House flipping looks simple on Instagram. In reality, most flips fail because investors

miscalculate financing costs, not renovation costs. In 2025, with higher interest rates and tighter lending, choosing

hard money vs. traditional financing can be the difference between a profitable flip and a six-figure mistake. This guide gives you the

exact calculator logic investors use, explains the

70% ARV rule, and shows how financing type directly impacts ROI. This is not theory. It’s deal math.

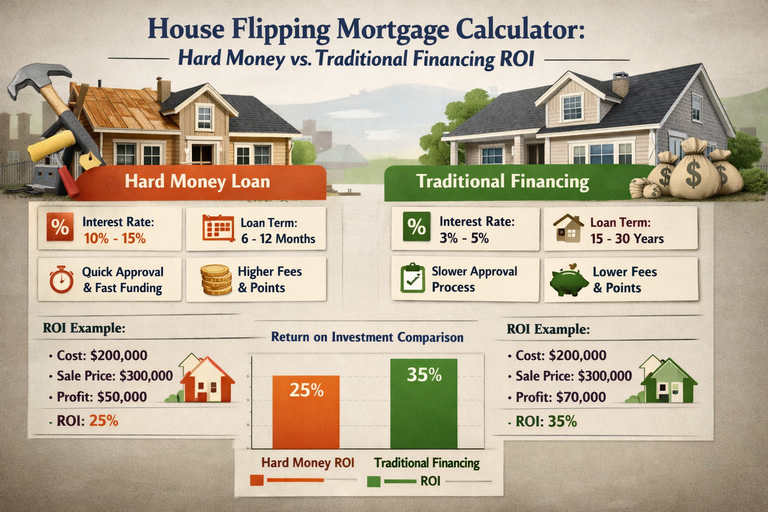

1) The two financing options that matter for flips

Hard money loans

Short-term, asset-based loans typically used for flips.

Typical 2025 terms:- Interest: 9%–13%

- Points: 2–4 points upfront

- Term: 6–12 months

- Down payment: 10%–25%

- Interest-only payments

Traditional financing

Conventional or renovation loans (harder to qualify).

Typical 2025 terms:- Interest: 6%–7%

- Points: 0–1

- Term: 15–30 years

- Slower approval

- Stricter condition requirements

Actionable truth: Hard money buys speed. Traditional loans buy margin.

2) The 70% ARV rule (the foundation of flip math)

The

After-Repair Value (ARV) is what the property should sell for

after renovations. The rule:

[\text{Max Purchase Price} = (ARV × 70%) − Renovation Costs] This rule exists to absorb:

- Financing costs

- Holding costs

- Sale costs

- Unexpected overruns

Example:

- ARV: $400,000

- Renovation: $60,000

[

(400,000 × 0.70) − 60,000 = $220,000

] If you pay more than $220,000, the deal is already fragile.

Actionable tip: If a deal doesn’t work at 70%, it won’t survive reality.

3) House flipping mortgage calculator (core inputs)

Any flip calculator must include:

Purchase side

- Purchase price

- Down payment

- Loan amount

- Interest rate

- Points

Renovation

- Rehab budget

- Draw fees (hard money)

- Overrun buffer (10–15%)

Holding costs (monthly)

- Interest payments

- Property taxes

- Insurance

- Utilities

- HOA

- Maintenance

Exit costs

- Agent commissions (5–6%)

- Closing costs (1–2%)

- Staging & concessions

Skipping

any of these inflates ROI artificially.

4) Hard money example (realistic numbers)

Deal assumptions:- Purchase price: $220,000

- Rehab: $60,000

- ARV: $400,000

- Hard money loan: 90% purchase, 100% rehab

- Rate: 11%

- Points: 3

- Hold time: 9 months

Financing costs

- Loan amount: ~$254,000

- Points (3%): ~$7,620

- Monthly interest: ~$2,325

- Interest over 9 months: ~$20,925

Holding + selling costs (est.)

- Taxes, insurance, utilities: ~$7,000

- Agent & closing costs: ~$24,000

Total costs

- Purchase + rehab: $280,000

- Financing & holding: ~$59,500

- Selling costs: ~$24,000

Total invested: ~$363,500

Sale price: $400,000 👉

Profit: ~$36,500

👉

ROI: ~10% (before taxes) That’s a

thin deal.

Actionable tip: Hard money compresses margins. Speed must compensate.

5) Traditional financing example (same deal)

Now assume:

- 20% down

- 6.5% interest

- No points

- Slower close, longer hold (12 months)

Financing costs

- Loan amount: ~$176,000

- Monthly P&I: ~$1,110

- Interest paid in year one: ~$11,200

Holding + selling costs

- Higher holding costs due to time: ~$10,000

- Agent & closing: ~$24,000

Total invested

- Higher cash down

- Lower interest

👉

Profit: ~$52,000

👉

ROI: Higher, but more capital tied up

Actionable tip: Traditional loans reward patience and liquidity.

6) ROI comparison: hard money vs traditional

| Factor | Hard Money | Traditional |

|---|

| Speed | Very fast | Slow |

| Cost | Very high | Lower |

| Cash required | Lower | Higher |

| Margin pressure | Extreme | Moderate |

| Best for | Short flips | Longer flips |

Key insight: Hard money doesn’t make bad deals good—it just makes them possible.

7) Holding costs: the silent profit killer

Every extra month kills ROI. Example:

- Hard money interest: ~$2,300/month

- Utilities, taxes, insurance: ~$800/month

👉

$3,100/month burn A 3-month delay =

$9,300 gone.

Actionable tip: Add 2–3 months buffer to every flip. If profit disappears, walk away.

8) When hard money makes sense

Hard money is rational when:

- The deal is deeply discounted

- Speed beats all alternatives

- You have contractor control

- The flip timeline is short

- ARV comps are strong and recent

If you’re using hard money because you

need it to qualify, the deal is already risky.

9) When traditional financing wins

Traditional financing is better when:

- Property qualifies for financing

- Timeline exceeds 9–12 months

- You have sufficient cash

- Profit margin is tight

- Market volatility is high

Lower carrying cost = higher survival rate.

Conclusion

House flipping profits are made

before you buy, not after you renovate. Hard money accelerates deals but compresses margins. Traditional financing improves ROI but requires patience and capital. The 70% ARV rule exists for a reason: it protects you from financing reality, not optimism. If your flip only works with perfect timing and no overruns, it doesn’t work.

FAQs

1) What is hard money financing? Short-term, high-interest loans based on property value, commonly used for flips.

2) What is the 70% ARV rule? A rule that limits purchase price to 70% of after-repair value minus rehab costs.

3) Is hard money bad? No—but it’s expensive. It only works when the deal margin is wide.

4) How long should a flip take? Ideally under 9 months. Longer timelines crush ROI.

5) What kills most house flips? Underestimating financing and holding costs—not renovation budgets.