Buying a home comes with hundreds of line items, but few have more long-term impact than mortgage points. Paying “points” upfront can reduce your interest rate for decades—but only if you stay in the home long enough to break even.

This guide shows exactly how points work, when they make sense, and how to calculate your break-even period using our Mortgage Interest Calculator

1. What Are Mortgage Points?

Mortgage points—sometimes called discount points—are prepaid interest.

Each point costs 1% of your loan amount and typically lowers your interest rate by about 0.25%.

| Term | Definition |

|---|---|

| 1 point | Equals 1% of loan amount |

| Purpose | Lowers your interest rate |

| Alternative name | Discount point |

| Tax-deductible? | Usually yes (consult your tax advisor) |

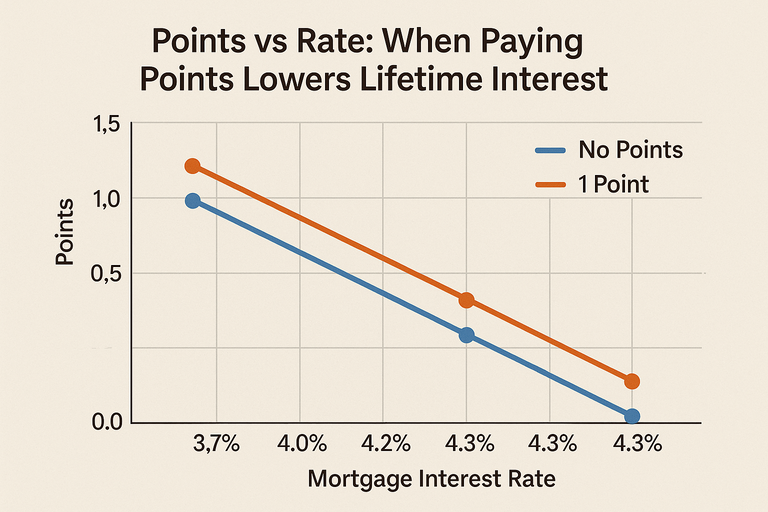

2. Points vs Rate: The Basic Trade-Off

When you buy points, you’re paying more upfront to save on monthly interest.

The key question: Do you save more over time than you paid upfront?

| Scenario | Loan Amount | Rate | Monthly (P&I) | Total Interest (30 yrs) |

|---|---|---|---|---|

| No points | $400,000 | 6.5% | $2,528 | $510,000 |

| 1 point (–0.25%) | $400,000 | 6.25% | $2,462 | $486,000 |

| 2 points (–0.50%) | $400,000 | 6.0% | $2,398 | $463,000 |

Paying 1 point ($4,000) saves $66/month and $24,000 over the full term.

💡 But you only “win” if you keep the loan long enough to recoup the upfront cost.

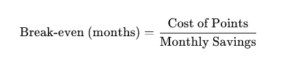

3. How to Calculate the Break-Even Point

Use this simple formula:

Example:

Cost of 1 point = $4,000

Monthly savings = $66

Break-even = $4,000 ÷ $66 = 61 months (≈5.1 years)

If you’ll stay in the home longer than 5 years, buying one point is likely worth it.

You can test your own numbers instantly with the Mortgage Interest Calculator or Mortgage Payment Calculator

4. How Points Work in Practice

You pay at closing: Points are part of your closing costs.

They reduce the interest rate permanently: Lower rate lasts for the full loan term.

They can be rolled into the loan: Though this adds back some interest cost.

They’re tax-deductible (in many cases): Especially for primary homes if itemizing deductions.

5. Case Study: 30-Year Loan vs 15-Year Loan

Scenario A: 30-year, $400k loan @ 6.5%, 1 point = 6.25%

Monthly savings: $66

Break-even: 5.1 years

Scenario B: 15-year, $400k loan @ 6%, 1 point = 5.75%

Monthly savings: $100

Break-even: $4,000 ÷ $100 = 3.3 years

Result:

Shorter loans reach break-even faster because monthly savings are larger.

🧮 Use the Mortgage Rate Calculator to visualize how even small rate reductions compound over time.

6. When Paying Points Makes Sense

✅ Buy points when:

You plan to stay in the home longer than 5 years.

You’re locking a fixed-rate mortgage (benefit lasts full term).

You’re close to qualifying for a lower DTI with reduced payment.

You can afford the upfront cash without draining savings.

❌ Avoid points when:

You expect to sell or refinance soon.

You’re choosing an ARM (adjustable rate)—discount won’t last.

You’re short on closing funds or prefer liquidity.

7. How Points Affect Refinancing

If you refinance before reaching your break-even, the remaining value of your points disappears—you’ve already paid them, and the new loan resets your interest rate.

However:

If rates drop and you still gain more from refinancing than you lose in points, it can still be worthwhile.

Track your remaining break-even months before deciding.

Use the Mortgage Refinance Calculator to see your actual recovery period.

8. Builder and Lender “Buydowns”

Builders and lenders sometimes offer temporary buydowns (like 2-1 or 3-2-1 programs), which are different from discount points.

| Type | How It Works | Duration |

|---|---|---|

| Permanent Buydown | You pay points upfront to lower rate for full term | 30 years |

| 2-1 Buydown | Lender or seller pays to reduce rate by 2% first year, 1% second | 2 years |

| 3-2-1 Buydown | Rate reduced by 3%, 2%, 1% over first 3 years | 3 years |

9. Combining Points with Extra Payments

You can stack strategies:

Buy 1 point to drop your rate.

Add $100/month in extra principal.

This double approach accelerates payoff and minimizes total interest—especially visible in the Amortization Schedule Calculator

10. Key Takeaways

Each point = 1% of the loan; typically reduces rate by ~0.25%.

Calculate break-even to decide if it’s worth paying.

Good rule: buy points if staying 5+ years or holding a fixed-rate loan.

Combine with extra payments for maximum savings.

Always compare multiple scenarios in your calculator before locking.

FAQ (Schema-Ready)

Are mortgage points tax-deductible?

Usually yes, if they’re used to buy down the rate on your primary residence. Consult your tax professional.How much does one point lower my rate?

Typically 0.25%, but it varies by lender and loan type.Is buying points better than a larger down payment?

A larger down payment reduces principal and PMI; points lower the rate. The best option depends on your time horizon.Can I finance mortgage points?

Yes, but you’ll pay interest on them—reducing their long-term benefit. Paying upfront yields the highest savings.