Not all loan calculators speak the same language. Auto, personal, and mortgage loans may look similar on paper, but they calculate interest, fees, and amortization differently. Understanding those differences ensures the results you get online actually match your lender’s quote.

Try it yourself: Mortgage Calculator or Home Loan Calculator

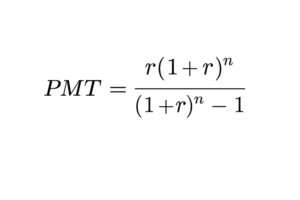

1. The Core Formula Looks Familiar—But the Details Change

Almost every loan calculator starts with the annuity formula:

Where:

P = loan amount (principal)

r = periodic interest rate

n = number of payments

The trick is what each calculator assumes for r and n**:

| Loan Type | Typical Term | Compounding | Payment Frequency |

|---|---|---|---|

| Car / Personal Loan | 2 – 7 years | Monthly or daily simple interest | Monthly |

| Mortgage | 10 – 30 years | Monthly compound interest | Monthly |

| Student Loan | 10 – 25 years | Daily simple interest | Monthly (after grace) |

2. Collateral & Risk Drive Rate Spread

Car loans are secured by a fast-depreciating asset. Lenders price risk high at short duration.

Mortgages are secured by real property that generally appreciates, so they can offer lower rates over decades.

Personal loans are unsecured; hence the highest rates.

Tip: When comparing calculators, ensure you’re entering an annual percentage rate (APR) that matches your loan type and collateral risk.

3. Simple Interest vs Compound Interest

| Type | How Interest Accrues | Impact |

|---|---|---|

| Simple interest (auto/personal) | Interest = principal × rate × time. | Paying early saves more; interest doesn’t compound. |

| Compound interest (mortgage) | Interest accrues on unpaid balance monthly. | Longer horizon = greater total interest. |

4. APR vs Nominal Rate: Why the Numbers Differ

Nominal (stated) rate → used to calculate your payment.

APR (Annual Percentage Rate) → includes most fees (origination, discount points, some closing costs) spread across the term.

Two loans with the same nominal rate but different fees can have different APRs—and different true costs.

Use the Real APR Calculator to reveal the real cost of borrowing.

5. Fees, Add-Ons & Prepayment Rules

| Loan | Common Fees | Prepayment Rules |

|---|---|---|

| Car Loan | Title, documentation, dealer financing fees | Often none—pay early to save interest |

| Mortgage | Origination, discount points, appraisal, title | Some investors impose early-payment windows |

| Personal Loan | Origination (1–8 %) | May include small penalty |

6. Term & Amortization Depth

Auto loans: 24 – 84 months. Front-loaded interest, small amortization table.

Mortgages: 120 – 360 months. Long amortization; interest dominates early years.

Personal loans: typically simple amortization with flat fees.

For long-term planning, use a mortgage calculator with a downloadable amortization schedule to visualize equity growth year by year.

Try: Amortization Schedule Calculator

7. Refinancing & Trade-In Nuances

Auto loans: Refinance if rates drop ≥ 2 % or you’re upside-down less than 80 %.

Mortgages: Even 0.75 % drop can justify refi thanks to large balance; test with Mortgage Refinance Calculator

- Personal loans: Generally not refinanced—better to pay off early and re-shop.

8. Putting It All Together (Example)

| Scenario | Loan Amount | Rate | Term | Monthly Payment* |

|---|---|---|---|---|

| Car Loan | $25 000 | 6.9 % | 5 yrs | ≈ $495 |

| Personal Loan | $25 000 | 10 % | 5 yrs | ≈ $531 |

| Mortgage | $250 000 | 6.5 % | 30 yrs | ≈ $1 580 |

9. Which Calculator Should You Use?

| Goal | Best Tool |

|---|---|

| Compare interest cost of auto vs mortgage | This article + Mortgage Calculator |

| Estimate true borrowing cost incl. fees | Real APR Calculator |

| Visualize payoff over decades | Amortization Schedule Calculator |

| Evaluate extra payments | Extra Payment Mortgage Calculator |

Key Takeaways

Always match the calculator’s compounding method to your loan type.

Use APR to compare loans, nominal rate to calculate payments.

Mortgages = long-term, compound; car/personal loans = short, simple.

Verify fees and penalties—they can outweigh small rate differences.

FAQ

Why does my auto-loan calculator show a different payment than my mortgage calculator?

Because one uses simple interest and shorter terms; the other compounds monthly over decades.Should I compare loans by APR or interest rate?

Use APR for apples-to-apples total cost; interest rate for payment size.Can I use a mortgage calculator for personal loans?

Only if you adjust for term and simple-interest math—otherwise results will be slightly off.