For many first-time buyers and moderate-income homebuyers, an

FHA loan is one of the most accessible mortgage options. The Federal Housing Administration (FHA)

insures these loans, enabling lenders to offer lower down payments (as little as 3.5%) and more flexible credit requirements. But FHA loans come with

loan limits that vary by county and property type—limits that directly affect how much you

can borrow in 2025. Understanding these limits is crucial before you start shopping or comparing financing options.

1) What are FHA loan limits (simple explanation)

FHA loan limits are the

maximum mortgage amounts the FHA will insure for buyers in a given county. If your loan amount exceeds the FHA limit for your area, you’ll need a different financing type (like a conventional or jumbo mortgage) or a larger down payment to cover the gap. Limits vary by:

- County or metropolitan area

- Number of units in the property (1-4 units)

- Local home prices (higher costs = higher limits)

Limits are updated annually based on median home prices.

Actionable tip: Always

look up your specific county rather than assume the national average applies—you could be limited or advantaged by your location.

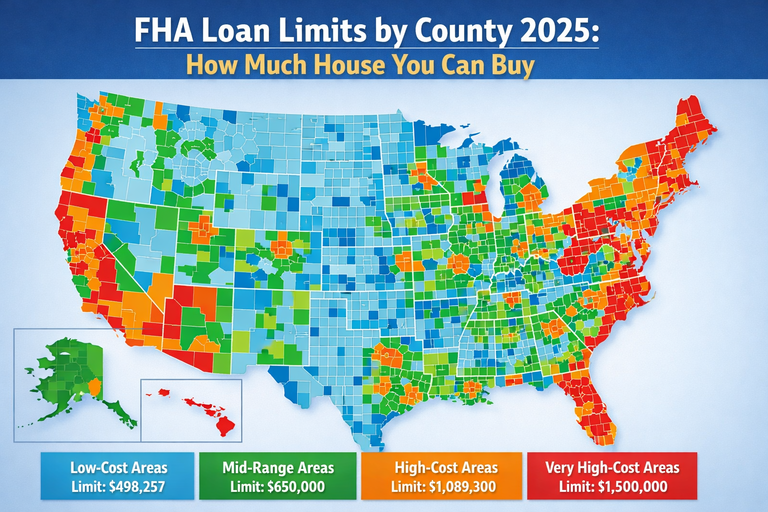

2) 2025 national FHA loan limits overview

In 2025 the

baseline FHA loan limits for most U.S. counties are as follows:

| Property Type | Standard Limit |

|---|

| Single-family | $524,225 |

| 2-unit | $671,200 |

| 3-unit | $811,275 |

| 4-unit | $1,008,300 |

These figures apply in

low-to-mid cost counties where home prices are closer to national medians.

Actionable tip: If the home price is above your FHA limit, you’ll need to either increase your down payment or explore a

conventional loan—which has higher qualifying criteria but no FHA cap.

3) High-cost area FHA loan limits

In more expensive counties where home prices are higher, FHA sets

higher “ceiling” limits to match the local market. These apply in many coastal and high-priced urban regions. In 2025, for example:

| Property Type | High-Cost Limit |

|---|

| Single-family | $1,209,750 |

| 2-unit | $1,548,975 |

| 3-unit | $1,872,225 |

| 4-unit | $2,326,875 |

This means a buyer in a high-cost county can borrow

significantly more with an FHA loan than in a standard-cost area.

Actionable tip: If you’re buying in a high-cost metro like New York City, San Francisco Bay Area, or parts of Hawaii, use your county’s high-cost limit—not the floor—to determine your maximum FHA loan amount.

4) Why county-level limits matter for buyers

FHA loan limits are tied to

local median home prices. In a county where prices are higher, limits adjust upward to maintain affordability relative to local market conditions. Examples of how this affects home buying:

- In a rural county with lower prices, the limit might remain near the baseline $524,225 for a single-family home.

- In an urban high-cost county, you may have limits over $1.2M for a single-family home.

Actionable tip: Before you get pre-approved, run the FHA

loan limit lookup tool on HUD.gov to confirm your maximum allowed loan amount—this avoids surprises when you make an offer.

5) Multi-unit loans and FHA limits

If you’re considering a

multi-unit property (like a duplex or triplex) where you plan to live in one unit and rent the others:

- FHA 2-unit limit starts above $671,000 in many counties

- 3-unit and 4-unit limits rise even higher

This is one reason some buyers look at FHA as a way to enter into

house-hacking strategies—living in one unit while renting out others to help cover payments.

Actionable tip: Always run numbers using a

rental income estimator if you intend to rent units—it may improve your qualifying scenario when combined with FHA’s multi-unit limits.

6) What happens if your home price is above your FHA limit

If the home you want to buy costs

more than your county’s FHA limit:

- You can increase your down payment so the FHA portion stays within the limit.

- You can choose a conventional loan (which may allow larger loan amounts).

- You could split financing (e.g., an FHA loan + subordinate second mortgage in some cases).

Actionable tip: Use a

Home Affordability Calculator to see whether a conventional loan might result in lower long-term costs, especially if you have strong credit and income.

7) Common borrower scenarios

First-time buyer in a mid-cost county: Median price $350,000 → FHA limit $524,225 → FHA loan covers most of the purchase with a low down payment.

Buyer in a high-cost city: Median price $900,000 → FHA high-cost limit $1,209,750 → You can use FHA with a 3.5% down payment even at higher prices.

Multi-unit investment buy: Two-unit FHA limit near $1.5M in many high-cost counties → Use FHA to buy and live in one unit while renting the other(s).

Conclusion

FHA loan limits in 2025 vary county by county and by property type. For most U.S. areas, the baseline single-family limit is

$524,225, but in high-cost counties the single-family limit can exceed

$1.2 million. This variability means your

geography directly influences your FHA buying power, and understanding your specific county limit before you shop is essential to avoid disappointment and plan financing correctly.

FAQs

1) How often do FHA loan limits change? FHA revises limits annually based on median home prices in each county.

2) Can I use an FHA loan in a high-cost county for a million-dollar home? Yes, if the FHA limit for that county’s single-family home category is above the purchase price.

3) What’s the 2025 baseline FHA limit for a single-family home? About

$524,225 in standard-cost counties.

4) Do FHA limits include the down payment? No. Limits refer only to the

loan amount; your down payment is extra.

5) Where can I find the exact limit for my county? Use the official FHA loan limit lookup tool on

HUD.gov to see precise, updated figures by county.