If you need cash for renovations, debt consolidation, or investment, two options often come up: a cash-out refinance or a home equity line of credit (HELOC).

Both convert your home equity into usable funds—but they work differently, and their long-term costs can vary by tens of thousands of dollars.

Let’s break down which option saves more in interest, when each one makes sense, and how to calculate your break-even point using the Mortgage Refinance Calculator

1. The Basics

| Feature | Cash-Out Refinance | HELOC |

|---|---|---|

| What it is | Replace your current mortgage with a new, larger one | Separate line of credit secured by your home |

| Payout | Lump sum at closing | Borrow as needed (revolving credit) |

| Interest type | Fixed or adjustable | Usually variable |

| Repayment | 15–30 years (full amortization) | 5–10 year draw, 10–20 year repayment |

| Best for | Long-term fixed-rate stability | Short-term flexible borrowing |

2. Example: Cash-Out Refi

Scenario:

Current loan: $300,000 @ 5.5% (25 years remaining)

Home value: $500,000

You want $50,000 cash for renovations

You refinance for $350,000 at 6.25% for 30 years.

| Metric | Old Loan | New Loan |

|---|---|---|

| Balance | $300,000 | $350,000 |

| Rate | 5.5% | 6.25% |

| Term | 25 yrs | 30 yrs |

| Payment | $1,845 | $2,156 |

| Cash Received | — | $50,000 |

Your payment rises, but you now have a single, fixed-rate loan and 30 years to repay.

You can model this instantly using the Mortgage Refinance Calculator or Cash-Out Refinance Calculator

3. Example: HELOC

Scenario:

You keep your existing $300,000 mortgage and open a HELOC for $50,000 at 8% variable rate.

| Term | HELOC Example |

|---|---|

| Draw period | 10 years (interest-only) |

| Monthly payment | $333 (interest only) |

| After draw ends | Converts to 15-year amortization |

Benefit: Lower initial payments and flexibility—you borrow only what you need.

Risk: If rates rise, payments can spike.

4. Comparing Long-Term Cost

Let’s compare both scenarios side by side.

| Metric | Cash-Out Refi | HELOC |

|---|---|---|

| Loan Size | $350,000 | $300,000 + $50,000 |

| Rate Type | Fixed | Variable |

| Average Rate | 6.25% | 8.0% (starting) |

| Monthly Payment | $2,156 | $1,845 + $333 = $2,178 |

| 10-Year Interest Paid | $204,000 | $211,000 |

Result:

If rates stay stable, both are similar short-term.

If rates rise, HELOCs cost more.

If rates drop, HELOC borrowers may win—unless they convert to a fixed rate later.

5. Tax and Interest Deductibility

Cash-Out Refi: Interest on the full loan amount is deductible only if used for home improvements.

HELOC: Interest is also deductible for qualifying renovations, but not for personal expenses (IRS Rule 936).

Always consult a tax advisor before counting on deductions.

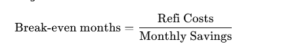

6. Break-Even Comparison

Use this formula to compare savings:

If your cash-out refi costs $5,000 in closing fees and saves $150/month (vs a HELOC or current rate):

5,000÷150=33.3 months (≈ 2.8 years)

After that, the refi becomes cheaper long-term.

You can model both options using the Mortgage Refinance Calculator to see total interest over time.

7. When to Choose a Cash-Out Refi

Best for:

Long-term rate stability (fixed loan)

Large one-time projects (renovations, debt consolidation)

Borrowers who can extend their term for lower payments

Locking in while rates are still low or steady

Avoid if:

You’re near the end of your loan

You only need small, short-term funds

You’ll move soon or refinance again soon

8. When a HELOC Wins

Best for:

Flexible borrowing—you only use what you need

Short-term or phased expenses (like remodeling in stages)

People expecting to pay off balance quickly

Borrowers expecting rates to fall or who plan to refinance soon

Avoid if:

You dislike variable payments

Your budget is tight and can’t absorb rising rates

You want predictable long-term costs

9. Hybrid Strategy: “Cash-Out + HELOC”

Some homeowners blend both:

Refinance a portion of equity for a low fixed-rate

Keep a small HELOC for flexible, future borrowing

This strategy keeps your main loan stable while preserving liquidity.

Use the HELOC Calculator alongside your refinance estimate to fine-tune your mix.

10. Key Takeaways

Cash-Out Refi: Long-term stability, higher upfront cost, predictable payments.

HELOC: Short-term flexibility, variable risk, lower upfront costs.

Use calculators to model both lifetime interest and break-even timelines.

The best choice depends on how much equity you need—and how long you’ll hold it.

FAQ

Which is cheaper—cash-out refinance or HELOC?

HELOCs are cheaper short-term, but cash-out refinances usually win long-term if you lock a lower fixed rate.Can I have both a HELOC and a mortgage?

Yes. A HELOC sits in second position behind your main mortgage and can be used anytime during the draw period.Do HELOC rates change often?

Most adjust monthly based on the prime rate. Always confirm your lender’s adjustment period.Can I switch from a HELOC to a fixed-rate loan later?

Yes—many lenders offer a “conversion” feature or you can refinance your HELOC balance into a fixed-rate loan.