Calculating mortgage amortization is essential for every homeowner or homebuyer who wants to understand how their loan payments are applied over time. Mortgage amortization determines how much of each payment goes toward interest and how much reduces the principal balance. By learning how to calculate mortgage amortization, you can make informed decisions, plan your finances, and even save money over the life of your loan.

What Is Mortgage Amortization?

Mortgage amortization is the process of paying off a home loan through regular, equal payments over a set period, typically 15 or 30 years. Each payment covers both the interest due on the remaining balance and a portion of the principal. Over time, the interest portion decreases, while the principal portion increases, ensuring the loan is fully paid off by the end of the term.

Why Is Calculating Mortgage Amortization Important?

Transparency: Understand exactly how your payments are allocated.

Financial Planning: Anticipate how much interest you’ll pay and when you’ll build equity.

Refinancing Decisions: See how extra payments or refinancing could impact your loan.

Budgeting: Prepare for future financial needs by knowing your loan’s trajectory.

The Mortgage Amortization Formula

To begin calculating mortgage amortization, you’ll need the following:

Loan amount (principal)

Annual interest rate

Loan term (in years)

Number of payments per year (usually 12 for monthly payments)

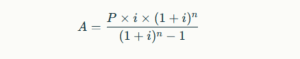

The standard formula to calculate the monthly mortgage payment (A) is:

Where:

A = monthly payment

P = principal (loan amount)

i = monthly interest rate (annual rate divided by 12)

n = total number of payments (years × 12)

Step-by-Step: Calculating Mortgage Amortization

1. Convert the Annual Interest Rate to a Monthly Rate

Divide the annual interest rate by 12.

Example: 6% annual rate → 0.06 ÷ 12 = 0.005 (0.5% monthly)2. Calculate the Total Number of Payments

Multiply the loan term in years by 12. Example: 30 years × 12 = 360 payments

3. Determine the Monthly Payment

Plug your numbers into the amortization formula above. Example: For a $200,000 loan at 4.5% for 30 years:

This results in a monthly payment of approximately $1,013.37.

4. Create an Amortization Schedule

For each month:

Interest Payment: Multiply the current loan balance by the monthly interest rate.

Principal Payment: Subtract the interest payment from the total monthly payment.

New Balance: Subtract the principal payment from the current loan balance.

Repeat these steps for every payment period until the loan is paid off.

Example: Mortgage Amortization Schedule

| Month | Payment | Interest | Principal | Balance |

|---|---|---|---|---|

| 1 | $1,013.37 | $750.00 | $263.37 | $199,736.63 |

| 2 | $1,013.37 | $749.01 | $264.36 | $199,472.27 |

| 3 | $1,013.37 | $748.02 | $265.35 | $199,206.92 |

| … | … | … | … | … |

| 360 | $1,013.37 | $3.79 | $1,009.58 | $0.00 |

Notice that in the early years, most of your payment goes toward interest, while in the later years, more goes toward principal.

Using Mortgage Amortization Calculators

Online mortgage amortization calculators can automate these calculations and generate full amortization tables. Simply input your loan amount, interest rate, and term to see your payment breakdown and how much interest you’ll pay over time.

Tips for Managing Mortgage Amortization

Make Extra Payments: Even small additional payments toward principal can save thousands in interest and shorten your loan term.

Refinance Strategically: If rates drop, refinancing can reduce your interest costs and monthly payments.

Review Your Amortization Schedule Regularly: Stay informed about your progress and adjust your strategy as needed.

Frequently Asked Questions About Calculating Mortgage Amortization

Q: What happens if I pay extra on my mortgage? A: Extra payments go directly to the principal, reducing the balance faster and saving on interest.

Q: Do all mortgages amortize the same way? A: Most fixed-rate mortgages fully amortize, but adjustable-rate mortgages can have varying payment amounts over time.

Q: Can I create my own amortization schedule? A: Yes, with the formula above or by using a spreadsheet and the PMT function.

Conclusion

Calculating mortgage amortization gives you a clear picture of how your home loan is paid off over time. By understanding the process, using the correct formulas, and reviewing your amortization schedule, you can make smarter financial decisions and potentially save money on your mortgage. Always use tools and resources to stay on top of your loan and maximize your home equity.