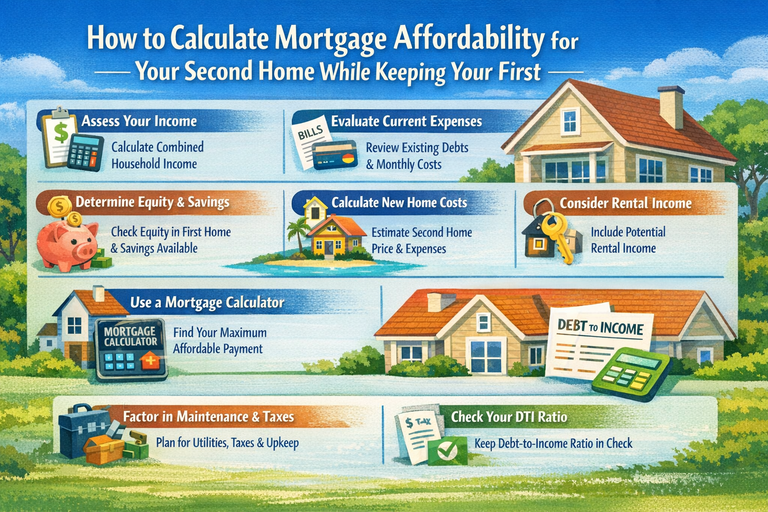

Buying a second home—whether a vacation retreat, family getaway, or future retirement spot—is a dream for many U.S. homeowners. But owning

two properties means

two sets of monthly payments, taxes, insurance, and debt obligations, which makes affordability math more complex than buying your

first house. In 2025, second home mortgages remain stricter than primary home loans. Typical 30-year fixed rates for second homes average around

6.9%, about

0.25–0.50% higher than primary mortgage rates, and lenders expect stronger finances for approval. This guide walks you through how to

calculate what you can afford when you already have a mortgage, with clear examples and actionable steps.

1) What makes a “second home” different from your first

Lenders and the IRS treat second homes differently than primary residences and

investment properties. A second home must be:

- A one-unit residential property

- Used personally for part of the year

- Not rented out full-time

- Distinct from your primary residence (often at a distance)

Second homes inspire vacations and calm—but mortgage underwriting sees

added risk because you already carry a mortgage. That means eligibility requirements are stricter.

Actionable tip: Confirm with your lender that the property clearly qualifies as a second home (not an investment property) to avoid higher rates and bigger down payments.

2) Understand the hard financial requirements

Compared with primary home loans, second home financing typically requires:

- Higher down payment: usually 10% minimum, and often 15–20% depending on credit and debt levels.

- Lower DTI expectations: lenders often want total DTI (including both mortgages) under 43–45%.

- Strong credit: 680+ is common, with better terms above 720.

- Cash reserves: lenders may require several months of reserves for both mortgages.

Actionable tip: Before house hunting, run your own DTI math including

both your primary and second home payments. If it’s above ~45%, you’ll likely need to reduce your loan request, raise your down payment, or improve income.

3) Use real numbers to project total costs

Let’s do a realistic example with 2025 averages:

Assumptions- Primary home mortgage payment: $2,200/month

- Target second home price: $300,000

- Down payment: 15% ($45,000)

- Loan amount: $255,000

- Second home rate: 6.9% (30-year fixed average)

- Taxes & insurance: $450/month

Second home payment estimate- Principal & interest: ~$1,700/month

- Taxes & insurance: $450/month

- Total second home PITI: ~$2,150/month

Combined housing cost- Primary: $2,200

- Second: $2,150

- Total: $4,350/month

Now plug into DTI: If your gross monthly income is

$12,000:

- Suppose other debt (car, student, cards) is $900/month

- DTI = (4,350 + 900) ÷ 12,000 ≈ 43.75%

That’s at the edge of typical underwriting limits. If your income were lower or other debts higher, you may

not qualify at that purchase price.

Actionable tip: Run multiple scenarios—e.g., increase down payment to 20% or reduce paid-off debts—to see whether a second home purchase is realistic.

4) Don’t forget the true cost of ownership

Mortgage payment is only part of the story. Owning two homes means duplicate recurring costs:

- Property taxes (may be higher in vacation markets)

- Homeowners insurance (second homes often cost more)

- HOA fees

- Maintenance & utilities

- Travel & upkeep

These factors add up quickly:

A $300 monthly tax + insurance increase adds $3,600/year in real cost.

Also consider that mortgage interest on a second home is deductible

only if you personally use the property and don’t rent it full-time—but total mortgage interest deduction limits apply across both homes.

Actionable tip: Put all recurring costs into a spreadsheet and treat them like

real expenses when evaluating affordability.

5) Calculating affordability with existing equity

If you’ve built equity in your primary home, that can be part of your plan:

- HELOC / Home equity loan

- Cash-out refinance

Tapping equity reduces cash you must bring to the second home down payment—but also increases your primary mortgage risk.

Example: Primary home equity available:

$60,000 Down payment needed for second home:

$45,000 You take a

HELOC for the down payment, which adds a second payment—so calculate both:

- HELOC monthly cost (say $400)

- Second home mortgage monthly cost ($2,150 from above)

Your combined monthly debt increases further, so re-do the DTI math

with the HELOC payment included.

Actionable tip: Use a mortgage calculator that allows multiple debt payments to see whether you

still qualify after tapping equity.

6) Protect your budget with stress tests

Interest rates move, and in 2025 mortgage rates could remain volatile. If the rate on new loans increases by even 0.5–1%, monthly payments can rise by hundreds of dollars, especially on the second mortgage.

Stress-test strategy- Run your affordability at +0.5% interest

- Recalculate DTI

- See if you still meet underwriting targets

If your stress test fails the DTI or reserve requirement,

adjust down payment, price, or wait.

Actionable tip: Ask your lender for a “stress scenario” calculation when pre-approved so you know the worst realistic payment.

Conclusion

Owning a second home while keeping your first is achievable—but the

math is unforgiving. Lenders expect lower DTI, stronger credit, and substantial reserves because they’re underwriting

two housing obligations. By plugging real numbers into a

combined housing cost and DTI calculation, you’ll understand whether a second home is a smart extension of your financial plan—or an overstretch. Before you commit:

- Do combined DTI math

- Stress-test interest rates

- Include all recurring costs

- Consider equity strategies carefully

This disciplined approach protects your financial future while giving you a clear picture of what version of “affordable” really means.

FAQs

1) Do I need more down payment for a second home? Yes. Most lenders require at least

10–15% down for second homes, compared with as low as 3–5% for primary homes.

2) Can I include rental income on a second home? If you rent the property more than part-time, lenders usually treat it as an

investment property with stricter rules and higher rates.

3) How do lenders count two mortgages in my DTI? They include

both mortgage payments, taxes, insurance, and any other debt payments when calculating total DTI.

4) Are rates higher for second homes? On average, yes—second home mortgage rates typically run

0.25–0.50% higher than primary home rates.

5) Can I use my home equity for a second home down payment? Yes, but you must factor the additional payment into your DTI to ensure you still qualify for both mortgages.