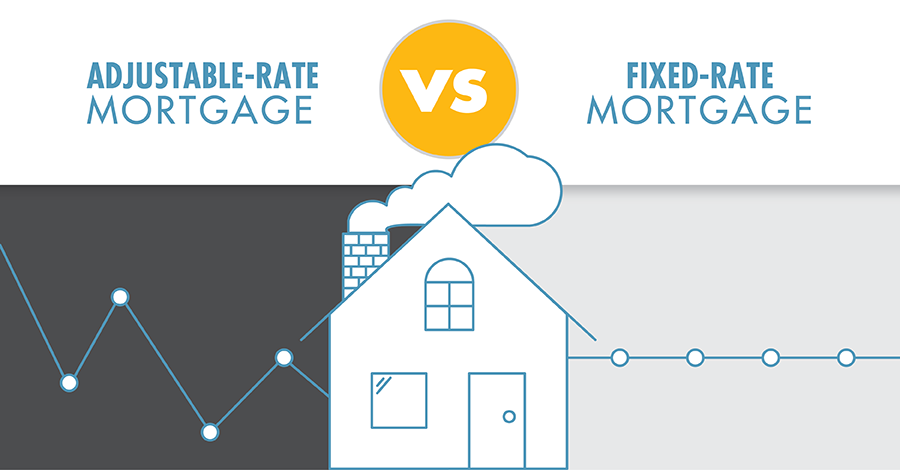

Refinancing a mortgage can save you money or help you achieve financial goals, but selecting the right loan type is key. The two most common refinancing options are fixed-rate mortgages and adjustable-rate mortgages (ARMs). Each offers distinct benefits and risks, and your choice depends on factors like your plans, budget, and the economic environment. This article explores both options in detail, comparing their features and providing guidance to help you decide which is best for your refinancing needs.

What is a Fixed-Rate Mortgage?

A fixed-rate mortgage locks in your interest rate for the entire loan term, typically 15 or 30 years. Your monthly principal and interest payments remain unchanged, regardless of market fluctuations.

Advantages of Fixed-Rate Mortgages

- Predictability: Consistent payments make budgeting straightforward and stress-free.

- Long-Term Security: Ideal if you plan to stay in your home for a decade or more, shielding you from rising rates.

- Peace of Mind: No surprises, even if interest rates spike in the future.

Disadvantages of Fixed-Rate Mortgages

- Higher Starting Rates: Initial rates are often higher than those of ARMs.

- Missed Opportunities: If market rates drop, you won’t benefit unless you refinance again.

What is an Adjustable-Rate Mortgage (ARM)?

An adjustable-rate mortgage begins with a fixed rate for an initial period—say, 5 or 7 years—then adjusts periodically based on an index (e.g., 5/1 ARM means 5 years fixed, adjusting annually thereafter). These adjustments can raise or lower your payments.

Advantages of Adjustable-Rate Mortgages

- Lower Initial Rates: You start with a lower rate than a fixed-rate loan, reducing early payments.

- Potential Savings: If rates fall or stay low, you could pay less over time.

- Short-Term Benefits: Great for those planning to sell or refinance before the adjustment period.

Disadvantages of Adjustable-Rate Mortgages

- Payment Uncertainty: Rising rates can increase your monthly costs significantly.

- Complexity: Terms like caps, margins, and adjustment intervals can be confusing.

- Financial Risk: Higher rates later could strain your budget.

Key Factors to Compare Fixed and Adjustable Rates

To choose wisely, weigh these considerations based on your circumstances:

1. Length of Homeownership

- Fixed-Rate: Suits long-term homeowners who value payment stability over 10+ years.

- ARM: Better for short-term stays (e.g., 5-7 years), leveraging the lower initial rate.

2. Current Economic Climate

- Fixed-Rate: If rates are low now (e.g., 3-4% in a stable economy), locking in protects against future hikes.

- ARM: If rates are high but expected to decline, an ARM could adjust downward later.

3. Risk Comfort Level

- Fixed-Rate: Appeals to risk-averse borrowers who prefer certainty.

- ARM: Fits those willing to gamble on rates staying low or dropping.

4. Budget Flexibility

- Fixed-Rate: Fixed payments align with steady income planning.

- ARM: Lower early payments help cash flow, but you’ll need a buffer for potential increases.

Real-Life Scenarios

Scenario 1: Long-Term Homeowner

Imagine you’re settling into your forever home. A 30-year fixed-rate mortgage at 4% ensures your $1,500 monthly payment stays put, even if rates climb to 6% in a decade. Stability trumps the slightly higher initial cost.

Scenario 2: Short-Term Stay

Suppose you’re in a starter home for 5 years. A 5/1 ARM at 3.5% saves you $100 monthly compared to a 4% fixed rate. If you sell before adjustments kick in, you pocket the savings without facing rate hikes.

Scenario 3: Rate Predictions

If you expect rates to drop from 5% to 3% in a few years, a 7/1 ARM starting at 4.5% could adjust downward, cutting costs. But if you’re wrong and rates rise to 7%, your payments jump—highlighting the gamble.

Making Your Decision

Choosing between a fixed-rate and adjustable-rate mortgage hinges on your unique situation. Fixed-rate loans shine for their reliability, making them a top pick for long-term homeowners or those in a low-rate environment. ARMs offer early savings and flexibility, ideal for shorter stays or optimistic rate forecasts—but they carry uncertainty. Reflect on how long you’ll keep the home, your financial cushion, and today’s rates (e.g., as of 2023, rates hover around 6-7%, per market trends). A mortgage professional can tailor advice to your goals, ensuring your refinance aligns with your future.