no exception. When inflation rises, it influences interest rates, the cost of

Calculating a Mortgage Loan During High Interest Rate Periods

Mortgage interest rates have a powerful impact on affordability. When rates are high, monthly payments increase, total interest paid over time balloons, and many buyers find themselves priced

Break-Even Analysis: Calculating a Mortgage Loan When Refinancing

Refinancing your mortgage can save you money by lowering your monthly payment or reducing the total interest you pay over time. But refinancing comes with costs—such as closing

How to Calculate the True Cost of a Mortgage Loan…

When you first look at a mortgage, it’s tempting to focus only on the monthly payment. But the true cost of a mortgage goes far beyond that number.

How to Compare Lender Offers When Calculating a Mortgage Loan

When you’re shopping for a mortgage, the lender you choose can have a huge impact on your monthly payment and long-term costs. Two offers that look similar on

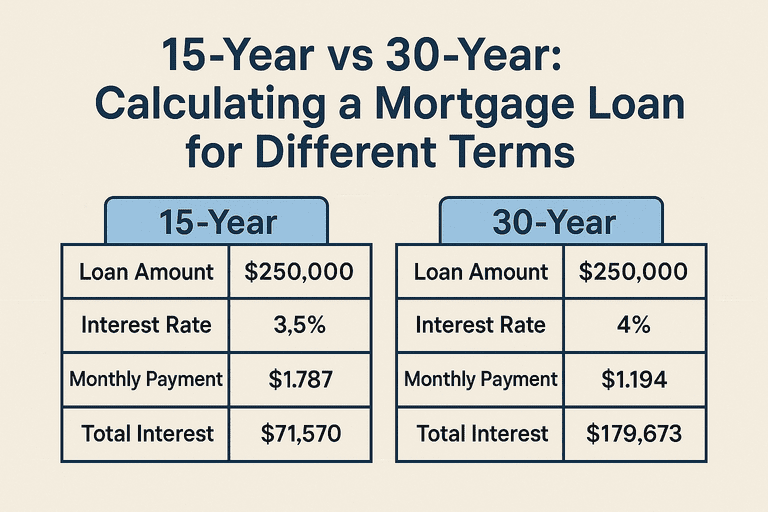

15-Year vs 30-Year: Calculating a Mortgage Loan for Different Terms

When choosing a mortgage, one of the most important decisions is whether to go with a 15-year term or a 30-year term. Both options have their pros and

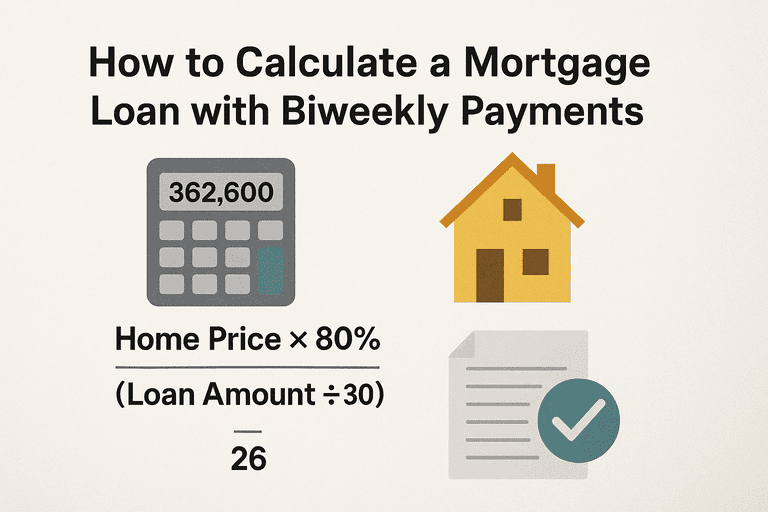

How to Calculate a Mortgage Loan with Biweekly Payments

Most mortgages are set up with monthly payments—12 payments per year. But with a biweekly mortgage plan, you pay half of your monthly payment every two weeks. Since

Calculating a Mortgage Loan for Investment Properties

Calculating a mortgage loan for an investment property isn’t the same as calculating one for your primary residence. Lenders view investment properties as higher risk, which often means

How First-Time Buyers Should Approach Calculating a Mortgage Loan

Buying your first home is exciting—but it can also feel overwhelming, especially when it comes to understanding your mortgage. The good news is that calculating your loan doesn’t

How to Calculate a Mortgage Loan with PMI, Taxes, and…

When calculating a mortgage loan, many people stop at the principal and interest. But in reality, your monthly payment often includes much more: property taxes, homeowners insurance, and—if

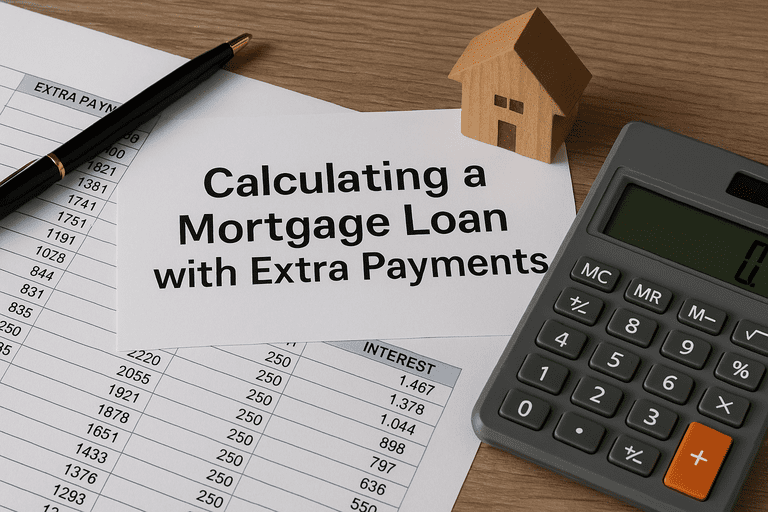

Calculating a Mortgage Loan with Extra Payments

One of the most powerful ways to save money on a mortgage is by making extra payments. Even small additional contributions toward the principal can shorten your loan

How to Use Excel for Calculating a Mortgage Loan

Excel is one of the most powerful tools for understanding and managing a mortgage loan. With just a few formulas, you can calculate monthly payments, compare loan terms,

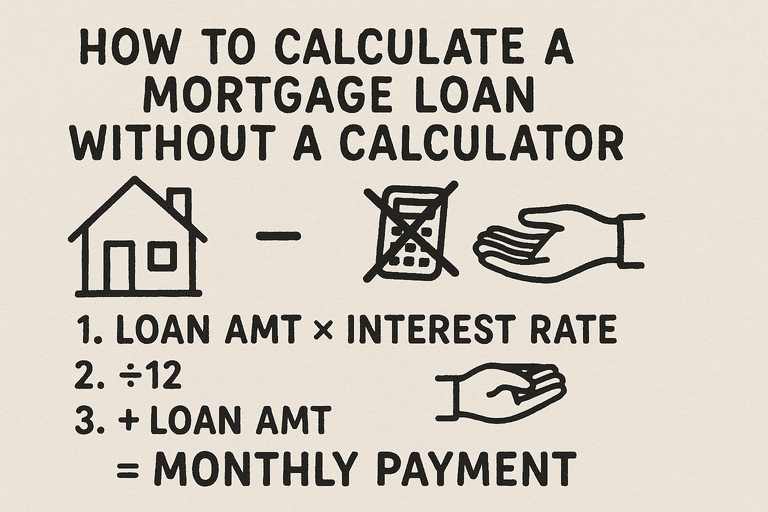

How to Calculate a Mortgage Loan Without a Calculator

In today’s digital world, most people rely on online mortgage calculators. But what if you don’t have one handy—or you simply want to understand the numbers behind your

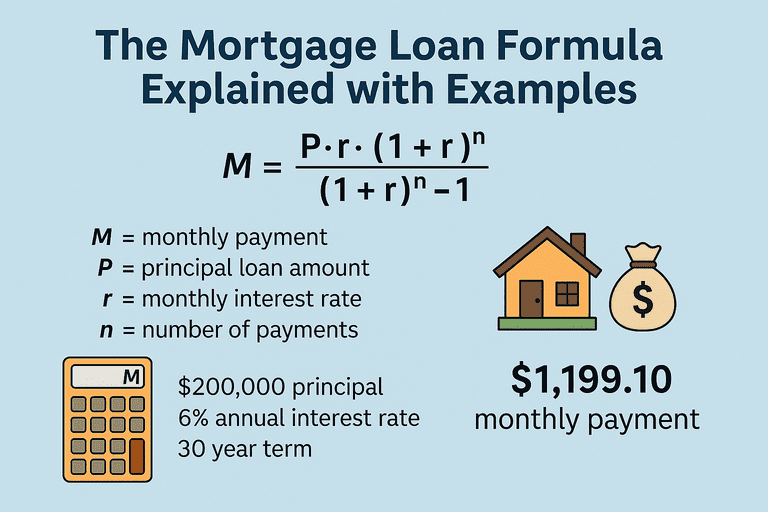

The Mortgage Loan Formula Explained with Examples

When you take out a mortgage, your monthly payment isn’t just guessed by the bank—it’s calculated using a standard mathematical formula. Understanding this formula helps you see exactly

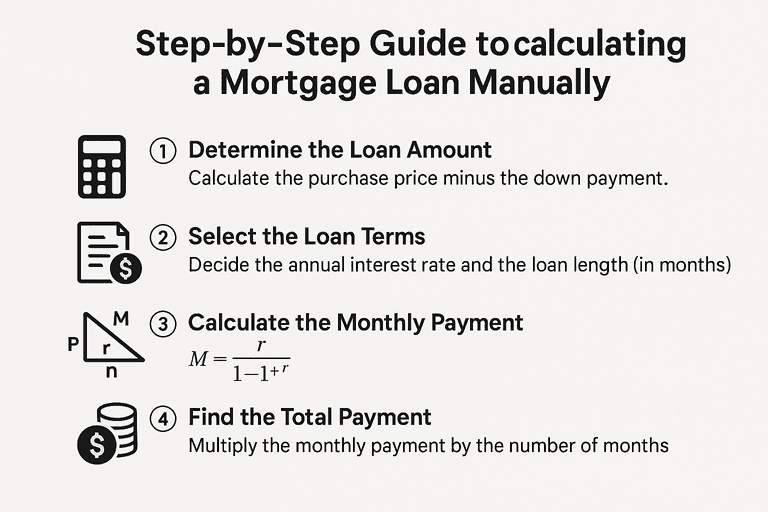

Step-by-Step Guide to Calculating a Mortgage Loan Manually

While online mortgage calculators are convenient, understanding how to calculate a mortgage loan manually gives you full control over the numbers. By doing the math yourself, you’ll know

Calculating a Mortgage Loan: The Complete Step-by-Step Guide (2025 Edition)

Calculating a mortgage loan is one of the most important steps in the homebuying process. Whether you’re a first-time buyer, a real estate investor, or someone considering refinancing,

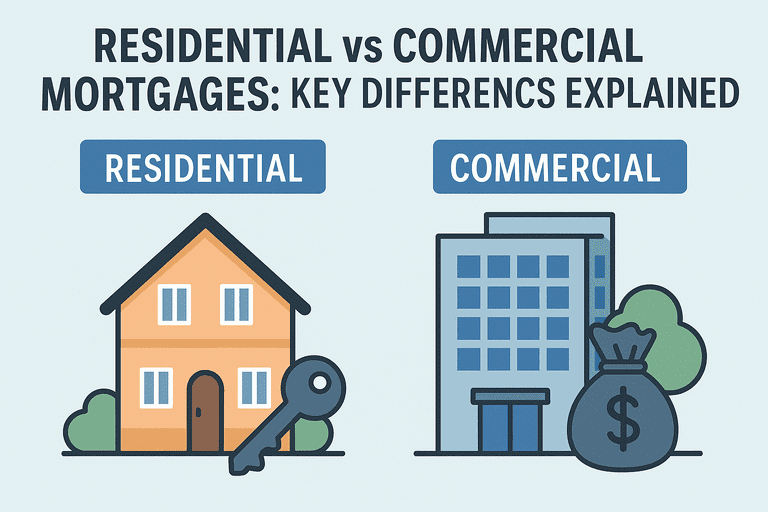

Residential vs Commercial Mortgages: Key Differences Explained

Buying property is a significant financial decision, whether for personal use or business purposes. Understanding the distinction between a commercial mortgage and a residential loan is crucial for

Mortgages in Divorce: Division, Refinancing, and Legal Tips

Divorce is a complex and emotional process, and handling jointly owned property adds another layer of financial and legal considerations. One of the most critical issues is the

Mortgages and Inheritance: Handling Loans in Estate Planning

Inheriting a property can be both a blessing and a responsibility. While receiving a home may provide long-term financial benefits, managing any existing mortgage on the property adds

Green Mortgages: Incentives for Energy-Efficient Homes

As sustainability becomes a priority in modern homeownership, financing options for energy-efficient homes have evolved. Green mortgages, designed to encourage eco-friendly construction and renovations, are gaining popularity. These

Tiny Home Financing: Mortgage Options for Minimalist Living

As the minimalist movement gains momentum, more people are exploring tiny homes as a practical and affordable housing option. These compact living spaces offer flexibility, reduced utility costs,

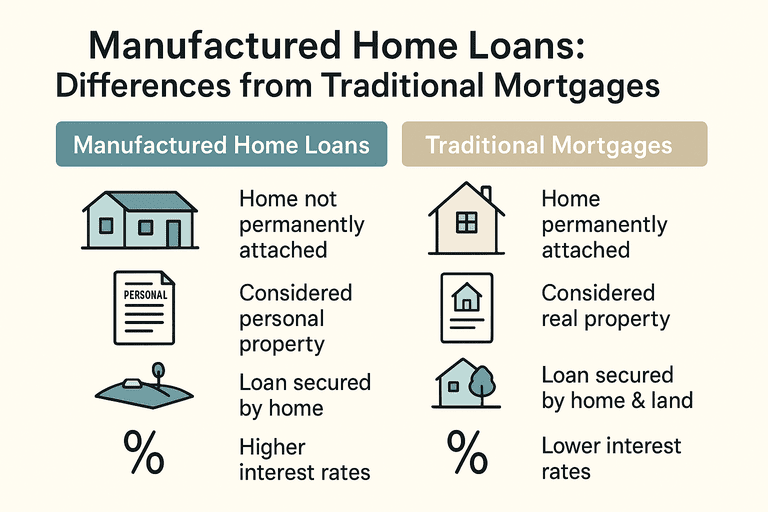

Manufactured Home Loans: Differences from Traditional Mortgages

Owning a home is a cornerstone of financial security, yet not all homes are financed the same way. Manufactured homes—sometimes called mobile homes or prefab homes—have unique characteristics

Interest-Only Mortgages: Benefits and Risks for Buyers

Buying a home is one of the largest financial commitments many people will ever make. For some buyers, interest-only mortgages offer a way to reduce initial payments and

Portfolio Loans: Custom Mortgages from Non-Traditional Lenders

For homebuyers who don’t fit the typical lending mold, traditional mortgages can be limiting. Standard loan guidelines may not accommodate unique financial situations, investment properties, or multiple income

Assumable Mortgages: Taking Over Existing Loans in 2025

Buying a home can be a complex process, especially with rising interest rates and strict lending requirements. However, some buyers can simplify the transaction and potentially save money

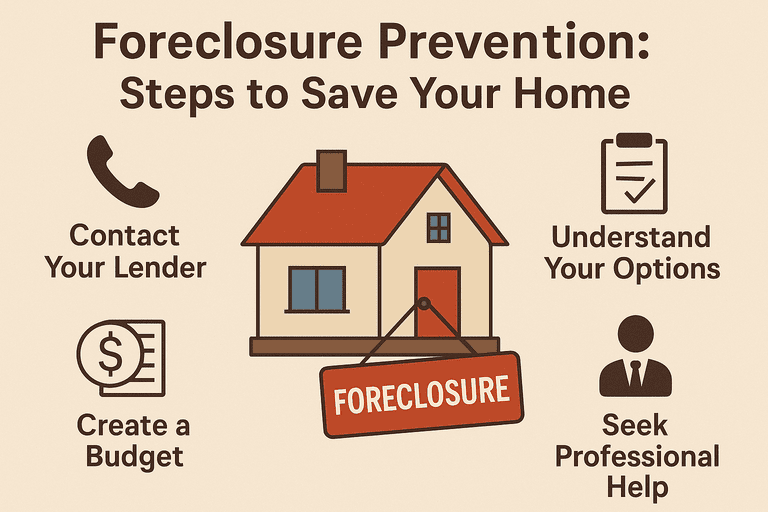

Foreclosure Prevention: Steps to Save Your Home

Facing the possibility of losing your home can be overwhelming. Financial setbacks, unexpected expenses, or changes in income can make keeping up with mortgage payments difficult. However, homeowners

Bridge Loans: Transitioning Homes Without Selling First

Buying a new home while still owning your current one can feel like walking a financial tightrope. A bridge loan can make that transition smoother by providing buy

Mortgage Points: Buying Down Rates for Long-Term Savings

When securing a mortgage, borrowers often focus on interest rates, monthly payments, and loan terms. However, mortgage points—also known as discount points—can provide significant long-term savings by lowering

Mortgage Rate Locks: Timing and Strategies for Protection

Mortgage rates fluctuate daily, and even a small change can impact your monthly payment and long-term interest costs. For prospective homebuyers, understanding how a rate lock mortgage works

Mortgages for Non-US Citizens: Options for Foreign Buyers

Purchasing property in the United States as a non-US citizen can be complicated, but it’s entirely possible with the right mortgage options. Foreign buyers often face unique challenges,

Home Appraisal Process: What to Expect and How to Prepare

Buying or selling a home involves many financial steps, and one crucial part of the journey is the home appraisal. Understanding how property valuation works and preparing for

Mortgages for Short-Term Rentals: Financing Airbnb Investments

Investing in a property for short-term rentals, such as Airbnb or vacation homes, has become increasingly popular for homeowners and entrepreneurs seeking supplemental income. Unlike traditional long-term rentals,

Escrow Account Management: Handling Surpluses and Shortages

When managing a mortgage, your escrow account plays a crucial role in covering property taxes, homeowners insurance, and sometimes other expenses. Proper escrow account management ensures you don’t

Mortgage Forbearance: Temporary Relief During Financial Hardship

Unexpected financial challenges can make it difficult to stay current on mortgage payments. Job loss, medical emergencies, or economic downturns may temporarily strain household budgets. Fortunately, lenders often

Joint Mortgages: Co-Buying Homes with Partners or Family

Purchasing a home is a major financial decision, and sometimes, sharing the responsibility with a partner, family member, or friend can make homeownership more accessible. This is where

Avoiding PMI: Strategies Beyond 20% Down Payments

When you buy a home with less than a 20% down payment, most lenders require you to pay Private Mortgage Insurance (PMI). This extra cost can add hundreds

Credit Inquiries: How They Impact Your Mortgage Application

When you apply for a credit inquiry mortgage, lenders review your credit report to evaluate your financial reliability. This process often involves a hard inquiry, which can temporarily

Seller Financing: Negotiating Mortgages Directly with Sellers

Buying a home doesn’t always require going through a bank. In fact, seller financing—also known as an owner-financed mortgage or private home loan—is becoming a popular alternative for

Second Home Financing: Mortgages for Vacation Properties

Owning a vacation retreat or second home is a dream for many. Whether it’s a beachside condo, a mountain cabin, or a suburban getaway, the path to making

Flipping Houses: Best Mortgage Strategies for Investors

House flipping can be a lucrative real estate investment strategy, but success often depends on securing the right house flipping mortgage. Whether you’re a seasoned investor or just

Mortgage Broker in Kendall: Secure Suburban Home Loans with Ease

Are you searching for a mortgage broker in Kendall? This sprawling suburban area in Miami-Dade County, known for its family-friendly neighborhoods and excellent amenities, is a top choice

Home Warranties: Coverage Details and If They’re Worth the Cost

For many homeowners, unexpected repairs can drain savings and cause stress. That’s where a home warranty comes in — a service contract that helps cover the cost of

Mortgage Interest Tax Deductions: Maximizing Savings in 2025

For many homeowners, the mortgage tax deduction remains one of the most valuable financial benefits of owning a home. By allowing you to deduct interest paid on your

Balloon Mortgage: When Short-Term Payments Make Sense

For some homebuyers or investors, traditional 15- or 30-year mortgages aren’t the right fit. Instead, they may choose a balloon mortgage, a short-term loan structure that offers lower

USDA Loan: Rural Home Buying Options and Requirements

For many Americans, buying a home in the countryside offers peace, space, and affordability. However, rural buyers often face challenges such as limited lender options and stricter loan

Construction Loan: Financing Your Dream Home Build from Scratch

Building a house from the ground up is an exciting journey — but before you can pour the foundation, you need a solid financing plan. A construction loan

Reverse Mortgage: Eligibility, Pros, and Cons for Seniors

For many retirees, their home is their largest financial asset — often worth more than any savings account or pension. A reverse mortgage allows seniors to tap into

Mortgage Broker in The Hammocks: Financing for Family-Friendly Suburban Homes

Are you searching for a mortgage broker in The Hammocks? This family-oriented Miami-Dade neighborhood, known for its suburban charm and community amenities, is a top choice for homebuyers

Mortgage Broker in Palmetto Estates: Affordable Home Loans for Miami…

Looking for a mortgage broker in Palmetto Estates? This suburban Miami-Dade neighborhood, known for its affordability and family-oriented communities, is ideal for first-time buyers and families. Whether you’re

Mortgage Broker in West Kendall: Find Suburban Mortgages for Families

Are you searching for a mortgage broker in West Kendall? This suburban Miami-Dade neighborhood, known for its family-friendly communities and modern homes, is a top choice for homebuyers

Mortgage Broker in Kendale Lakes: Secure Affordable Family Home Loans

Looking for a mortgage broker in Kendale Lakes? This family-oriented Miami neighborhood, known for its affordable homes and suburban charm, is a great choice for first-time buyers and

Mortgage Broker in Doral West: Your Modern Home Loans in…

Searching for a mortgage broker in Doral West? This modern Miami-Dade neighborhood, part of the thriving Doral area, is known for its new developments and family-friendly communities. Whether

Mortgage Broker in Tamiami: Affordable Mortgages for Suburban Living

Looking for a mortgage broker in Tamiami? This suburban Miami neighborhood, known for its affordability and family-oriented communities, is a great choice for first-time buyers and families. Whether

Mortgage Broker in Doral: Find Loans for Business and Family…

Searching for a mortgage broker in Doral? This thriving Miami-Dade city, known as a business hub with modern homes and vibrant communities, is a top choice for professionals

Mortgage Broker in Palmetto Bay: Financing for Suburban Family Retreats

Looking for a mortgage broker in Palmetto Bay? This suburban Miami-Dade village, known for its family-friendly neighborhoods and lush parks, is ideal for homebuyers seeking a peaceful lifestyle.

Mortgage Broker in Hialeah: Find Home Loans for Hispanic Heritage…

Searching for a mortgage broker in Hialeah? This vibrant Miami-Dade city, known for its strong Hispanic heritage and affordable housing, is a top choice for first-time buyers and

Mortgage Broker in Golden Glades: Secure Affordable Home Loans Today

Looking for a mortgage broker in Golden Glades? This suburban Miami neighborhood, known for its affordability and diverse community, is a great choice for first-time buyers and families.

Mortgage Broker in North Miami: Affordable Mortgages for Cultural Diversity

Searching for a mortgage broker in North Miami? This diverse Miami neighborhood, known for its cultural vibrancy and affordable housing, is ideal for first-time buyers and families. Whether

Mortgage Broker in South Miami: Financing for Vibrant Family Homes

Are you searching for a mortgage broker in South Miami? This charming Miami neighborhood, known for its vibrant local businesses and family-friendly vibe, is a popular choice for

Florida Mortgage Calculator: Your Key to Homeownership in the Sunshine…

Navigating the real estate market can be complex, especially when it comes to understanding the financial aspects of purchasing a home. For those looking to buy property in

Mortgage Broker in University Park: Find Loans for Student-Friendly Homes

Looking for a mortgage broker in University Park? This Miami neighborhood, home to Florida International University, is known for its student-friendly vibe and affordable housing options. Whether you’re

Mortgage Broker in Westchester: Secure Family Home Loans in Miami…

Searching for a mortgage broker in Westchester? This residential Miami neighborhood, known for its family-friendly communities and suburban charm, is a popular choice for homebuyers. Whether you’re seeking

Mortgage Broker in Cutler Bay: Affordable Home Loans for Suburban…

Looking for a mortgage broker in Cutler Bay? This suburban Miami-Dade community, known for its family-friendly neighborhoods and affordable homes, is ideal for first-time buyers and families. Whether

Mortgage Broker in Fisher Island: Navigate Exclusive Luxury Home Loans

Seeking a mortgage broker in Fisher Island? This ultra-exclusive Miami enclave, accessible only by ferry or private boat, is one of the most prestigious addresses in the U.S.

Mortgage Broker in Miami Beach: Find Loans for Coastal Luxury…

Are you searching for a mortgage broker in Miami Beach? This iconic coastal city, renowned for its vibrant beaches, Art Deco architecture, and luxury lifestyle, is a prime

Mortgage Broker in South Beach: Secure Oceanfront Condo Loans Today

Looking for a mortgage broker in South Beach? This iconic Miami Beach neighborhood, famous for its Art Deco architecture and vibrant nightlife, is a hotspot for luxury condos

Mortgage Broker in West Flagler: Affordable Mortgages for Historic Homes

Looking for a mortgage broker in West Flagler? This diverse Miami neighborhood, located west of Downtown, is known for its affordable housing and strong community ties. Whether you’re

Mortgage Broker in Aventura: Your Guide to Luxury Condo Financing

Searching for a mortgage broker in Aventura? This upscale Miami-Dade city, known for its luxury condos and Aventura Mall, is a prime destination for affluent buyers and investors.

Mortgage Broker in South Coral Gables: Financing for Upscale Family…

Searching for a mortgage broker in South Coral Gables? This residential enclave, part of Miami’s prestigious Coral Gables, is known for its family-friendly neighborhoods and charming homes. Whether

Mortgage Broker in Key Biscayne: Secure Luxury Waterfront Home Loans

Are you looking for a mortgage broker in Key Biscayne? This exclusive island paradise, just minutes from Miami, is renowned for its pristine beaches, luxury homes, and serene

Mortgage Broker in Coconut Grove: Secure Loans for Bohemian-Chic Homes

Seeking a mortgage broker in Coconut Grove? This historic Miami neighborhood, known for its lush greenery and bohemian charm, is a haven for luxury homebuyers and condo seekers.

Mortgage Broker in Omni District: Find Home Loans for Urban…

Searching for a mortgage broker in Omni District? This emerging Miami neighborhood, located just north of Downtown, is known for its artsy vibe, modern condos, and proximity to

Mortgage Broker in Brickell: Navigate Urban Condo Loans with Ease

Looking for a mortgage broker in Brickell? Known as Miami’s financial district, Brickell is a bustling urban hub with sleek high-rise condos and luxury apartments. Whether you’re a

Mortgage Broker in Edgewater: Your Guide to Waterfront Condo Financing

Looking for a mortgage broker in Edgewater? This dynamic Miami neighborhood, nestled along Biscayne Bay, is known for its modern high-rise condos and waterfront views. Whether you’re a

Mortgage Broker in Coral Gables: Find Luxury Home Financing in…

Are you searching for a mortgage broker in Coral Gables? Known as “The City Beautiful,” Coral Gables is a premier Miami neighborhood with Mediterranean Revival architecture, tree-lined streets,

Mortgage Broker in Little Havana: Affordable Home Loans for Cultural…

Searching for a mortgage broker in Little Havana? This vibrant Miami neighborhood, known for its rich Cuban heritage and lively cultural scene, is a popular choice for homebuyers

Mortgage Broker in Downtown Miami: Secure Urban Condo Loans Today

Looking for a mortgage broker in Downtown Miami? As the heart of Miami’s Central Business District, Downtown Miami is a vibrant hub of international finance, dining, and high-rise

Escrow: What Is It and How Does It Work?

Understanding escrow—what it is and how it works—is essential for anyone buying a home or participating in a major financial transaction. Escrow plays a critical role in protecting

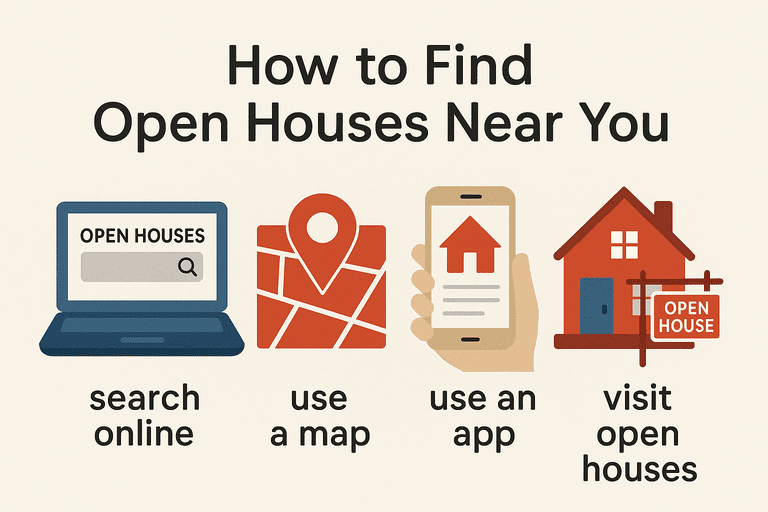

How to Find Open Houses Near You: 10 Tips

Knowing how to find open houses near you is a crucial step in the home buying process. Open houses give buyers a chance to tour properties, meet real

What is a down payment and how does it work?

Understanding what a down payment is and how it works is essential for anyone planning to buy a home. A down payment is a key part of the

Home Equity Calculator: Estimate Your Home’s Value and Borrowing Power

A home equity calculator is an essential tool for homeowners who want to understand how much of their property they truly own and how much they can potentially

Down Payment Calculator: Your Guide to Smart Home Buying

A down payment calculator is an essential tool for anyone planning to buy a home. Understanding how much you’ll need for a down payment, how it impacts your

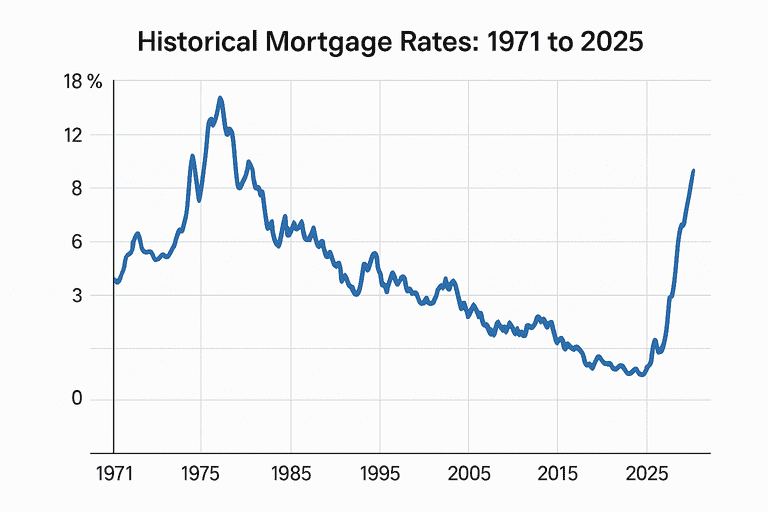

Historical Mortgage Rates: 1971 to 2025

Understanding historical mortgage rates from 1971 to 2025 offers valuable perspective for homebuyers, homeowners, and investors. Mortgage rates have fluctuated dramatically over the past five decades, influenced by

What Is Home Equity and How Can I Use It?

Understanding what home equity is and how you can use it is essential for homeowners looking to build wealth or access funds for major expenses. Home equity represents

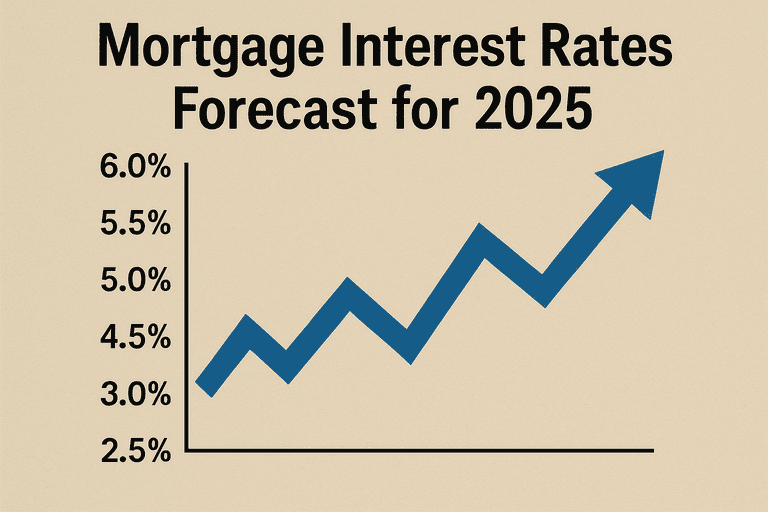

Mortgage Interest Rates Forecast for 2025

Understanding the mortgage interest rates forecast for 2025 is crucial for anyone planning to buy a home, refinance, or invest in real estate this year. As we move

How Much Does It Cost to Refinance a Mortgage?

Understanding how much it costs to refinance a mortgage is crucial before you decide to replace your existing home loan. Refinancing can lower your monthly payment, help you

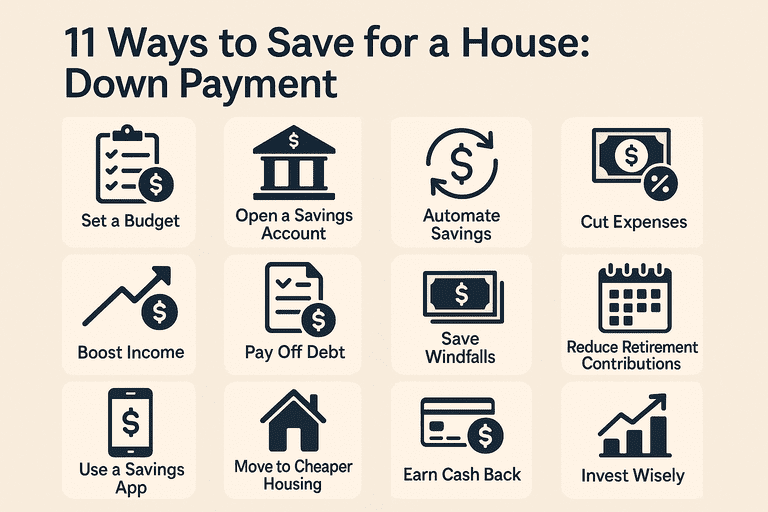

11 Ways to Save for a House: Down Payment

Saving for a house down payment is one of the most important steps toward homeownership. With rising home prices and evolving mortgage requirements, knowing the best ways to

How to Buy a House with No Money Down

Knowing how to buy a house with no money down can make homeownership possible even if you haven’t saved for a large down payment. In 2025, there are

Federal Reserve Statement Explained – June 2025

The Federal Reserve statement explained for June 2025 is critical for anyone tracking interest rates, inflation, and the broader U.S. economy. On June 18, 2025, the Federal Open

Mortgage Payment Calculator: Your Key to Home Loan Planning

A mortgage payment calculator is an essential tool for anyone looking to buy a home or refinance an existing loan. By inputting key details like loan amount, interest

5 Types of Home Loans for All Home Buyers

Introduction: 5 Types of Home Loans for All Home Buyers Understanding the 5 types of home loans for all home buyers is crucial when starting your homeownership journey.

House Hunting Tips on How to Find a House to…

Introduction: House Hunting Tips on How to Find a House to Buy Learning house hunting tips on how to find a house to buy can make your search

Refinancing: What is it and how does it work?

Introduction: Refinancing Basics Refinancing is a financial strategy that allows homeowners and borrowers to replace an existing loan with a new one—typically to secure better terms, a lower

How to Find a Real Estate Agent: The Complete Guide

Knowing how to find a real estate agent is crucial whether you’re buying or selling a home. The right real estate agent can make your transaction smoother, help

Understanding Different Loan Types: A Comprehensive Guide

Introduction: Understanding Different Loan Types Understanding different loan types is crucial when shopping for a mortgage. The type of loan you choose affects your down payment, interest rate,

How to Calculate Your Monthly Mortgage Payment: Step-by-Step Guide

Knowing how to calculate your monthly mortgage payment is essential for every homebuyer and homeowner. Your monthly mortgage payment affects your budget, loan affordability, and long-term financial planning.

Calculating Mortgage Amortization: A Complete Guide

Calculating mortgage amortization is essential for every homeowner or homebuyer who wants to understand how their loan payments are applied over time. Mortgage amortization determines how much of

What Is a Cash-In Refinance?

A cash-in refinance is a mortgage refinancing strategy where a homeowner replaces their current mortgage with a new one while making a lump-sum payment to reduce the new

What Is Rent Control and How Does It Work?

Rent control is a government policy that limits how much landlords can charge for rent and how much they can increase rent each year. Understanding what rent control

Secured Overnight Financing Rate (SOFR) Explained

Understanding the Secured Overnight Financing Rate (SOFR) is essential for anyone involved in mortgages, loans, or financial markets. SOFR has become the primary benchmark interest rate for U.S.

Cash-Out Refinance vs. HELOC: Which Is Best?

Cash-Out Refinance vs. HELOC Understanding the differences between a cash-out refinance and a home equity line of credit (HELOC) is crucial for homeowners looking to tap into their

Fixed-Rate HELOCs: What They Are and How They Work

A fixed-rate HELOC, or fixed-rate home equity line of credit, is a unique lending product that allows homeowners to borrow against their home’s equity with the security of

Homeownership Through a Jumbo Smart Loan: Your Complete Guide

Homeownership through a Jumbo Smart Loan is now more accessible than ever, especially for buyers seeking properties above standard conforming loan limits. Understanding how a Jumbo Smart Loan

How Are Mortgage Rates Determined? The Complete Guide

Understanding how mortgage rates are determined is essential for anyone considering a home loan. Mortgage rates affect your monthly payments and the total cost of your home, so

First-Time Home Buyers: Navigating Market Turbulence

First-time home buyers face unique challenges, especially when navigating market turbulence. With fluctuating mortgage rates, limited housing inventory, and economic uncertainty, understanding how to buy your first home

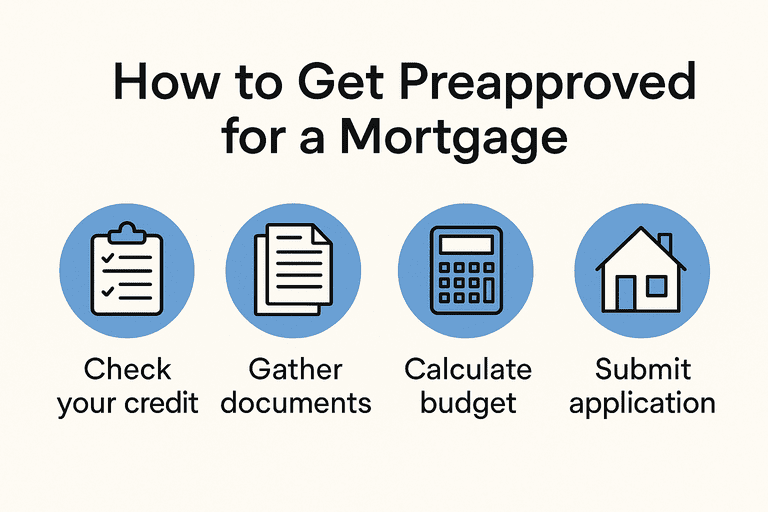

How to Get Preapproved for a Mortgage: The Complete Guide

Are you ready to buy a home? The first step is to understand how to get preapproved for a mortgage. Getting preapproved for a mortgage shows sellers you’re

Biweekly Mortgage Payment Calculator: Accelerate Your Loan Payoff

A biweekly mortgage payment calculator is a valuable tool for homeowners looking to save on interest and pay off their mortgage faster by switching to a biweekly payment schedule. By

Amortization Schedule Calculator: Understand Your Mortgage Payments

An amortization schedule calculator is an essential tool for homeowners and prospective buyers who want to understand how their mortgage payments are applied over time. By inputting details like loan

Extra Payment Mortgage Calculator: Save Money and Time

An extra payment mortgage calculator is a crucial tool for homeowners looking to reduce their mortgage interest and pay off their loan early. By entering details such as your loan

Home Affordability Calculator: Set Your Homebuying Budget

A home affordability calculator is a vital tool for anyone preparing to purchase a home. By inputting details like income, monthly expenses, loan term, and interest rate, you can estimate

Mortgage Rate Calculator: Plan Your Home Loan with Precision

A mortgage rate calculator is an indispensable tool for homebuyers and refinancers looking to understand how interest rates impact their mortgage payments. By inputting details like loan amount, interest rate,

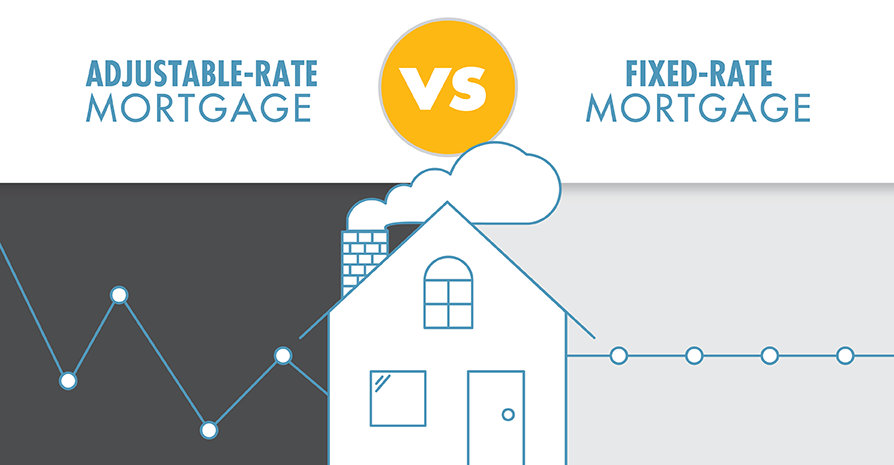

Fixed vs Adjustable-Rate Mortgage Calculator: Choose the Right Loan

A fixed vs adjustable-rate mortgage calculator is an essential tool for homebuyers and refinancers deciding between a fixed-rate and an adjustable-rate mortgage (ARM). By inputting details like loan amount, interest

Mortgage Payoff Calculator: Accelerate Your Loan Repayment

A mortgage payoff calculator is a powerful tool for homeowners aiming to pay off their mortgage early and save on interest. By inputting details like your current loan balance, interest

Mortgage Refinance Calculator: Optimize Your Home Loan

A mortgage refinance calculator is an essential tool for homeowners considering refinancing their existing mortgage. By inputting details like your current loan balance, new interest rate, loan term,

Rent vs Buy Calculator: Make an Informed Housing Decision

A rent vs buy calculator is an essential tool for anyone weighing the decision between renting a home and purchasing one. By inputting details like monthly rent, home

Mortgage Affordability Calculator: Set Your Homebuying Budget

A mortgage affordability calculator is a crucial tool for anyone planning to purchase a home or refinance a mortgage. By inputting details like income, monthly expenses, loan term,

Mortgage Calculator: Your Key to Understanding Home Loan Payments

A mortgage calculator is an essential tool for anyone looking to buy a home or refinance an existing loan. By inputting key details like loan amount, interest rate,

How Much House Can I Afford Calculator: Plan Your Home…

A how much house can I afford calculator is a vital tool for anyone preparing to buy a home. By inputting details like income, monthly expenses, loan term,

Jumbo Loan Calculator: Navigate Your High-Value Mortgage

A jumbo loan calculator is an indispensable tool for anyone considering a jumbo mortgage to finance a high-value home purchase or refinance. By entering details such as loan

Conventional Loan Calculator: Master Your Mortgage Planning

A conventional loan calculator is an essential tool for anyone considering a conventional mortgage to purchase or refinance a home. By entering details like loan amount, interest rate,

VA Loan Mortgage Calculator: Streamline Your Home Loan Planning

A VA loan mortgage calculator is a critical tool for veterans, active-duty service members, and eligible spouses exploring a VA-backed home loan. By inputting details like loan amount,

FHA Mortgage Calculator: Simplify Your Home Loan Planning

An FHA mortgage calculator is an essential tool for anyone considering a Federal Housing Administration (FHA) loan to purchase a home. By entering details like loan amount, interest

Mortgage Interest Calculator: Understand Your Loan’s True Cost

A mortgage interest calculator is an invaluable tool for anyone navigating the homebuying or refinancing process. By inputting details such as loan amount, interest rate, and loan term,

House Payment Calculator: Simplify Your Home Buying Journey

A house payment calculator is a vital tool for anyone planning to purchase a home or refinance a mortgage. Specifically, by inputting details like loan amount, interest rate,

Home Loan Calculator: Your Guide to Affordable Homeownership

A home loan calculator is a powerful tool that helps you estimate your monthly mortgage payments, making it easier to plan your home-buying journey. By entering details like

Debt-to-Income (DTI) Calculator: Evaluate Your Mortgage Readiness

A Debt-to-Income (DTI) Calculator is a vital tool for anyone preparing to apply for a mortgage or refinance. By inputting your monthly gross income and debt payments, you

Real APR Calculator: Uncover the True Cost of Your Loan

A Real APR calculator is a powerful tool for anyone looking to understand the true cost of a loan, including a mortgage. Unlike the nominal interest rate, the

HELOC Calculator: Maximize Your Home Equity

A HELOC calculator is an essential tool for homeowners looking to tap into their home equity with a home equity line of credit (HELOC). By inputting details like

Closing Costs Calculator: Plan Your Homebuying Expenses

A closing costs calculator is a vital tool for anyone preparing to buy a home or refinance a mortgage. By inputting details like loan amount, home price, location,

PMI Calculator: Understand Your Mortgage Insurance Costs

A PMI calculator is an essential tool for anyone considering a home loan with a down payment of less than 20%. By inputting details like loan amount, interest

Top Tips for Selling Your Home in a Buyer’s Market

Selling your home in a buyer’s market—where supply exceeds demand—can feel like an uphill battle. Buyers have the upper hand, with more options and less urgency, often driving

How Economic Recessions Have Affected Mortgage Rates Over Time

Economic recessions have a profound impact on mortgage rates, often serving as a barometer of broader financial health. Over decades, these downturns—marked by declining GDP, rising unemployment, and

Cooling Housing Market: Advice for Sellers in 2025

As of April 3, 2025, the housing market is cooling, with 30-year fixed mortgage rates at 6.65% and inventory rising 15% from 2024 levels. Home prices remain high—median

Short Sales Explained: What Homeowners Need to Know

Facing financial hardship and considering selling your home? A short sale might be an option worth exploring. As of April 3, 2025, with mortgage rates at 6.65% and

The Pros and Cons of Selling Your Home Without an…

Selling your home without a real estate agent—known as a For Sale By Owner (FSBO) transaction—can be tempting in 2025, especially with mortgage rates at 6.65% and a

How to Price Your Home for a Quick Sale in…

Selling your home quickly in 2025 requires a sharp pricing strategy, especially with mortgage rates at 6.65% and a market tilting toward buyers as of April 3. High

Long-Term Mortgage Rate Trends: What Homebuyers Should Know

Mortgage rates are a cornerstone of homebuying, influencing monthly payments, affordability, and long-term financial planning. Understanding their trends over decades—not just years—offers homebuyers critical perspective. From the sky-high

Unlock Your Dream Home: Understanding and Calculating Your Down Payment…

Maximize your home buying power with our FREE Mortgage Calculator at www.calculatingamortgageloan.com Buying a home is a significant milestone, and understanding the down payment is a crucial first

Navigating Mortgage Rates in April 2025: A Guide for Homebuyers

The week of April 14th, 2025, presents a dynamic landscape for mortgage rates. Understanding the current trends, the factors influencing these rates, and how to strategically approach your

A Look Back: Mortgage Rates in the 2008 Financial Crisis…

The 2008 financial crisis and the mortgage landscape of 2025 offer a fascinating contrast in how economic upheaval shapes borrowing costs. The Great Recession, sparked by a housing

Calculating a Mortgage Loan April 2025: Determining Affordable Housing Costs

Key takeaways: Financial experts generally advise spending no more than 28 percent of your gross monthly income or 25 percent of your net income on mortgage payments. Use

The Highest and Lowest Mortgage Rates in History: Lessons for…

Mortgage rates have shaped the housing market for decades, swinging from dizzying highs to unprecedented lows. These extremes—peaking at 18.63% in 1981 and bottoming out at 2.65% in

Mortgage Rate History: How 2025 Compares to the Past Decade

Mortgage rates are a critical factor for homebuyers and homeowners alike, shaping affordability and influencing decisions to buy, sell, or refinance. As we navigate 2025, understanding how current

Credit Score Ranges Explained: What You Need for a Competitive…

Understanding credit score ranges is key to securing competitive interest rates on loans, credit cards, and other financial products. Your credit score, a three-digit number between 300 and

Does Paying Off Debt Before Applying for a Mortgage Help?

When preparing to apply for a mortgage, many prospective homeowners wonder whether paying off debt beforehand can improve their chances. The answer is generally yes, but the benefits

Common Credit Mistakes That Hurt Your Mortgage Chances

Securing a mortgage is a significant financial milestone, but your credit score plays a pivotal role in determining your eligibility and the terms you’ll receive. A strong credit

How Credit Scores Impact Your Mortgage Approval in 2025

Securing a mortgage in 2025 is a major financial milestone, and your credit score is a key factor in determining your success. It serves as a snapshot of

5 Ways to Improve Your Credit Score for a Better…

Introduction When applying for a mortgage, your credit score is a key factor that lenders use to determine your interest rate. A higher credit score can unlock lower

How Often Can You Refinance Your Mortgage? A 2025 Guide

Refinancing a mortgage can be a powerful financial strategy, allowing homeowners to lower monthly payments, secure better interest rates, or access home equity. But how often can you

Refinancing for Cash-Out: Pros and Cons for Homeowners

Refinancing a mortgage is a common financial strategy, but when it comes to cash-out refinancing, homeowners need to weigh the benefits and risks carefully. Cash-out refinancing allows you

The Benefits of Refinancing to Lower Your Monthly Payment

Refinancing your mortgage can be a smart financial move, especially if you’re looking to lower your monthly payment. But what exactly is refinancing, and how does it work?

How to Compare Refinancing Options: Fixed vs. Adjustable Rates

Refinancing a mortgage can save you money or help you achieve financial goals, but selecting the right loan type is key. The two most common refinancing options are

Renting vs. Buying: Which Is Right for You?

Introduction: A Personal Housing Choice in 2025 Deciding whether to rent or buy a home as of February 27, 2025, is a major financial fork in the road.

When Should You Refinance Your Mortgage in 2025?

As we move through 2025, homeowners are increasingly asking: is now the right time to refinance my mortgage? With shifting economic conditions, refinancing can be a smart financial

AI-Powered Mortgage Calculators

AI-powered mortgage calculators are reshaping the way borrowers approach home financing. Traditionally, mortgage calculators offered basic functionality—simply inputting loan amount, interest rate, and loan term to produce a

Real-Time Rate Integration

Real-Time Rate Integration Real-time rate integration is revolutionizing how borrowers assess their mortgage options. In the past, mortgage calculators used static or outdated interest rate data, often leading

Top Trends for Calculating a Mortgage Loan in 2025

In the rapidly evolving landscape of personal finance and home ownership, mortgage loan calculations have become more sophisticated, accurate, and user-centric than ever before. As of 2025, technological

Sustainability Incentive Calculations

Sustainability incentive calculations are becoming a crucial feature in modern mortgage tools, especially as more homebuyers seek eco-friendly options and long-term cost savings. These calculators help users factor

Localized Tax and Insurance Estimates

One of the most overlooked aspects of home affordability is the variability in property taxes and homeowners insurance. To address this, modern mortgage calculators now include localized tax

Education-Based Add-ons

Education-based add-ons are enhancing the functionality of mortgage calculators by turning them into interactive learning tools. Rather than just spitting out numbers, these smart calculators help users understand

Rent vs. Buy Comparisons

The decision to rent or buy a home is one of the most significant financial choices a person can make—and modern calculators now make this comparison easier than

Hidden Costs of Buying a Home: What Your Budget Really…

Beyond the Down Payment: The Full Financial Picture When planning to buy a home in 2025, it’s easy to fixate on the down payment—say, $70,000 for a $350,000

First-Time Homebuyer Mistakes to Avoid: A Comprehensive Guide

Introduction: Stepping Into Homeownership Wisely Buying your first home in 2025 is a thrilling milestone, but it’s a complex journey where missteps can cost you thousands—or your dream

Best Mortgage Rates in 2025: What to Expect

Navigating the Mortgage Landscape in 2025 As we progress through February 2025, the mortgage rate landscape continues to shift, driven by economic forces, Federal Reserve policies, and market

Is Now a Good Time to Buy? A Clear-Eyed Look…

Navigating the 2025 Housing Landscape As we move through February 2025, potential homebuyers face a housing market shaped by elevated interest rates, shifting inventory, and stabilizing prices. Deciding

How Inflation Affects Mortgage Rates: A Comprehensive Analysis

The Basic Relationship Direct Impact of Inflation Inflation fundamentally shapes mortgage rates because lenders need their returns to outpace rising prices to profit in real terms. If inflation

Using Mortgages to Build a Rental Property Portfolio

Introduction: A Path to Wealth Through Real Estate Leveraging mortgages to purchase rental properties is a powerful wealth-building strategy for 2025 and beyond. With rising demand for rentals

How AI and Fintech Are Changing the Mortgage Industry

Executive Summary The mortgage industry is undergoing a fundamental transformation driven by artificial intelligence and financial technology. These innovations are streamlining processes, improving accuracy, reducing costs, and creating

FHA Mortgage Calculator: How It Works

Turning Miami Dreams into Reality Just imagine turning your Miami homeownership dreams into reality with the help of an FHA loan and a specialized mortgage calculator. As you

Power of the Mortgage Calculator for First-Time Buyers in 2025

Many first-time homebuyers in Miami, Florida, find themselves overwhelmed by the mortgage process, but I’m here to tell you about a game-changing tool that will transform your home-buying

15-Year vs. 30-Year Mortgage: Pros and Cons

Introduction: Choosing Your Mortgage Path in 2025 As of February 27, 2025, picking between a 15-year and 30-year mortgage shapes your financial future. With 30-year rates at 6.8%

How to Qualify for a Mortgage as a Self-Employed Borrower

Introduction: Overcoming the Self-Employment Hurdle As a self-employed borrower in February 2025, securing a mortgage—like a $300,000 loan at 6.8% ($1,897 monthly)—comes with extra hoops. Lenders scrutinize income

Understanding Property Taxes and Home Insurance: Essential Costs of Homeownership

Introduction: Core Expenses Beyond the Mortgage Property taxes and home insurance are two unavoidable pillars of homeownership that every buyer must grasp as of February 27, 2025. Beyond

What’s the Difference between FHA, VA, and Conventional Loans?

Introduction: Navigating Your Mortgage Options in 2025 As you step into homeownership in February 2025, choosing the right mortgage is pivotal. With rates averaging 6.8% for 30-year loans,

Unlock Your Dream Home in Miami, Florida

The Power of the Mortgage Calculator for First-Time Buyers in 2025 Buying your first home in Miami Florida is a monumental step, filled with excitement and perhaps a

Unlock Homeownership in Miami, Florida with an FHA Mortgage Calculator

Unlock Homeownership in Miami, Florida with an FHA Mortgage Calculator: A Guide for First-Time Buyers Dreaming of owning your first home in Miami? An FHA loan, insured by

Mission Statement from Calculating A Mortgage Loan

Simplifying Your Mortgage Journey At Calculating A Mortgage Loan, our mission is the heartbeat of everything we do. We’re dedicated to simplifying the mortgage journey, ensuring that each

Why is it important to use a mortgage calculator 2025

Mapping Your Home-Buying Journey Just as you wouldn’t head out on a road trip without a map, you shouldn’t embark on the journey of home buying without understanding

6 Essential Steps to Use a Mortgage Calculator

Mastering Your Mortgage with Confidence You can make smarter home financing decisions by mastering the use of a mortgage calculator. This powerful tool takes the guesswork out of

How to Calculate a mortgage loan 2025

Planning Your Home Purchase with Confidence Just thinking about purchasing a home in 2025? You’re likely wondering how to calculate your mortgage loan effectively. Understanding your mortgage payment

Adjustable-Rate Mortgage Calculator 2025: Explore Your Options

Understand How Adjustable-Rate Mortgages Impact Your Monthly Payments Choosing the right mortgage is one of the most critical decisions you’ll make when buying a home or refinancing. Our

A Step-by-Step Guide to Applying for a Mortgage Loan

Your Path to Homeownership Starts Here You’re about to embark on an exciting journey toward homeownership, and understanding the mortgage loan application process is your first step to