Every loan—from car loans to 30-year mortgages—relies on the same foundation: the loan payment formula.

Once you understand it, you can check any calculator’s math, estimate payments by hand, and spot errors in lender quotes.

Let’s walk through the PMT formula, how to use it, and what changes for special cases like zero-interest, balloon, and interest-only loans.

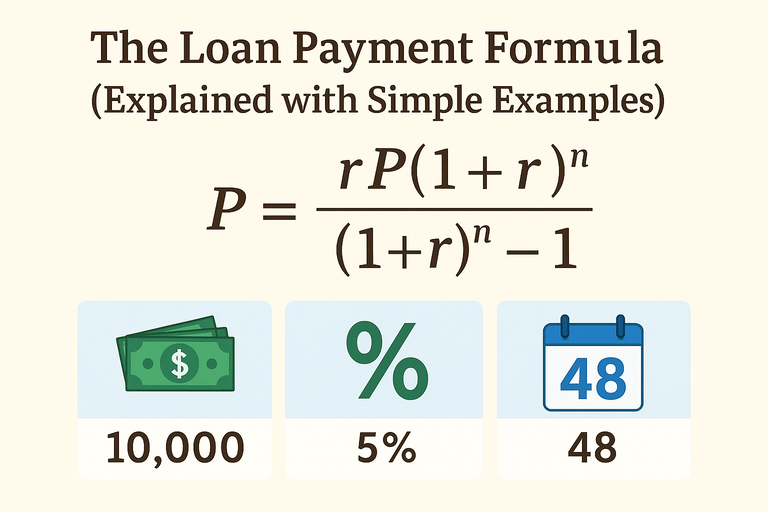

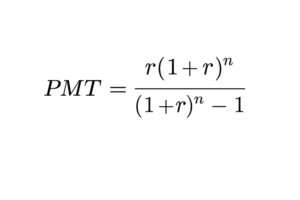

1. The Core Loan Payment (PMT) Formula

The standard formula for fixed-rate, fully amortized loans is:

Where:

PMT = periodic payment (monthly)

P = principal (loan amount)

r = periodic interest rate (annual rate ÷ 12)

n = total number of payments (years × 12)

This formula ensures the loan is paid off completely after n payments.

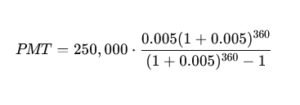

2. Step-by-Step Example

Scenario:

Loan amount: $250,000

Interest rate: 6% (0.06 annually)

Term: 30 years (360 months)

Step 1: Find the monthly interest rate

r = 0.06 ÷ 12 = 0.005

Step 2: Find total payments

n = 30 × 12 = 360

Step 3: Plug into the formula

Result:

PMT ≈ $1,498.88 per month (principal + interest)

You can check this instantly using the Home Loan Calculator or Mortgage Loan Formula Explained for step-by-step versions.

3. Understanding the Variables

| Variable | What It Controls | Common Mistake |

|---|---|---|

| P (Loan Amount) | Directly scales payment size | Forgetting to subtract down payment |

| r (Rate) | Small increases raise total interest drastically | Using annual rate instead of monthly |

| n (Payments) | Longer term lowers payment but raises interest | Using years instead of months |

4. Edge Case: Zero-Interest Loans

Some builder or dealer loans advertise 0% financing.

In that case, the formula simplifies because there’s no compounding:

![]()

Example: $12,000 car loan for 3 years → 36 payments

PMT = $12,000 ÷ 36 = $333.33/month

In zero-rate cases, every dollar goes to principal. There’s no interest portion.

5. Edge Case: Interest-Only Loans

An interest-only loan delays principal repayment. You pay only interest for an initial period (e.g., 5 or 10 years), then amortize the rest.

Example:

Loan: $400,000

Rate: 5%

Interest-only period: 10 years

Monthly interest-only payment =

![]()

After 10 years, payments jump when principal amortization begins.

Use: Balloon Mortgage & Interest-Only Calculator

6. Edge Case: Balloon Loans

Balloon loans have small monthly payments and a large lump-sum (balloon) due at the end.

They’re often used for short-term financing or bridge loans.

Example:

$250,000 loan

5-year term, 30-year amortization (balloon after 60 months)

The calculator uses a 30-year formula to get the monthly P&I (~$1,498), but after 60 months, you’ll still owe about $232,000 due immediately.

Key takeaway: The formula stays the same—only the number of payments before the balloon changes.

7. What Happens When You Add Extra Payments

Each time you pay extra principal, you shorten n—the total remaining payments.

Mathematically, you’re reducing the base for interest, not changing r.

Try this with an Extra Payment Mortgage Calculator to see months shaved off instantly.

8. Common Pitfalls When Using the Formula

Confusing rate and APR:

Use the interest rate, not APR, for payment calculations.

APR includes fees and won’t match the monthly payment formula exactly.Mixing time units:

Don’t plug annual rate directly—always divide by 12 for monthly loans.Ignoring rounding differences:

Lenders round to the nearest cent, which slightly shifts total interest over years.Not including escrow costs:

This formula covers only principal and interest. Taxes, insurance, and PMI must be added separately.

9. When to Use a Calculator vs. the Formula

| Use Case | Best Option |

|---|---|

| Quick payment estimate | Formula (manual or spreadsheet) |

| Visual amortization schedule | Home Loan Calculator |

| Check balloon or interest-only cases | Balloon Mortgage Calculator |

| Compare loan types or extra payments | Mortgage Calculator |

10. Quick Reference Table

| Loan Type | Formula Used | Notes |

|---|---|---|

| Standard Amortized | PMT = P·r(1+r)^n / ((1+r)^n–1) | Default for fixed-rate mortgages |

| Zero-Interest | PMT = P / n | Simple division |

| Interest-Only | PMT = P·r | Principal stays constant |

| Balloon | PMT as amortized; large final balance due | Use amortization + lump sum |

Key Takeaways

The PMT formula is universal across loan types; only inputs change.

Always convert annual rates to monthly when using the formula.

Edge cases (zero-interest, interest-only, balloon) modify which part of the formula applies.

Use calculators to confirm your math and explore “what-if” scenarios.

FAQ

Why do some calculators show slightly different payments?

Rounding differences and compounding conventions (monthly vs daily) cause small variations.Can I use the same formula for biweekly payments?

Yes, but double n (number of payments) and halve r (periodic rate).What if the loan has a teaser or adjustable rate?

Use a calculator that supports rate changes over time; this static formula assumes a fixed rate.