When you use a refinance calculator, one small setting—“cash-out” vs “rate-and-term”—can change your entire payment picture.

Both refinance types lower costs or free up cash, but they do it in very different ways.

This guide explains how to use calculator settings correctly, how to model each scenario, and how to interpret the payment delta (difference) between them.

👉 Start by opening the Refinance Calculator

1. The Two Main Refinance Types

| Type | Goal | Loan Balance | Common Term |

|---|---|---|---|

| Rate-and-Term Refinance | Replace existing loan to get lower rate or shorter term | ≈ Current balance | 15–30 years |

| Cash-Out Refinance | Replace loan and add equity funds for cash at closing | Higher than current balance | 20–30 years |

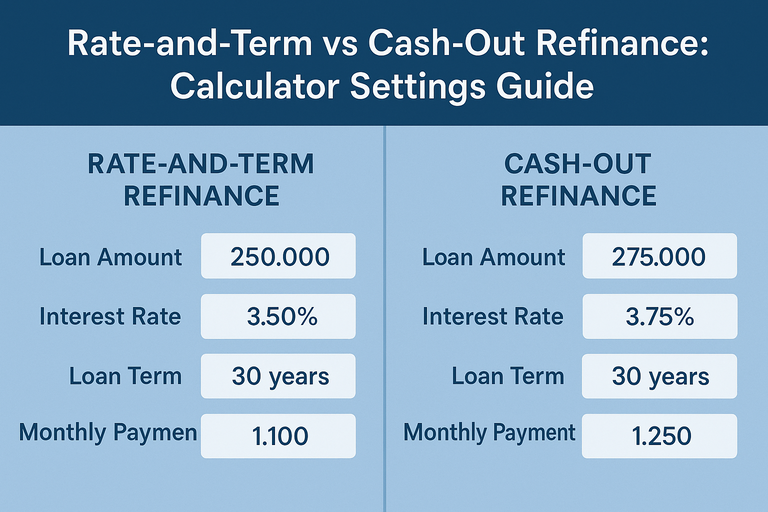

2. Setting Up Your Calculator Correctly

A. Rate-and-Term Refinance Settings

In the Refinance Calculator:

Loan amount: Enter your current balance (no cash-out added).

Rate: Input your new, lower interest rate.

Loan term: Choose same or shorter (30→25 years for savings).

Closing costs: Add estimated fees (typically 1–2% of loan).

Cash-out: Leave blank or zero.

This shows you the pure interest and payment savings from a lower rate.

B. Cash-Out Refinance Settings

In the same calculator:

Loan amount: Enter current balance + desired cash-out.

Rate: Often slightly higher than standard rate (add 0.25–0.5%).

Loan term: Usually reset to 30 years.

Cash-out amount: Add your target lump sum (e.g., $40,000).

Closing costs: Include total refi fees + title and appraisal.

Then compare your new monthly payment to your old one.

💡 Use the “Include Cash-Out” toggle if available—many calculators will automatically display the new balance and payment delta.

3. Real-World Example: Side-by-Side

| Scenario | Loan Balance | Rate | Term | Monthly Payment |

|---|---|---|---|---|

| Current Loan | $300,000 | 7.0% | 30 yrs | $1,996 |

| Rate-and-Term Refi | $300,000 | 6.25% | 30 yrs | $1,847 |

| Cash-Out Refi | $340,000 | 6.5% | 30 yrs | $2,150 |

Result:

Rate-and-term saves $149/month.

Cash-out adds $154/month—but gives you $40,000 cash.

To test your own scenario, use both the Refinance Calculator and the Mortgage Payment Calculator to model your payment delta precisely.

4. Understanding the “Payment Delta”

The payment delta is the difference between your new and old monthly payments.

| Scenario | Monthly Change | Cause |

|---|---|---|

| Lower rate, same balance | Decrease | Interest drop |

| Lower rate, shorter term | Neutral or slight increase | Accelerated payoff |

| Higher balance (cash-out) | Increase | Added loan amount |

| Shorter term + lower rate | Decrease overall interest, higher payment | Principal reduction focus |

5. Rate Impact: Why Cash-Out Costs More

Cash-out refinances carry slightly higher rates because they pose more risk to lenders.

Typical difference:

Rate-and-Term: Standard base rate

Cash-Out: +0.25–0.50% premium

Example:

$350,000 loan

6.25% → 6.5% difference = +$55/month

That small increase adds up to $19,800 over 30 years—worth factoring into your decision.

6. Credit, LTV, and Seasoning Rules

| Factor | Rate-and-Term | Cash-Out |

|---|---|---|

| Credit Score | 620+ | 660+ recommended |

| Loan-to-Value (LTV) | Up to 97% | Usually capped at 80% |

| Seasoning Period | 6 months | 6–12 months |

| Purpose | Reduce interest | Extract equity |

7. Break-Even Timeline

Use this quick formula to find when your refinance pays off:

Break-even months=Monthly Savings/Closing Costs

Example:

Closing costs = $4,800

Monthly savings = $160

→ Break-even ≈ 30 months (2.5 years)

Cash-out refis often extend this timeline because you’re borrowing more—but you also gain immediate liquidity.

Run this calculation using the Refinance Calculator or Mortgage Payment Calculator

8. Alternative Option: Cash-In Refinance

Not everyone wants to pull cash out—some homeowners prefer to pay in.

means bringing extra cash to closing to:

Drop below 80% LTV and eliminate PMI

Qualify for a lower rate bracket

Shorten your amortization schedule

It’s the mirror opposite of cash-out—but can deliver huge rate savings.

9. Visualizing Both Scenarios

When comparing rate-and-term vs cash-out, focus on:

Payment change (delta)

Total interest paid

Time to break-even

Equity position after closing

Most calculators will plot this as two lines—one for each scenario—so you can visualize crossover points.

10. Key Takeaways

Rate-and-term: Best for lowering payments or shortening term.

Cash-out: Best for tapping equity for debt consolidation or improvements.

Always compare total interest and not just monthly payment.

Expect 0.25–0.5% higher rates for cash-out loans.

Use calculators to balance immediate needs vs long-term savings.

FAQ

Which saves more: rate-and-term or cash-out refinance?

Rate-and-term usually saves more interest long-term, but cash-out provides liquidity that can create indirect savings.Do cash-out refinances always raise payments?

Not always—if your new rate is significantly lower, your payment may stay similar despite the higher balance.How much equity can I pull out?

Most lenders cap cash-out loans at 80% of your home’s appraised value.Can I combine a cash-out refi with a shorter term?

Yes—many borrowers choose a 20- or 25-year term to balance cash access and interest reduction.