Down payments play a pivotal role in determining your mortgage amount, monthly payment, equity trajectory, and insurance requirements. This article walks you through how different down payment scenarios—5%, 10%, and 20%—impact the numbers. It ties directly into our core resource, the Guide to Calculating a Mortgage Loan

1. How Down Payment Size Affects Your Loan

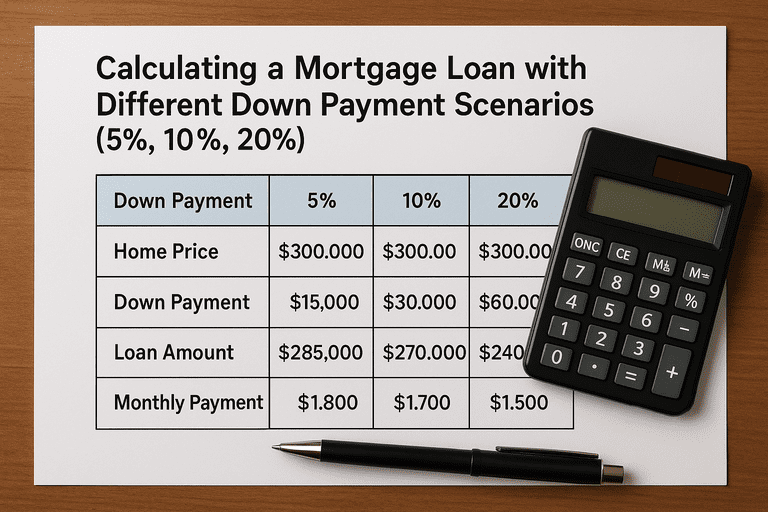

| Down Payment | Loan-to-Value (LTV) | PMI Required? | Loan Amount (on $300,000 home) |

|---|

| 5% | 95% | Yes | $285,000 |

| 10% | 90% | Yes | $270,000 |

| 20% | 80% | No | $240,000 |

Smaller down payments increase your loan amount and typically require PMI if the LTV exceeds 80%.

20% down achieves two goals: it lowers your loan and eliminates PMI.

2. Monthly Payments Across Down Payment Levels

For a $300,000 purchase at 6% over 30 years:

5% down ($285,000 loan) → ≈ $1,709/month

10% down ($270,000 loan) → ≈ $1,619/month

20% down ($240,000 loan) → ≈ $1,439/month

Each additional 10% you put down reduces the monthly payment by approximately $170–$200.

3. Long-Term Cost Impact

Over the course of the loan:

Lower loan amounts mean less interest paid over time.

Avoiding PMI (by putting down 20%) results in hundreds per month in savings—and that adds up significantly.

Smaller down payments may preserve cash for other uses, but expect higher lifetime mortgage costs.

4. Choosing What Works for You

5% down: Lowest upfront cost, but highest monthly payments and PMI.

10% down: A middle ground—reduced loan and payment, but still includes PMI.

20% down: Highest upfront cost, but lowest ongoing burden and no PMI.

Run each scenario against your monthly budget and long-term goals to see which down payment path makes the most sense for you.

5. Use Our Tools to Compare Scenarios

Make your decision clearer with these tools:

Our Down Payment Calculator lets you explore different percentages and immediately see loan amounts and payments.

- Pair that with the Debt-to-Income (DTI) Calculator to understand how payments might affect your borrowing power.

Conclusion

Down payment size significantly shapes your mortgage experience—from monthly costs to insurance and long-term equity. Whether you’re aiming for affordability now or efficiency over the life of the loan, comparing 5%, 10%, and 20% down payment scenarios helps you find the smartest path forward.