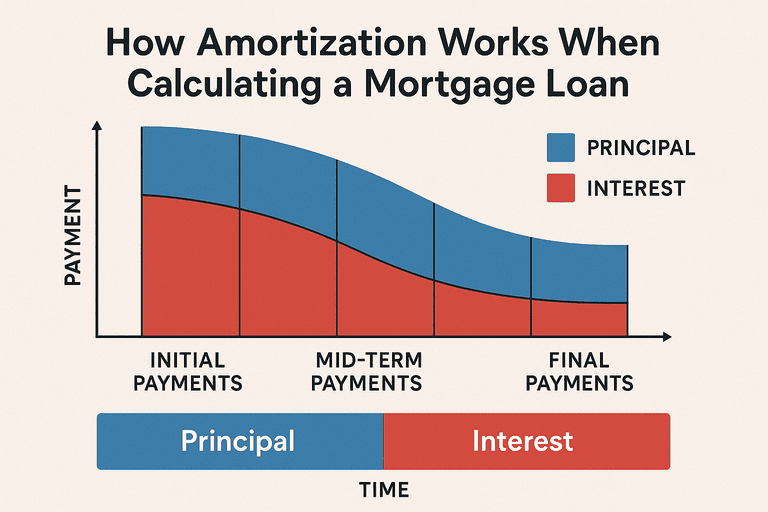

Amortization is one of the most important concepts in mortgage lending. It explains how each payment you make is divided between interest and principal over time. Understanding amortization helps you see why your balance drops slowly at first, then accelerates as you pay down more principal. For a full foundation in mortgage math, see our ultimate mortgage loan calculation guide

1. What Is Amortization?

Amortization is the process of paying off a loan in regular installments over time. Each payment is split into:

Interest: The cost of borrowing money, based on the outstanding balance.

Principal: The portion that reduces the loan balance.

At the start of the loan, most of your payment goes toward interest. As the balance decreases, more goes toward principal.

2. The Role of the Mortgage Formula

The standard mortgage formula ensures that you pay a fixed monthly amount (for fixed-rate loans), but the distribution of interest vs. principal changes monthly.

Formula reminder:

M = P × [ r × (1 + r)^n ] / [ (1 + r)^n – 1 ]

Where:

M = Monthly payment (fixed)

P = Loan principal

r = Monthly interest rate (annual ÷ 12)

n = Total number of payments

This formula guarantees consistent payments—but behind the scenes, the ratio of interest to principal shifts over time.

3. Example: $250,000 Loan at 6% for 30 Years

Loan Amount: $250,000

Rate: 6%

Term: 30 years (360 payments)

Monthly Payment (P+I): ≈ $1,499

First Payment Breakdown

Interest = $250,000 × 0.005 = $1,250

Principal = $1,499 – $1,250 = $249

New Balance = $249,751

Payment #120 (Year 10)

Balance reduced, so interest is lower.

Interest ≈ $1,000

Principal ≈ $499

Payment #360 (Final Payment)

Interest is minimal.

Nearly the entire payment goes toward the remaining principal.

4. The Amortization Schedule

An amortization schedule is a table showing this breakdown for every payment until the loan is paid off. It includes:

| Payment # | Interest Paid | Principal Paid | Remaining Balance |

|---|

| 1 | $1,250 | $249 | $249,751 |

| 2 | $1,249 | $250 | $249,501 |

| … | … | … | … |

| 360 | ~$7 | ~$1,492 | $0 |

This helps borrowers understand exactly how much of each payment goes toward interest vs. debt reduction.

5. Why Amortization Matters in Mortgage Calculations

Total Interest Costs – Shows how much interest you’ll pay over the life of the loan.

Impact of Extra Payments – Adding principal payments early reduces interest dramatically.

Comparing Loan Terms – A 15-year loan amortizes much faster than a 30-year, saving huge interest.

Budgeting & Planning – Helps you project balance milestones (e.g., when you’ll hit 20% equity and can drop PMI).

6. Accelerating Amortization

Strategies to pay off your loan faster:

Biweekly Payments – 26 half-payments per year = 13 full payments.

Extra Principal Payments – Even small extra amounts early on save years of interest.

Refinancing – Shortening your loan term resets the amortization schedule but accelerates debt payoff.

Conclusion

Amortization is the engine behind mortgage repayment—it explains how your loan balance shrinks and how interest costs add up. By studying amortization schedules, you can see the long-term cost of borrowing and the dramatic effect of strategies like extra payments.