In 2025, the biggest hidden cost in homeownership isn’t interest rates.

It’s

insurance driven by climate risk. Two homes with the same price and mortgage rate can differ by

$800–$1,500 per month purely because of location. Coastal buyers are discovering this the hard way—often

after they’re under contract. This guide breaks down

how climate risk changes mortgage affordability, how lenders calculate coastal vs inland costs, and how to run the numbers

before you buy.

1) Why climate risk now directly affects mortgages

Historically, climate risk was abstract. Today it’s priced in. In high-risk zones, lenders must account for:

- Rising homeowners insurance premiums

- Mandatory flood insurance

- Hurricane or windstorm riders

- Fire risk surcharges

- Insurer withdrawal or non-renewal risk

These costs affect:

- Monthly payment (PITI)

- Debt-to-income (DTI)

- Loan approval and appraisal

- Long-term affordability

Actionable tip: If insurance isn’t quoted early, your affordability math is wrong.

2) Coastal vs inland: what actually changes

Let’s define terms clearly.

Coastal properties typically face:

- Flood zone exposure (FEMA)

- Hurricane and wind risk

- Saltwater corrosion risk

- Fewer insurance carriers

- Rapid premium increases

Inland properties typically face:

- Lower flood exposure

- Fire risk (in some regions)

- More stable insurance markets

- Lower volatility in premiums

The mortgage itself may be identical. The

non-mortgage costs are not.

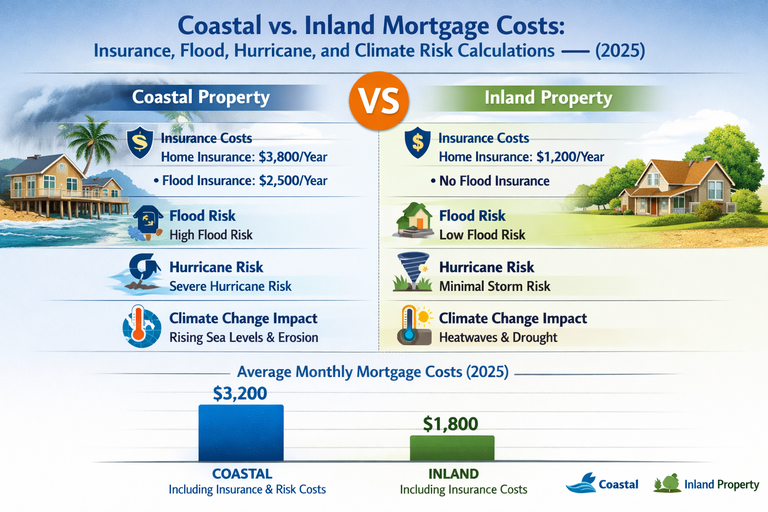

3) Insurance cost comparison (realistic 2025 ranges)

Example: $500,000 home, same loan terms

Inland (low-risk area)

- Homeowners insurance: $1,400–$1,800/year

- Flood insurance: $0

- Monthly insurance: ~$125

Coastal (flood + hurricane zone)

- Homeowners insurance: $4,000–$7,000/year

- Flood insurance: $1,200–$3,000/year

- Windstorm rider: often included or extra

- Monthly insurance: ~$450–$850

That’s a

$325–$725/month difference—before taxes or HOA.

Actionable tip: Insurance, not mortgage rate, is now the main affordability lever in coastal markets.

4) Flood insurance: the deal-breaker buyers ignore

If a property is in a

Special Flood Hazard Area (SFHA):

- Flood insurance is mandatory for federally backed loans

- Coverage applies for the life of the loan

- Costs rise with FEMA map updates

Typical flood insurance costs (2025)

- Low-risk flood zone: $500–$800/year

- High-risk zone: $1,500–$3,500+/year

Flood insurance does

not:

- Build equity

- Reduce your rate

- Protect everything (coverage limits apply)

Actionable tip: Always check FEMA flood maps

before making an offer—not after.

5) DTI impact: how climate costs kill approvals

Lenders include insurance and flood premiums in

PITI.

Example

- Mortgage P&I: $2,900

- Property taxes: $550

Inland total PITI:- Insurance: $125

- Total: ~$3,575

Coastal total PITI:- Insurance + flood: $700

- Total: ~$4,150

That extra

$575/month can:

- Push DTI over limits

- Reduce buying power by $75k–$100k+

- Force a smaller loan or denial

Actionable tip: Climate risk reduces buying power just like higher interest rates.

6) Fire zones: the inland climate trap

Inland doesn’t always mean safe. High fire-risk areas face:

- Insurance non-renewals

- Forced use of state-backed insurers

- High deductibles

- Limited coverage options

California, Colorado, and parts of the West are prime examples.

Fire risk insurance reality

- Premiums rising 20–40% annually in some zones

- Fewer carriers willing to underwrite

- Lenders may reject policies with exclusions

Actionable tip: Ask insurers

if they’ll renew, not just if they’ll issue a policy today.

7) Long-term risk: insurance volatility matters more than today’s cost

Mortgage rates are fixed.

Insurance is not. Coastal buyers face:

- Unpredictable premium hikes

- Mid-loan affordability erosion

- Forced escrow increases

- Refinance difficulty if costs explode

A home affordable today can become unaffordable

without any change to income or rate.

Actionable tip: Stress-test insurance rising 30–50% over 5 years. If that breaks the budget, walk away.

8) Coastal vs inland: full monthly cost comparison

Same home price: $500,000

Same loan, same rate

| Cost Component | Inland | Coastal |

|---|

| Mortgage P&I | $2,900 | $2,900 |

| Taxes | $550 | $550 |

| Insurance & flood | $125 | $700 |

| Total Monthly | $3,575 | $4,150 |

Difference: ~$575/month

That’s

$207,000 over 30 years—purely from climate risk.

9) When coastal buying can still make sense

Coastal properties can work if:

- You have high discretionary income

- You maintain large cash reserves

- Insurance costs are a small % of income

- You plan for self-insurance later

- You accept long-term volatility

It’s not about fear—it’s about

capacity.

Actionable tip: Climate risk is manageable only if it’s optional, not existential.

Conclusion

In 2025, climate risk is no longer hypothetical—it’s embedded in your monthly payment. Coastal homes carry rising, unpredictable insurance costs that directly affect mortgage approval, affordability, and long-term stability. Two buyers with the same income and loan can have wildly different outcomes based solely on

geography. Before choosing coastal or inland, calculate:

- Insurance today

- Insurance volatility tomorrow

- DTI impact

- Long-term affordability under stress

If the math works only under perfect conditions, it doesn’t work.

FAQs

1) Do lenders require flood insurance? Yes, if the property is in a FEMA-designated flood zone and the loan is federally backed.

2) Are coastal homes harder to finance? They can be, due to insurance availability, higher PITI, and appraisal risk.

3) Can insurance costs change after closing? Yes—insurance premiums can rise annually and affect escrow payments.

4) Are inland homes always safer? No. Fire zones and extreme weather can create similar insurance challenges inland.

5) What’s the biggest mistake buyers make? Ignoring insurance costs until after they’re under contract.