In today’s digital world, most people rely on online mortgage calculators. But what if you don’t have one handy—or you simply want to understand the numbers behind your payment? Learning how to calculate a mortgage loan without a calculator gives you financial independence and confidence. For a deeper dive into strategies and amortization schedules, check out our how to calculate a mortgage loan

This guide walks you through simple methods to estimate or manually calculate your monthly mortgage payment, step by step.

1. Gather the Basics

Before you begin, you’ll need to know:

Loan amount (Principal) – The total amount you’re borrowing.

Interest rate – The annual percentage rate (APR).

Loan term – The length of your loan, usually 15, 20, or 30 years.

Payment frequency – Typically monthly.

2. Use the Mortgage Formula (Pen and Paper Method)

The official formula for fixed-rate mortgages is:

Where:

M = Monthly payment

P = Loan principal

r = Monthly interest rate (annual ÷ 12)

n = Total number of payments (years × 12)

Example (Step by Step)

Loan = $200,000

Interest = 6% → 0.06 ÷ 12 = 0.005 monthly

Term = 30 years → 360 payments

Add 1 + r = 1.005

Raise to the power of 360 = (1.005^360) ≈ 6.022

Multiply by r = 6.022 × 0.005 = 0.03011

Subtract 1 from (1.005^360) = 6.022 – 1 = 5.022

Divide = 0.03011 ÷ 5.022 ≈ 0.005996

Multiply by loan amount = 200,000 × 0.005996 ≈ $1,199.20

Your monthly payment would be about $1,199 (before taxes and insurance).

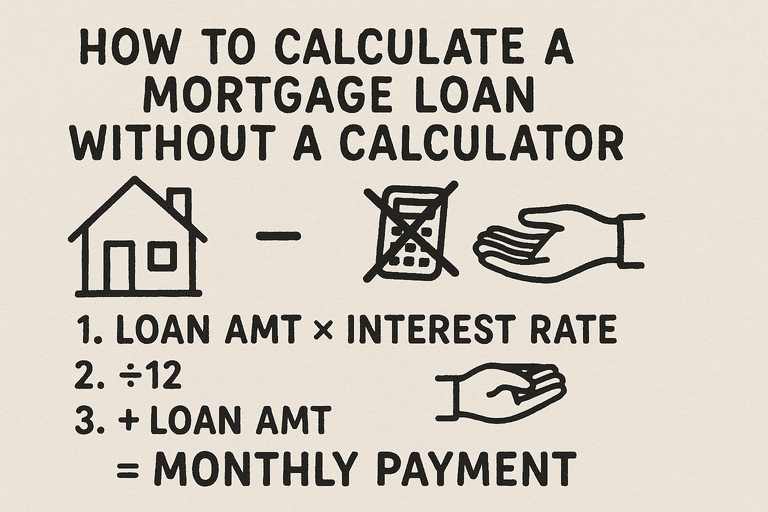

3. Estimate Using the “Rule of Thumb” Method

If you don’t want to do the full calculation, use this simple estimation trick:

For every $1,000 borrowed, at 5% interest, you’ll pay about $5–$6 per month over 30 years.

Adjust slightly upward for higher interest rates, and downward for lower rates.

Example:

$200,000 loan ≈ 200 × $6 = about $1,200/month.

This method isn’t exact but gives you a quick ballpark figure.

4. Create a Simple Amortization Table

To see how your loan balance decreases, set up a table:

Multiply your loan balance by the monthly interest rate → interest portion.

Subtract this interest from your total payment → principal portion.

Subtract the principal portion from the balance → new balance.

Repeat for each month.

Example Snapshot

| Payment # | Interest | Principal | Balance Remaining |

|---|---|---|---|

| 1 | $1,000 | $199.20 | $199,800.80 |

| 2 | $999.00 | $200.20 | $199,600.60 |

5. Why Manual Calculation Matters

You’ll understand how lenders structure your payment.

You can double-check online calculators.

You gain flexibility to estimate quickly, even offline.

You’ll see how small interest changes impact your loan dramatically.

Conclusion

Calculating a mortgage loan without a calculator might take a little patience, but it’s straightforward once you understand the formula and steps. Whether you use the exact math method or a quick estimation rule, you’ll be able to confidently evaluate any mortgage offer.