A refinance can feel like “free money” when mortgage rates drop—but not every refi saves you money.

Between closing costs, origination fees, and rate resets, you might pay thousands before you actually come out ahead.

That’s where the refinance break-even point comes in—the month when your savings finally exceed your costs.

In this guide, you’ll learn how to calculate it, what counts as a true break-even, and how to test scenarios instantly with our Mortgage Refinance Calculator

1. What Is the Refinance Break-Even Point?

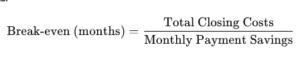

Your break-even point is the number of months it takes for your monthly payment savings to equal your upfront refinance costs.

Example:

Closing costs: $6,000

Monthly savings: $150

Break-even = 6,000 ÷ 150 = 40 months (≈3.3 years)

That means you need to stay in your new loan at least 3.3 years to benefit.

2. What Counts Toward Closing Costs

Refinance costs typically range 2–6% of the loan amount.

Here’s what’s included:

| Category | Typical Range | Notes |

|---|---|---|

| Loan origination | 0.5–1% | Lender processing fee |

| Appraisal | $400–$800 | Required for most refis |

| Title & escrow | $800–$2,000 | Title search and insurance |

| Recording & taxes | $150–$500 | Local filing fees |

| Prepaid interest | Varies | Based on closing date |

| Points (optional) | 1% per point | Reduces rate |

3. Why Break-Even Isn’t Just About the Math

Breaking even isn’t only about monthly payment savings—it’s about how long you’ll hold the loan.

If you plan to:

Sell soon: You might not recoup closing costs in time.

Stay long-term: Lower monthly payments and interest savings stack dramatically.

A refi makes sense only if:

The break-even point < your expected homeownership timeline.

The total interest savings exceed the refi costs over that time.

4. Example: 30-Year Refinance Comparison

| Scenario | Loan Amount | Rate | Monthly P&I | Monthly Savings | Closing Costs | Break-Even |

|---|---|---|---|---|---|---|

| Current loan | $350,000 | 6.75% | $2,270 | — | — | — |

| New refi | $350,000 | 5.75% | $2,043 | $227 | $6,000 | 26.4 months |

5. Should You Refi Into Another 30-Year Loan?

Refinancing resets your amortization clock, meaning you restart at Month 1.

Even with a lower rate, you might pay more total interest if you extend your term.

Example:

Remaining: 25 years @ 6.75%

New refi: 30 years @ 5.75%

→ Monthly drops $227, but you’ll pay 5 extra years of interest unless you keep the same payoff schedule.

🧮 To see lifetime savings, use our Amortization Schedule Calculator alongside the refinance tool.

6. How to Shorten Your Loan Instead

If you’re refinancing to save interest—not just payment—consider dropping from 30 years to 15 or 20.

You’ll pay more monthly, but far less overall.

| Term | Rate | Payment (for $350k) | Total Interest |

|---|---|---|---|

| 30 years | 5.75% | $2,043 | $384,000 |

| 20 years | 5.5% | $2,408 | $229,000 |

| 15 years | 5.25% | $2,810 | $156,000 |

7. Hidden Factors That Skew Break-Even

Taxes & escrow: If rolled into the loan, they delay true payoff savings.

Points paid upfront: Lower your rate but increase cost; add them to break-even math.

Extra payments: Can shift your break-even earlier since your savings compound faster.

Future refinance potential: Rates could drop again—calculate if waiting makes sense.

Use the Extra Payment Mortgage Calculator to simulate accelerated savings.

8. When Refinancing Doesn’t Make Sense

❌ Refinancing is not ideal if:

You’ll move or sell within 2–3 years.

Your credit score dropped significantly.

Your current loan already has a low fixed rate.

You’re deep into your amortization (most interest already paid).

Better alternative: Consider a cash-out refinance or HELOC if you need funds without resetting your mortgage clock. (See next article in this cluster.)

9. Refinancing Checklist

Before refinancing, confirm:

Rate drop of at least 0.75–1%

No prepayment penalty on current loan

Break-even < 5 years

You plan to stay in the home long-term

Sufficient equity (usually 20%+)

10. Key Takeaways

The refinance break-even = closing costs ÷ monthly savings.

Most homeowners break even in 2–5 years depending on fees and rate drop.

Shorter terms save far more total interest—even if payments are higher.

Always compare 30-, 20-, and 15-year options in your calculator before committing.

FAQ

What is a good refinance break-even point?

Under 3 years is excellent; 4–5 years is still reasonable if you’ll stay in the home.Do closing costs affect my break-even?

Yes—higher upfront fees delay savings. Always include lender and title costs.Is it better to refinance or make extra payments?

If your current rate is already competitive, extra payments often save more over time.Can I refinance with no closing costs?

Yes—but “no-cost” usually means the lender builds those costs into a slightly higher rate.