Ever run a rent vs buy calculator and get a different result than your friend?

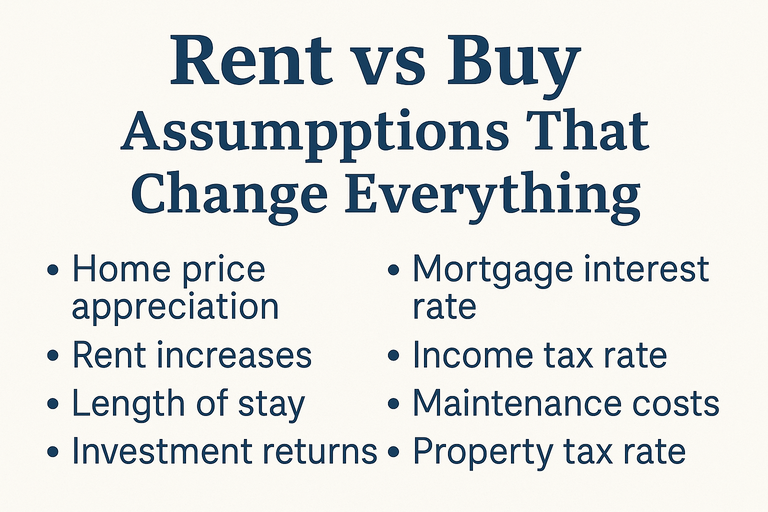

That’s not a glitch — it’s because tiny assumption changes completely shift the outcome.

Factors like home appreciation, rent inflation, and ownership horizon can flip a “buy” recommendation into “rent” in seconds.

This guide breaks down the four assumptions that matter most — and how to model them correctly with our Rent vs Buy Calculator

1. Appreciation: How Fast Your Home’s Value Grows

Home appreciation drives the long-term benefit of ownership.

A 1–2% difference in annual growth can mean hundreds of thousands in equity over time.

| Annual Appreciation | 10-Year Equity Gain (on $400K home) |

|---|---|

| 2% | $87,000 |

| 3% | $137,000 |

| 4% | $196,000 |

Tip:

If you live in a high-growth metro like Miami, Austin, or Tampa, test 4–5% annual appreciation.

If you’re in slower markets or factoring inflation, use 2–3%.

Use the “Home Value Growth Rate” field in the Rent vs Buy Calculator

2. Rent Inflation: The Hidden Cost of Staying Put

Rent rarely stays flat — in many cities, it increases 3–6% per year.

That means even if buying feels more expensive today, ownership can become cheaper within a few years.

| Rent Inflation | 5-Year Rent Change (Starting at $2,500/month) |

|---|---|

| 0% | $2,500 |

| 3% | $2,897 |

| 5% | $3,191 |

What to model:

Use your city’s historic rent inflation (Zillow or Census data).

Consider whether local rent control caps annual increases.

Check if your mortgage payment stays fixed — that stability is your inflation shield.

💡 Run scenarios in the calculator with 0%, 3%, and 5% rent growth — you’ll see how fast the buy advantage appears.

3. Selling Costs: The Forgotten Factor

Even if your home appreciates, selling costs (typically 6–8% of sale price) can erase years of gains if you sell too soon.

Example:

Home purchased for $400,000

Sells after 4 years for $440,000 (2.4% annual growth)

Appreciation gain: $40,000

Selling costs: 6% × $440,000 = $26,400

→ Net equity gain: only $13,600

If you sell early, transaction costs dominate.

That’s why most calculators assume at least a 5-year horizon before buying pays off.

Include 6–8% “selling costs” in the assumptions section of the Rent vs Buy Calculator for accuracy.

4. Horizon Length: How Long You’ll Stay

The holding period is the most powerful input.

Buying only makes sense if you’ll stay long enough for equity growth and cost recovery.

| Time in Home | Likely Better Option |

|---|---|

| 1–3 years | Rent (selling costs too high) |

| 4–7 years | Depends on rate & appreciation |

| 8+ years | Buy (ownership benefits compound) |

5. Other Variables That Matter (But Less Than You Think)

| Factor | Impact | Notes |

|---|---|---|

| Mortgage Rate | High | Every 1% = ~$300–$400/month difference |

| Property Taxes | Moderate | Often offset by appreciation |

| Maintenance | Moderate | Budget 1–2% of home value annually |

| Down Payment | Moderate | Affects upfront cost, not long-term ROI |

6. The Real Power of Calculator Sensitivity

The Rent vs Buy Calculator isn’t about a yes/no answer — it’s about understanding which assumption matters most for you.

Here’s how to use it strategically:

Set baseline values (local taxes, rate, down payment).

Change one variable (e.g., appreciation from 2% → 4%).

Watch the “break-even year” shift.

Decide whether your assumptions are realistic for your market.

🧮 Pair it with the How Much House Can I Afford Calculator to test affordability under both scenarios.

7. Case Study: 5-Year Horizon

Scenario:

$2,500 rent, 4% annual increase

$400,000 home, 6.5% mortgage, 3% appreciation

5-year ownership horizon

Results:

Renting cost after 5 years: $161,000

Owning cost (net of appreciation): $155,000

→ Break-even: Year 5

Push the horizon to 8 years, and buying wins by over $50,000.

8. Key Takeaways

Home appreciation and rent inflation are the biggest swing factors.

Selling costs make short stays unprofitable for buyers.

The “stay-or-go” horizon determines your break-even year.

Test 3–5 scenarios to understand your range of outcomes — not just one.

FAQ

How many years should I stay in a home to make buying worth it?

Usually 5–7 years, depending on rates, appreciation, and selling costs.How much should I assume for home appreciation?

2–4% per year is a conservative national average; check local trends.What’s a safe rent inflation assumption?

3–5% annually unless your area has rent control or stagnant population growth.Does renting always lose long-term?

Not always—if housing prices stagnate or you move frequently, renting can be smarter short-term.